SUBHEAD: Chinese public sector worker in over head on stocks wants market to rise to he can get out. "I'm now waiting for the market to rebound so that I can get out." Good luck.

By Tyler Durden on 4 July 2015 for Zero HEdge -

(http://www.zerohedge.com/news/2015-07-05/panic-china-central-bank-steps-bailout-stocks)

Image above: A Chinese investor looks at prices of shares in Fuyang in Anhui province. Photograph by Imaginechina/Corbis. From (http://www.theguardian.com/business/2015/jul/05/china-freezes-new-share-offers-in-bid-to-shore-up-plunging-stock-markets).

China’s equity miracle — the one bright spot that has so far served to distract the masses from rapidly decelerating economic growth and a bursting real estate bubble — is in deep trouble.

A dramatic unwind in unofficial margin lending channels such as umbrella trusts and structured funds which have together served to pump some CNY1 trillion into a market that was already red-hot, sparked and perpetuated a 30% decline in the space of just three weeks, pushing Beijing into panic mode and prompting simultaneous policy rate cuts along with a variety of other measures designed to stop the bleeding.

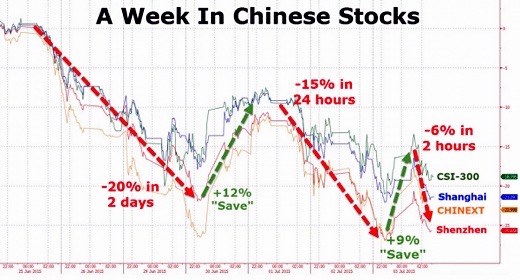

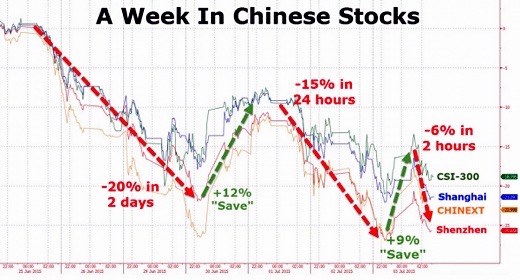

Image above: A week long chart of Chinese stocks showing accelerating downward now shift underway. From original article.

On Saturday we learned that a consortium of Chinese brokers will inject 15% of their net assets — or around $19 billion — into blue chip stocks starting Monday and China’s mutual funds have pledged not to sell their equity positions for at least a year.

As we and others noted, the injection from the brokerages likely will not matter. As one analyst told Bloomberg, “it won’t last an hour in this market.”

Besides, much of the unofficial, backdoor margin buying was funneled into speculative small caps, which are, for now anyway, outside the purvey of the emergency measures. For these reasons (and others) we said the following:

And here is the WSJ:

Despite being one step removed from onboarding equities directly onto its balance sheet, the PBoC is effectively buying stocks, which amounts (of course) to QE. What's particularly interesting here is that as we've said on too many occasions to count, it's exceedingly likely that the plan in China was to save outright QE for purchases of China's local government bonds.

The CNY15 trillion (at least) of new muni bond issuance that's part and parcel of the country's critical local government debt refi program will likely put quite a bit of upward pressure on rates which will make benchmark lending rate cuts less effective, eventually necessitating outright purchases by the PBoC.

Now, a very inconvenient stock market rout may have just pushed Beijing into QE far sooner (and in a different market) than it would have liked.

But as noted above, China has no choice. The effect of an outright stock market collapse on domestic morale would be devastating and might very well serve to undermine international confidence in the country's equity markets just when momentum was building for MSCI benchmark inclusion.

We'll close with our (slightly modified) warning from Saturday which seems particularly relevant now:

However it may now be too late as the psychology has changed irreparably: "I didn't sell at the peak because people all say the market will rise beyond 6,000 points," Shao Qinglong, a public service worker who has already lost over a quarter of his capital investing in stocks, told Reuters all he is waiting for is for the market to recover enough for him to break even.

.

By Tyler Durden on 4 July 2015 for Zero HEdge -

(http://www.zerohedge.com/news/2015-07-05/panic-china-central-bank-steps-bailout-stocks)

Image above: A Chinese investor looks at prices of shares in Fuyang in Anhui province. Photograph by Imaginechina/Corbis. From (http://www.theguardian.com/business/2015/jul/05/china-freezes-new-share-offers-in-bid-to-shore-up-plunging-stock-markets).

