SUBHEAD: The founding assumptions of neoclassical economics developed in the empty world no longer hold.

By Herman Daly on 11 JUne 2015 for Great Transition -

(http://www.greattransition.org/publication/economics-for-a-full-world)

Image above: From (http://nuclear-news.net/2014/12/29/predictions-of-limits-to-growth-now-coming-true/).

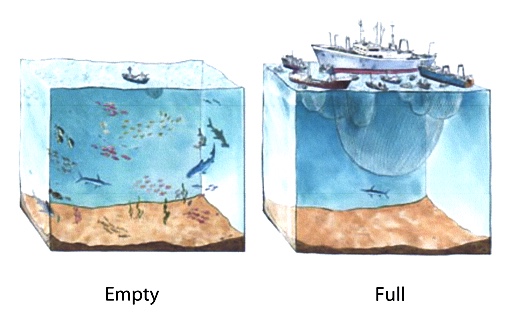

Because of the exponential economic growth since World War II, we now live in a full world, but we still behave as if it were empty, with ample space and resources for the indefinite future.

The founding assumptions of neoclassical economics, developed in the empty world, no longer hold, as the aggregate burden of the human species is reaching—or, in some cases, exceeding—the limits of nature at the local, regional, and planetary levels. The prevailing obsession with economic growth puts us on the path to ecological collapse, sacrificing the very sustenance of our well-being and survival.

To reverse this ominous trajectory, we must transition toward a steady-state economy focused on qualitative development, as opposed to quantitative growth, and the interdependence of the human economy and global ecosphere. Developing policies and institutions for a steady-state economy will require us to revisit the question of the purpose and ends of the economy.

When I worked at the World Bank, I often heard the statement, “There is no conflict between economics and ecology. We can and must grow the economy and protect the environment at the same time.” I still hear it a lot today.

Although it is a comforting idea, it is at most half true. The “true” part stems from a confusion of reallocation with aggregate growth. Possibilities of better allocation almost always exist—more of something desired in exchange for a reduction in something less desired. However, aggregate growth, what macro-economists mean by the term “growth” (and the meaning in this essay), is that the total market value of all final goods and services (GDP) is expanding.

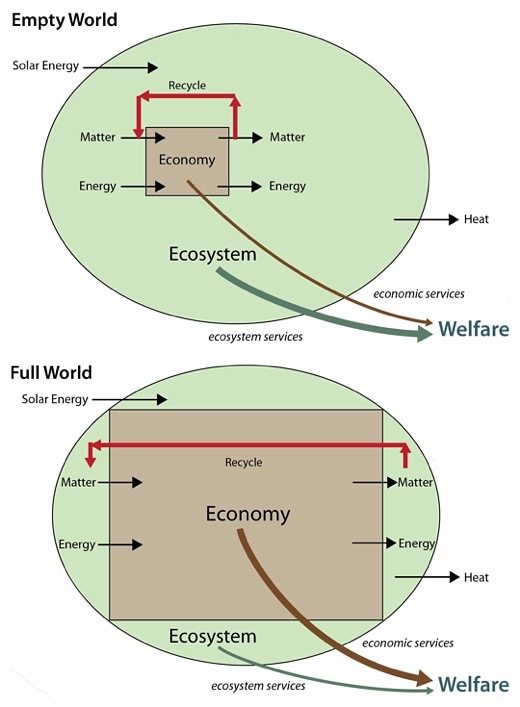

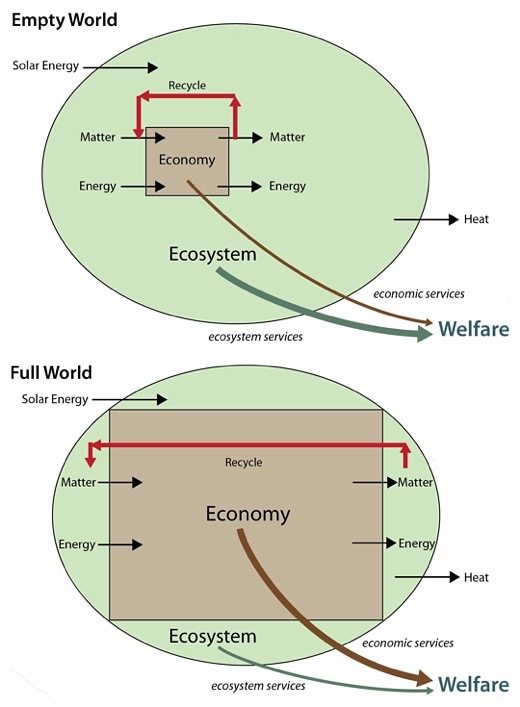

The economy, as shown in Figure 1, is an open subsystem of the larger ecosphere, which is finite, non-growing, and materially closed, although open to a continual, but non-growing, throughput of solar energy. When the economy grows in physical dimensions, it incorporates matter and energy from the rest of the ecosystem into itself.

It must, by the law of conservation of matter and energy (First Law of Thermodynamics), encroach on the ecosystem, diverting matter from previous natural uses. More human economy (more people and commodities) means less natural ecosystem. In this sense, the statement that there is “no conflict” is false. There is an obvious physical conflict between the growth of the economy and the preservation of the environment.

That the economy is a subsystem of the ecosphere seems perhaps too obvious to emphasize. Yet the opposite view is common in high places. For example, a recent study by the British government’s Natural Capital Committee asserted, “The environment is part of the economy and needs to be properly integrated into it so that growth opportunities will not be missed.” To the contrary, it is the economy that is the part and needs to be integrated into the whole of the finite ecosphere so that growth limits will not be missed.1

But is this physical conflict economically important? Some believe that we still live in an “empty” world. In the empty world, the economy was small relative to the containing ecosystem, our technologies of extraction and harvesting were not very powerful, and our numbers were small.