China’s equity miracle — the one bright spot that has so far served to distract the masses from rapidly decelerating economic growth and a bursting real estate bubble — is in deep trouble.

A dramatic unwind in unofficial margin lending channels such as umbrella trusts and structured funds which have together served to pump some CNY1 trillion into a market that was already red-hot, sparked and perpetuated a 30% decline in the space of just three weeks, pushing Beijing into panic mode and prompting simultaneous policy rate cuts along with a variety of other measures designed to stop the bleeding.

Image above: A week long chart of Chinese stocks showing accelerating downward now shift underway. From original article.

On Saturday we learned that a consortium of Chinese brokers will inject 15% of their net assets — or around $19 billion — into blue chip stocks starting Monday and China’s mutual funds have pledged not to sell their equity positions for at least a year.

As we and others noted, the injection from the brokerages likely will not matter. As one analyst told Bloomberg, “it won’t last an hour in this market.”

Besides, much of the unofficial, backdoor margin buying was funneled into speculative small caps, which are, for now anyway, outside the purvey of the emergency measures. For these reasons (and others) we said the following:

It took less than 24 hours for that prediction to be proven correct because on Sunday, the China Securities Regulatory Commission announced that the PBoC is set to inject capital into China Securities Finance Corp which will use the funds to help brokerages expand their businesses and reinvigorate stocks.It's probably just a matter of time before the PBoC intervenes to provide Kuroda-style plunge protection when "sentiment" looks to be souring.

And here is the WSJ:

In other words, China’s central bank is now underwriting brokerages’ margin lending businesses; that is, the PBoC is now in the business of financing leveraged stock buying.China’s central bank will provide liquidity to help stabilize the country’s crumbling stock market, according to a statement by China’s top securities regulator late Sunday.

The People’s Bank of China will inject capital into China Securities Finance Corp., which is owned by the securities regulator, according to the statement by the China Securities Regulatory Commission. The company will then use the funds to expand brokerages’ business of financing investors’ stock purchases.

The CSRC said Friday it would dramatically increase the company’s capital to 100 billion yuan ($16.1 billion) from the current 24 billion yuan. The exact amount to come from the central bank hasn’t been disclosed.

The latest move comes as Chinese authorities are scrambling to stem a stock-market slide that officials fear could spread to other parts of the world’s second-largest economy.

Also late Sunday, a unit of China’s giant sovereign-wealth fund, Central Huijin, said it recently purchased exchange-traded funds and will continue to do so, another measure aimed at stabilizing the market.

Despite being one step removed from onboarding equities directly onto its balance sheet, the PBoC is effectively buying stocks, which amounts (of course) to QE. What's particularly interesting here is that as we've said on too many occasions to count, it's exceedingly likely that the plan in China was to save outright QE for purchases of China's local government bonds.

The CNY15 trillion (at least) of new muni bond issuance that's part and parcel of the country's critical local government debt refi program will likely put quite a bit of upward pressure on rates which will make benchmark lending rate cuts less effective, eventually necessitating outright purchases by the PBoC.

Now, a very inconvenient stock market rout may have just pushed Beijing into QE far sooner (and in a different market) than it would have liked.

But as noted above, China has no choice. The effect of an outright stock market collapse on domestic morale would be devastating and might very well serve to undermine international confidence in the country's equity markets just when momentum was building for MSCI benchmark inclusion.

We'll close with our (slightly modified) warning from Saturday which seems particularly relevant now:

"Leverage your dream", now sponsored by the PBoC."Because the reckless margin buying in China is concentrated in small caps trading at nosebleed multiples, the central bank will be funding the purchase of umbrella manufacturers, real estate developers-turned P2P lenders, and ponzi schemes unlike the BoJ's equity book which (at least as far as we know), is comprised mostly of ETFs."

However it may now be too late as the psychology has changed irreparably: "I didn't sell at the peak because people all say the market will rise beyond 6,000 points," Shao Qinglong, a public service worker who has already lost over a quarter of his capital investing in stocks, told Reuters all he is waiting for is for the market to recover enough for him to break even.

"I'm now waiting for the market to rebound so that I can get out."Good luck.

.

No comments :

Post a Comment