Fish reproduced faster than we could catch them, trees grew faster than we could harvest them, and minerals in the Earth’s crust were abundant. In other words, natural resources were not really scarce. In the empty world, it made economic sense to say that there was no conflict between economic growth and the ecosystem, even if it were not strictly true in a physical sense.

Figure 1. From original article.

Neoclassical economic theory developed during this era and still embodies many assumptions from it. But the empty world has rapidly turned into a “full” world thanks to growth, the number one goal of all countries—capitalist, communist, or in-between. Since the mid-twentieth century, the world population has more than tripled—from two billion to over seven billion.

The populations of cattle, chickens, pigs, and soybean plants and corn stalks have as well. The non-living populations of cars, buildings, refrigerators, and cell phones have grown even more rapidly.

All these populations, both living and non-living, are what physicists call “dissipative structures”—that is, their maintenance and reproduction require a metabolic flow, a throughput that begins with depletion of low-entropy resources from the ecosphere and ends with the return of polluting, high-entropy waste back to the ecosphere.

This disrupts the ecosphere at both ends, an unavoidable cost necessary for the production, maintenance, and reproduction of the stock of both people and wealth. Until recently, standard economic theory ignored the concept of metabolic throughput, and, even now, its importance is greatly downplayed.2

The concept of metabolic throughput in economics brings with it the laws of thermodynamics, which are inconvenient to growthist ideology. The First Law, as noted above, imposes a quantitative trade-off of matter/energy between the environment and the economy.

The Second Law, that the entropy (or disorder) of the universe is always increasing, imposes a qualitative degradation of the environment— by extracting low-entropy resources and returning high-entropy wastes.

The Second Law of Thermodynamics thus imposes an additional conflict between expansion of the economy and preservation of the environment, namely that the order and structure of the economy is paid for by imposing disorder in the sustaining ecosphere. Furthermore, this disorder, exported from the economy, disrupts the complex ecological interdependencies of our life-supporting ecosystem.

Those who deny the conflict between growth and environment often claim that since GDP is measured in value units, it has no necessary physical impact on the environment. But one must remember that a dollar’s worth of gasoline is a physical quantity—recently about one fourth of a gallon in the United States. GDP is an aggregate of all such “dollar’s worth” quantities bought for final use, and is consequently a value-weighted index of physical quantities.

GDP is certainly not perfectly correlated with resource throughput. Nevertheless, prospects for absolute “decoupling” of resource throughput from GDP are quite limited, even though much discussed and wished for.3

These limits are made visible by considering an input-output matrix for an economy. Nearly every sector requires inputs from, and provides outputs to, nearly every other sector. And these inputs require a further round of inputs for their production, etc.

The economy grows as an integrated whole, not as a loose mix of sectors. Even the information and service sectors require substantial physical resource inputs. In addition to the supply side limit reflected in the input-output interdependence of production sectors, there is the demand side limit of what has been called the “lexicographic ordering of wants”—unless we first have sufficient food on the plate, we are just not interested in the information contained in a million recipes on the Internet.

And, of course, the Jevons Paradox—the idea that, as technology progresses, the increase in efficiency with which a resource is used tends to increase the rate of consumption of that resource—negates much of the benefits of such progress. This does not deny real possibilities of improved technical efficiency in the use of resources, or ethical improvement in the ordering of our priorities. But these represent qualitative development and are frequently not captured in GDP, which mainly reflects quantitative growth.

Since GDP reflects both harmful and beneficial activity, ecological economists have not considered it to be a desideratum in itself. Instead, they have distinguished growth (quantitative increase in size by accretion or assimilation of matter) from development (qualitative improvement in design, technology, or ethical priorities). Ecological economists advocate development without growth—qualitative improvement without quantitative increase in resource throughput beyond an ecologically sustainable scale.

Given this distinction, one could indeed say that there is no necessary conflict between qualitative development and the environment. GDP accounting mixes together both growth and development, as well as costs and benefits. It thus confuses more than it clarifies.

When the entropic throughput becomes too large, it overwhelms either the regenerative capacity of nature’s sources or the assimilative capacity of nature’s sinks. This tells us that we no longer live in the empty world, but instead inhabit a full world. Natural resource flows are now the scarce factor, and labor and capital stocks are now relatively abundant. This basic pattern of scarcity has been reversed by a century of growth.

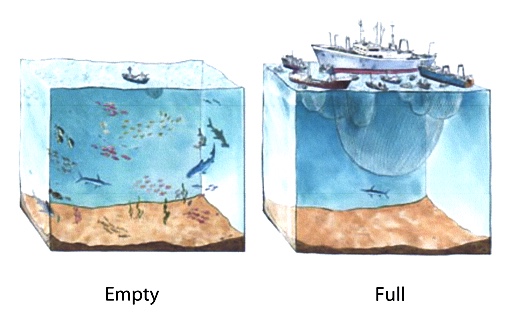

Figure 2. From original article.

This simple picture is instructive. In the past, the fish catch was limited by the number of fishing boats and fishermen. Now, it is limited by the number of fish and their capacity to reproduce. More fishing boats will not result in more caught fish. The limiting factor is no longer the manmade capital of boats, but the remaining natural capital of fish populations and their aquatic habitat.

Economic logic would tell us to invest in the limiting factor. The old economic policy of building more fishing boats is now uneconomic, so we need to invest in natural capital, the new limiting factor. How do we do that? For one, we can do so by reducing the catch to allow fish populations to increase to their previous levels, and by other measures such as fallowing agricultural land to refresh its fertility. More generally, we can do so through restoration ecology, biodiversity conservation, and sustainable use practices.

One could draw similar pictures for other natural resources.

What ultimately limits the production of cut timber? Is it the number of chainsaws, sawmills, and lumberjacks, or the remaining forests and the growth rate of new trees? What limits the crops from irrigated agriculture? Is it the number of pipes, sprinklers, and pumps, or the stock of water in aquifers, their recharge rate, and the flow of surface water in rivers?

What limits the number of barrels of pumped crude oil: the number of drilling rigs or the remaining accessible deposits of petroleum? What limits the use of all fossil fuels: our mining equipment and combustion engines, or the capacity of the atmosphere to absorb the resulting greenhouse gases without causing drastic climate change? In all cases, it is the latter, the natural capital (whether source or sink), rather than the man-made capital.

Traditional economists reacted to this change in the identity of the limiting factor in three ways.

First, they ignored it—by continuing to believe that we live in the empty world of the past.

Second, they pretended that GDP is an ethereal, angelic number rather than a physical aggregate.

Third, they claimed that natural capital has not, in fact, replaced manmade capital as the limiting factor because manmade and natural capital are interchangeable substitutes, at least according to neoclassical production functions.

Only if factors of production are complements can the one in short supply be limiting. So even if natural capital is now scarcer than before, this would not be a problem, neoclassical economists say, because manmade capital is a “near perfect” substitute for natural resources. It is represented as such in multiplicative production functions such as the widely used Cobb-Douglas.

But multiplying “factors” of production to get a “product” is mathematics, not economics. In the real world, what we call “production” is in fact transformation, not multiplication. Natural resources are transformed by capital and labor inputs into useful products and waste.

While improved technologies can certainly reduce waste and facilitate recycling, agents of transformation (capital and labor) cannot serve as direct substitutes for the material and energy being transformed (natural resources). Can we produce a ten-pound cake with only one pound of ingredients, simply by using more cooks and ovens?

And further, how could we make more capital (or labor) without also using more natural resources? While a capital investment in sonar may help locate those remaining fish, it is hardly a good substitute for more fish in the sea. And what happens to the capital value of fishing boats, including their sonar, as the fish disappear?

It is clear from Figure 1 that the transition from empty to full world involves both costs and benefits. The brown arrow from Economy to Welfare represents economic services (benefits from the economy). It is small in the empty world but large in the full world. It grows at a diminishing rate because, as rational beings, we satisfy our most important wants first—the law of diminishing marginal utility.

The costs of growth are represented by the shrinking ecosystem services (green arrow) that are large in the empty world but small in the full world. It diminishes at an increasing rate as the ecosystem is displaced by the economy because we—in theory—sacrifice the least important ecosystem services first—the law of increasing marginal costs.

We can restate this in terms of Figure 3, showing the declining marginal benefit of growth of the economy and the increasing marginal cost of the resulting environmental sacrifice:

Figure 3. From original article.

From the diagram, we can distinguish three concepts of limits to growth:

From the graph, it is evident that increasing aggregate production and consumption is rightly called economic growth only up to the economic limit. Beyond that point, it becomes uneconomic growth because it increases costs by more than benefits, making us poorer, not richer.

Nonetheless, we perversely continue to call it economic growth. Indeed, you will not find the term “uneconomic growth” in any macroeconomics textbook.

Any increase in real GDP is called “economic growth” even if it increases costs faster than benefits. That richer (more net wealth) is better than poorer is a truism. The relevant question, though, is, does growth still make us richer, or has it begun to make us poorer by increasing “illth” faster than wealth?

Examples of “illth” are everywhere, even if they are still unmeasured in national accounts. They include things like nuclear wastes, climate change from excess carbon in the atmosphere, biodiversity loss, depleted mines, deforestation, eroded topsoil, dry wells and rivers, sea level rise, the dead zone in the Gulf of Mexico, gyres of plastic trash in the oceans, and the ozone hole. They also include exhausting and dangerous labor and the un-repayable debt from trying to push growth in the symbolic financial sector beyond what is possible in the real sector.

Economists will note that the logic employed in Figure 3 is familiar in microeconomics—the optimal size of a microeconomic unit, be it a firm or a household, occurs where the marginal cost is equal to the marginal benefit. That logic is not applied to the macro-economy, however, because the latter is thought to be the Whole rather than a Part.

When a Part expands into the finite Whole, it imposes an opportunity cost on other Parts that must shrink to make room for it. When the Whole itself expands, it is thought to impose no opportunity cost because it displaces nothing, presumably expanding into the void.

But as seen in Figure 1, the macroeconomy is not the Whole. It, too, is a Part, a part of the larger natural economy, the ecosphere, and its growth does inflict opportunity costs on the finite Whole that must be counted. Their refusal to acknowledge this is why many economists cannot conceive of the possibility that growth in GDP could ever be uneconomic.

Standard economists might accept Figure 3 as a static picture but then argue that, in a dynamic world, technology will shift the marginal benefit curve upward and the marginal cost curve downward, moving their intersection (economic limit) ever to the right, so that continual growth remains both desirable and possible.

However, the macroeconomic curve-shifters need to remember three things.

First, the physically growing macro-economy is still limited by its displacement of the finite ecosphere and by the entropic nature of its maintenance throughput.

Second, the timing of new technology is uncertain. The expected technology may not be invented or come online until after we have passed the economic limit.

Do we then endure uneconomic growth while waiting and hoping for the curves to shift? Third, the curves can also shift in the wrong directions, moving the economic limit back to the left. Did the technological “advances” of tetraethyl lead and chlorofluorocarbons shift the cost curve down or up? How about nuclear power? Or “fracking”?

Adopting a steady-state economy at the macro level (while, of course, allowing for improvements in allocation at the micro level) helps us to avoid being shoved past the economic limit. We could take our time to evaluate new technologies rather than blindly adopting them in the interest of aggregate growth that may well be uneconomic.

And the steady state gives us some insurance against the risks of ecological catastrophe that increase with growthism and technological impatience.

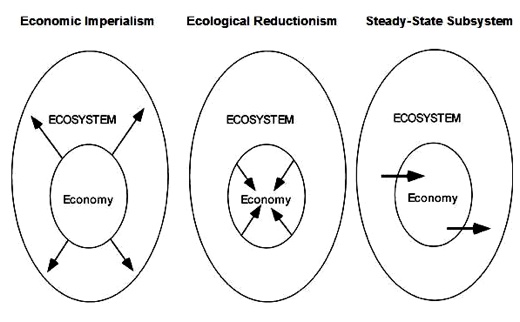

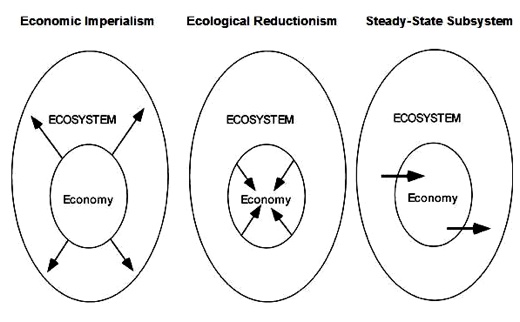

Our vision and policies should be based on an integrated view of the economy as a subsystem of the finite and non-growing ecosphere. Three different theoretical understandings have grounded such attempts at integration, and all three start from the vision of the economy as a subsystem of the ecosphere and thus recognize limits to growth. They differ, however, in the way they each treat the boundary between the economy and the rest of the ecosystem, and these differences have large policy consequences for how we adjust to limits.

Figure 4. From original article.

Economic imperialism seeks to expand the boundary of the economic subsystem until it encompasses the entire ecosphere. The goal is one system, the macroeconomy as the Whole. This is accomplished by the complete internalization of all external costs and benefits into prices. Those myriad aspects of the biosphere not customarily traded in markets are treated as if they were by imputation of “shadow prices”—the economist’s best estimate of what the price of the function or thing would be if it were traded in a competitive market.

Everything in the ecosphere is theoretically rendered comparable in terms of its priced ability to help or hinder individuals in satisfying their wants. Implicitly, the end pursued is an ever-greater level of consumption, and the way to effectively achieve this end is growth in the aggregate exchange value of marketed final goods and services (GDP).

Economic imperialism is essentially the neoclassical approach. Subjective individual preferences, however whimsical or uninstructed, are taken as the ultimate source of value. This is a perverse value judgment, not the absence of value judgments, as economists normally treat it. Since subjective wants are thought to be infinite in the aggregate, as well as sovereign, the scale of activities devoted to satisfying them tends to expand. The expansion is considered legitimate as long as “all costs are internalized into prices.”

While costs should certainly be internalized into prices, this should not become an excuse for allowing excessive takeover of the ecosphere by economic growth. Unfortunately, many of the costs of growth that we have experienced have come as surprises. We cannot internalize them if we cannot first imagine and foresee them.

Furthermore, even after some external costs have become quite visible (e.g., climate change), internalization has been very slow, partial, and much resisted. Profit-maximizing firms have an incentive to externalize costs. As long as the evolutionary fitness of the environment to support life is not perceived by economists as a value, it is likely to be destroyed in the imperialistic quest to subject every molecule and photon in creation to the pecuniary rules of present value maximization.

There is no doubt that once the scale of the economy has grown to the point that formerly free environmental goods and services become scarce, it is better that they should have a positive price reflecting their scarcity than to continue to be priced at zero. But the prior question remains:

Are we better off at the new larger scale with formerly free goods correctly priced, or at the old smaller scale with free goods also correctly priced (at zero)? In both cases, the prices are right. This question of optimal macro scale is neither answered nor even asked by either neoclassical or Keynesian economics in their blind quest for growth.

Ecological reductionism begins with the true insight that humans and markets are not exempt from the laws of nature. It then proceeds to the false inference that human action is totally explainable by and reducible to the laws of nature. It seeks to explain whatever happens within the economic subsystem by exactly the same natural laws that it applies to the rest of the ecosystem. It subsumes the economic subsystem indifferently into the natural system, erasing its boundary.

Taken to the extreme, this view purports to explain everything by a materialist deterministic system that has no room for purpose or will. This is a sensible vision from which to study the ecology of a coral reef or a rainforest. But if one adopts it for studying the human economy, one is stuck with the inconvenient policy implication that policy can make no difference.

Ecology has inherited from its parent discipline, biology, a measure of modern biology’s mechanistic philosophy. This stems from a neo-Darwinian fundamentalism that is often uncritically accepted by many leading biologists as a deterministic metaphysics validated by science, rather than as a fruitful working hypothesis for doing science.

Determinism is totally at odds with purposeful policy of any kind, and consequently with any economic thought aiming at policy. A happy marriage between economics and ecology, as in “ecological economics,” must overcome this latent incompatibility. Economic imperialism reduces everything to human will and utility, neglecting objective constraints of the natural world.

Ecological reductionism sees only deterministic natural laws, and imperiously extends these into materialist “explanations” of human will and consciousness as mere illusions. It is a tragic irony that the discipline whose scientific findings have done most to awaken us to the environmental dangers we face is also the discipline whose metaphysical presuppositions have done most to weaken our will to respond to these dangers through purposeful policy.5

Economic imperialism and ecological reductionism are both monistic visions, albeit rather opposite monisms. The monistic quest for a single entity or principle by which to explain everything leads to excessive reductionism on both sides.

Certainly, science should strive for the most reduced or parsimonious explanation possible without ignoring the facts. But respect for the basic empirical facts of natural laws on the one hand, and self-conscious purpose and will on the other hand, should lead us to a kind of practical dualism.

After all, that our world should consist of two fundamental features offers no greater inherent improbability than that it should rest on only one. How these two fundamental features of our world (material cause and final cause) interact is a venerable mystery—precisely the mystery that the monists of both kinds are seeking to avoid.

But economists are too much in the middle of things to adopt either extreme. They are better off denying the tidy-mindedness of either monism than denying the facts that point to an untidy dualism.

The remaining perspective is the steady-state subsystem. It does not attempt to eliminate the subsystem boundary, either by expanding it to coincide with the whole system or by reducing it to nothing. Rather, it affirms both the interdependence and the qualitative difference between the human economy and the natural ecosystem. The boundary must be recognized and drawn in the right place.

The scale of the human subsystem defined by the boundary has an optimum, and the throughput by which the ecosphere physically maintains and replenishes the economic subsystem must be ecologically sustainable.

The goal of the economy is to minimize the low-entropy used up to attain a sufficient standard of living—by sifting it slowly and carefully through efficient technologies aimed at important purposes. The economy should not be viewed as an idiot machine dedicated to maximizing waste. Its ultimate purpose is the maintenance and enjoyment of life for a long time (not forever) at a sufficient level of wealth for a good (not luxurious) life.

The idea of a steady-state economy comes from classical economics, and was most developed by John Stuart Mill (1857), who referred to it as the “stationary state.”6 In such a state, the population and the capital stock would no longer grow, although the art of living would continue to improve. The constancy of these two physical stocks defined the scale of the economic subsystem.

Birth rates would be equal to death rates and production rates equal to depreciation rates. Today, we add that both rates should be equal at low levels rather than high levels because we value longevity of people and durability of artifacts, and wish to minimize throughput, subject to maintenance of sufficient stocks for a good life.

Ecological economics should seek to develop the steady-state vision and get beyond the dead ends of both economic imperialism and ecological reductionism. Ten policies for moving toward a steady-state economy appear below. Many could be adopted independently and gradually, although they cohere in the sense that some compensate for the shortcomings of others. Of course, the question of the desired level of steady-state economy is crucial, and local, regional, and global ecological limits must be considered in fashioning effective policies.

Globalization by free trade, free capital mobility, and free migration dissolves national community, leaving nothing to federate. Such globalization is individualism writ large—a post-national corporate feudalism in a global commons. Instead, strengthen the original Bretton Woods vision of interdependent national economies, and resist the WTO vision of a single integrated global economy.

Respect the principle of subsidiarity: although climate change and arms control require global institutions, basic law enforcement and infrastructure maintenance remain local issues. Focus our limited capacity for global cooperation on those needs and functions that truly require it.

It is one thing to suggest a general outline of policies, but it is something else entirely to say how we will secure the will, strength, and clarity of purpose to carry out these policies—especially when we have treated growth as the summum bonum for the past century.

Such will requires a major change in philosophical vision and ethical practice, a shift that is hardly guaranteed even in light of the increasingly perilous circumstances in which the planet finds itself.

As a way to contemplate such a change, consider the “ends-means pyramid” in Figure 5. The policies suggested above belong in the middle, under “Political Economy.” At the base of the pyramid are our ultimate means (low-entropy matter-energy)—that which we require to satisfy our wants, but which we cannot make, only use up.

We use these ultimate means directly, guided by technology, to produce intermediate means (e.g., artifacts, commodities, services) that directly satisfy our needs. These intermediate means are allocated by political economy to serve our intermediate ends (e.g., health, comfort, education), ethically ranked by how strongly they contribute to the Ultimate End under existing circumstances.

We can perceive the Ultimate End only vaguely, but in order to ethically rank our intermediate ends, we must compare them to some ultimate criterion. We cannot avoid philosophical and theological inquiry into the Ultimate End just because it is difficult. To prioritize requires that something go in first place.

Figure 5. From original article.

The middle position of economics is significant. Economics traditionally deals with the allocation of given intermediate means to satisfy a given hierarchy of intermediate ends. It takes the technological problem of converting ultimate means into intermediate means and the ethical problem of ranking intermediate ends with reference to an Ultimate End as solved.

All economics has to do, then, is efficiently allocate given means among a given hierarchy of ends. In neglecting the Ultimate End and ethics, economics has been too materialistic; in neglecting ultimate physical means and technology, it has not been materialistic enough.

Ultimate political economy (stewardship) is the total problem of using ultimate means to best serve the Ultimate End, no longer taking technology and ethics as given, but as steps in the total problem to be solved. The overall problem is too large to be tackled without breaking it down into its pieces. But without a vision of the total problem, the pieces do not fit together.

The dark base of the pyramid represents the relatively solid and consensual knowledge of various sources of low-entropy matter-energy. The light apex of the pyramid represents the fact that our knowledge of the Ultimate End is uncertain and not nearly as consensual as physics.

The single apex will annoy pluralists who think that there are many “ultimate ends.” Grammatically and logically, however, “ultimate” requires the singular. Yet there is certainly room for more than one perception of the nature of the singular Ultimate End, and much need for tolerance and patience in reasoning together about it.

The Ultimate End, whatever it may be, cannot be growth. A better starting point for reasoning together is John Ruskin’s aphorism that “there is no wealth but life.” How might that insight be restated as an economic policy goal? I would suggest the following: maximizing the cumulative number of lives ever to be lived over time at a level of per capita wealth sufficient for a good life.

This leaves open the traditional ethical question of what is a good life, while conditioning its answer to the realities of ecology and the economics of sufficiency. At a minimum, it seems a more reasonable approximation than the current impossible goal of “ever more things for ever more people forever.”

This essay has been adapted from a speech delivered on the occasion of the Blue Planet Prize, Tokyo, November 2014.

Endnotes

.

By Herman Daly on 11 JUne 2015 for Great Transition -

(http://www.greattransition.org/publication/economics-for-a-full-world)

Image above: From (http://nuclear-news.net/2014/12/29/predictions-of-limits-to-growth-now-coming-true/).

Because of the exponential economic growth since World War II, we now live in a full world, but we still behave as if it were empty, with ample space and resources for the indefinite future.

The founding assumptions of neoclassical economics, developed in the empty world, no longer hold, as the aggregate burden of the human species is reaching—or, in some cases, exceeding—the limits of nature at the local, regional, and planetary levels. The prevailing obsession with economic growth puts us on the path to ecological collapse, sacrificing the very sustenance of our well-being and survival.

To reverse this ominous trajectory, we must transition toward a steady-state economy focused on qualitative development, as opposed to quantitative growth, and the interdependence of the human economy and global ecosphere. Developing policies and institutions for a steady-state economy will require us to revisit the question of the purpose and ends of the economy.

When I worked at the World Bank, I often heard the statement, “There is no conflict between economics and ecology. We can and must grow the economy and protect the environment at the same time.” I still hear it a lot today.

Although it is a comforting idea, it is at most half true. The “true” part stems from a confusion of reallocation with aggregate growth. Possibilities of better allocation almost always exist—more of something desired in exchange for a reduction in something less desired. However, aggregate growth, what macro-economists mean by the term “growth” (and the meaning in this essay), is that the total market value of all final goods and services (GDP) is expanding.

The economy, as shown in Figure 1, is an open subsystem of the larger ecosphere, which is finite, non-growing, and materially closed, although open to a continual, but non-growing, throughput of solar energy. When the economy grows in physical dimensions, it incorporates matter and energy from the rest of the ecosystem into itself.

It must, by the law of conservation of matter and energy (First Law of Thermodynamics), encroach on the ecosystem, diverting matter from previous natural uses. More human economy (more people and commodities) means less natural ecosystem. In this sense, the statement that there is “no conflict” is false. There is an obvious physical conflict between the growth of the economy and the preservation of the environment.

That the economy is a subsystem of the ecosphere seems perhaps too obvious to emphasize. Yet the opposite view is common in high places. For example, a recent study by the British government’s Natural Capital Committee asserted, “The environment is part of the economy and needs to be properly integrated into it so that growth opportunities will not be missed.” To the contrary, it is the economy that is the part and needs to be integrated into the whole of the finite ecosphere so that growth limits will not be missed.1

But is this physical conflict economically important? Some believe that we still live in an “empty” world. In the empty world, the economy was small relative to the containing ecosystem, our technologies of extraction and harvesting were not very powerful, and our numbers were small.

Fish reproduced faster than we could catch them, trees grew faster than we could harvest them, and minerals in the Earth’s crust were abundant. In other words, natural resources were not really scarce. In the empty world, it made economic sense to say that there was no conflict between economic growth and the ecosystem, even if it were not strictly true in a physical sense.

Figure 1. From original article.

Neoclassical economic theory developed during this era and still embodies many assumptions from it. But the empty world has rapidly turned into a “full” world thanks to growth, the number one goal of all countries—capitalist, communist, or in-between. Since the mid-twentieth century, the world population has more than tripled—from two billion to over seven billion.

The populations of cattle, chickens, pigs, and soybean plants and corn stalks have as well. The non-living populations of cars, buildings, refrigerators, and cell phones have grown even more rapidly.

All these populations, both living and non-living, are what physicists call “dissipative structures”—that is, their maintenance and reproduction require a metabolic flow, a throughput that begins with depletion of low-entropy resources from the ecosphere and ends with the return of polluting, high-entropy waste back to the ecosphere.

This disrupts the ecosphere at both ends, an unavoidable cost necessary for the production, maintenance, and reproduction of the stock of both people and wealth. Until recently, standard economic theory ignored the concept of metabolic throughput, and, even now, its importance is greatly downplayed.2

The concept of metabolic throughput in economics brings with it the laws of thermodynamics, which are inconvenient to growthist ideology. The First Law, as noted above, imposes a quantitative trade-off of matter/energy between the environment and the economy.

The Second Law, that the entropy (or disorder) of the universe is always increasing, imposes a qualitative degradation of the environment— by extracting low-entropy resources and returning high-entropy wastes.

The Second Law of Thermodynamics thus imposes an additional conflict between expansion of the economy and preservation of the environment, namely that the order and structure of the economy is paid for by imposing disorder in the sustaining ecosphere. Furthermore, this disorder, exported from the economy, disrupts the complex ecological interdependencies of our life-supporting ecosystem.

Those who deny the conflict between growth and environment often claim that since GDP is measured in value units, it has no necessary physical impact on the environment. But one must remember that a dollar’s worth of gasoline is a physical quantity—recently about one fourth of a gallon in the United States. GDP is an aggregate of all such “dollar’s worth” quantities bought for final use, and is consequently a value-weighted index of physical quantities.

GDP is certainly not perfectly correlated with resource throughput. Nevertheless, prospects for absolute “decoupling” of resource throughput from GDP are quite limited, even though much discussed and wished for.3

These limits are made visible by considering an input-output matrix for an economy. Nearly every sector requires inputs from, and provides outputs to, nearly every other sector. And these inputs require a further round of inputs for their production, etc.

The economy grows as an integrated whole, not as a loose mix of sectors. Even the information and service sectors require substantial physical resource inputs. In addition to the supply side limit reflected in the input-output interdependence of production sectors, there is the demand side limit of what has been called the “lexicographic ordering of wants”—unless we first have sufficient food on the plate, we are just not interested in the information contained in a million recipes on the Internet.

And, of course, the Jevons Paradox—the idea that, as technology progresses, the increase in efficiency with which a resource is used tends to increase the rate of consumption of that resource—negates much of the benefits of such progress. This does not deny real possibilities of improved technical efficiency in the use of resources, or ethical improvement in the ordering of our priorities. But these represent qualitative development and are frequently not captured in GDP, which mainly reflects quantitative growth.

Since GDP reflects both harmful and beneficial activity, ecological economists have not considered it to be a desideratum in itself. Instead, they have distinguished growth (quantitative increase in size by accretion or assimilation of matter) from development (qualitative improvement in design, technology, or ethical priorities). Ecological economists advocate development without growth—qualitative improvement without quantitative increase in resource throughput beyond an ecologically sustainable scale.

Given this distinction, one could indeed say that there is no necessary conflict between qualitative development and the environment. GDP accounting mixes together both growth and development, as well as costs and benefits. It thus confuses more than it clarifies.

When the entropic throughput becomes too large, it overwhelms either the regenerative capacity of nature’s sources or the assimilative capacity of nature’s sinks. This tells us that we no longer live in the empty world, but instead inhabit a full world. Natural resource flows are now the scarce factor, and labor and capital stocks are now relatively abundant. This basic pattern of scarcity has been reversed by a century of growth.

Figure 2. From original article.

This simple picture is instructive. In the past, the fish catch was limited by the number of fishing boats and fishermen. Now, it is limited by the number of fish and their capacity to reproduce. More fishing boats will not result in more caught fish. The limiting factor is no longer the manmade capital of boats, but the remaining natural capital of fish populations and their aquatic habitat.

Economic logic would tell us to invest in the limiting factor. The old economic policy of building more fishing boats is now uneconomic, so we need to invest in natural capital, the new limiting factor. How do we do that? For one, we can do so by reducing the catch to allow fish populations to increase to their previous levels, and by other measures such as fallowing agricultural land to refresh its fertility. More generally, we can do so through restoration ecology, biodiversity conservation, and sustainable use practices.

One could draw similar pictures for other natural resources.

What ultimately limits the production of cut timber? Is it the number of chainsaws, sawmills, and lumberjacks, or the remaining forests and the growth rate of new trees? What limits the crops from irrigated agriculture? Is it the number of pipes, sprinklers, and pumps, or the stock of water in aquifers, their recharge rate, and the flow of surface water in rivers?

What limits the number of barrels of pumped crude oil: the number of drilling rigs or the remaining accessible deposits of petroleum? What limits the use of all fossil fuels: our mining equipment and combustion engines, or the capacity of the atmosphere to absorb the resulting greenhouse gases without causing drastic climate change? In all cases, it is the latter, the natural capital (whether source or sink), rather than the man-made capital.

Traditional economists reacted to this change in the identity of the limiting factor in three ways.

First, they ignored it—by continuing to believe that we live in the empty world of the past.

Second, they pretended that GDP is an ethereal, angelic number rather than a physical aggregate.

Third, they claimed that natural capital has not, in fact, replaced manmade capital as the limiting factor because manmade and natural capital are interchangeable substitutes, at least according to neoclassical production functions.

Only if factors of production are complements can the one in short supply be limiting. So even if natural capital is now scarcer than before, this would not be a problem, neoclassical economists say, because manmade capital is a “near perfect” substitute for natural resources. It is represented as such in multiplicative production functions such as the widely used Cobb-Douglas.

But multiplying “factors” of production to get a “product” is mathematics, not economics. In the real world, what we call “production” is in fact transformation, not multiplication. Natural resources are transformed by capital and labor inputs into useful products and waste.

While improved technologies can certainly reduce waste and facilitate recycling, agents of transformation (capital and labor) cannot serve as direct substitutes for the material and energy being transformed (natural resources). Can we produce a ten-pound cake with only one pound of ingredients, simply by using more cooks and ovens?

And further, how could we make more capital (or labor) without also using more natural resources? While a capital investment in sonar may help locate those remaining fish, it is hardly a good substitute for more fish in the sea. And what happens to the capital value of fishing boats, including their sonar, as the fish disappear?

It is clear from Figure 1 that the transition from empty to full world involves both costs and benefits. The brown arrow from Economy to Welfare represents economic services (benefits from the economy). It is small in the empty world but large in the full world. It grows at a diminishing rate because, as rational beings, we satisfy our most important wants first—the law of diminishing marginal utility.

The costs of growth are represented by the shrinking ecosystem services (green arrow) that are large in the empty world but small in the full world. It diminishes at an increasing rate as the ecosystem is displaced by the economy because we—in theory—sacrifice the least important ecosystem services first—the law of increasing marginal costs.

We can restate this in terms of Figure 3, showing the declining marginal benefit of growth of the economy and the increasing marginal cost of the resulting environmental sacrifice:

Figure 3. From original article.

From the diagram, we can distinguish three concepts of limits to growth:

- The futility limit occurs when the marginal utility of production falls to zero. Even with no cost of production, there is a limit to how much we can consume and still enjoy it. There is a limit to how many goods we can enjoy in a given time period, as well as a limit to our stomachs and the sensory capacity of our nervous systems. In a world with considerable poverty, and in which the poor observe the very rich still enjoying their extra wealth, many view this futility limit as far away, not only for the poor, but for everyone. By its “non-satiety” postulate, neoclassical economics formally denies the concept of the futility limit. However, studies have shown that, beyond a “sufficiency threshold,” both self-evaluated happiness and objective indices of welfare cease to increase with GDP.4

- The ecological catastrophe limit is represented by a sharp increase to the vertical of the marginal cost curve. Some human activity, or novel combination of activities, may induce a chain reaction, or tipping point, and collapse our ecological niche. The leading candidate for the catastrophe limit at present is runaway climate change induced by greenhouse gases emitted in pursuit of economic growth. Where along the horizontal axis it might occur is uncertain. The assumption of a continuously and smoothly increasing marginal cost curve is quite optimistic. Given our limited understanding of how the ecosystem functions, we cannot be sure that we have correctly sequenced our sacrifices of ecological services from least to most important. In making way for growth, we may ignorantly sacrifice a vital ecosystem service ahead of a trivial one. Thus, the marginal cost curve might in reality zigzag up and down discontinuously, making it difficult to define the third and most important limit, namely the economic limit.

- The economic limit is defined by the equality of marginal cost and marginal benefit and the corresponding maximization of net benefit. The economic limit would appear to be the first limit encountered. It certainly occurs before the futility limit, and likely before the catastrophe limit. At worst, the catastrophe limit might coincide with and discontinuously determine the economic limit. Therefore, it is very important to estimate the risks of catastrophe and include them as costs counted in the disutility curve as far as possible.

From the graph, it is evident that increasing aggregate production and consumption is rightly called economic growth only up to the economic limit. Beyond that point, it becomes uneconomic growth because it increases costs by more than benefits, making us poorer, not richer.

Nonetheless, we perversely continue to call it economic growth. Indeed, you will not find the term “uneconomic growth” in any macroeconomics textbook.

Any increase in real GDP is called “economic growth” even if it increases costs faster than benefits. That richer (more net wealth) is better than poorer is a truism. The relevant question, though, is, does growth still make us richer, or has it begun to make us poorer by increasing “illth” faster than wealth?

Examples of “illth” are everywhere, even if they are still unmeasured in national accounts. They include things like nuclear wastes, climate change from excess carbon in the atmosphere, biodiversity loss, depleted mines, deforestation, eroded topsoil, dry wells and rivers, sea level rise, the dead zone in the Gulf of Mexico, gyres of plastic trash in the oceans, and the ozone hole. They also include exhausting and dangerous labor and the un-repayable debt from trying to push growth in the symbolic financial sector beyond what is possible in the real sector.

Economists will note that the logic employed in Figure 3 is familiar in microeconomics—the optimal size of a microeconomic unit, be it a firm or a household, occurs where the marginal cost is equal to the marginal benefit. That logic is not applied to the macro-economy, however, because the latter is thought to be the Whole rather than a Part.

When a Part expands into the finite Whole, it imposes an opportunity cost on other Parts that must shrink to make room for it. When the Whole itself expands, it is thought to impose no opportunity cost because it displaces nothing, presumably expanding into the void.

But as seen in Figure 1, the macroeconomy is not the Whole. It, too, is a Part, a part of the larger natural economy, the ecosphere, and its growth does inflict opportunity costs on the finite Whole that must be counted. Their refusal to acknowledge this is why many economists cannot conceive of the possibility that growth in GDP could ever be uneconomic.

Standard economists might accept Figure 3 as a static picture but then argue that, in a dynamic world, technology will shift the marginal benefit curve upward and the marginal cost curve downward, moving their intersection (economic limit) ever to the right, so that continual growth remains both desirable and possible.

However, the macroeconomic curve-shifters need to remember three things.

First, the physically growing macro-economy is still limited by its displacement of the finite ecosphere and by the entropic nature of its maintenance throughput.

Second, the timing of new technology is uncertain. The expected technology may not be invented or come online until after we have passed the economic limit.

Do we then endure uneconomic growth while waiting and hoping for the curves to shift? Third, the curves can also shift in the wrong directions, moving the economic limit back to the left. Did the technological “advances” of tetraethyl lead and chlorofluorocarbons shift the cost curve down or up? How about nuclear power? Or “fracking”?

Adopting a steady-state economy at the macro level (while, of course, allowing for improvements in allocation at the micro level) helps us to avoid being shoved past the economic limit. We could take our time to evaluate new technologies rather than blindly adopting them in the interest of aggregate growth that may well be uneconomic.

And the steady state gives us some insurance against the risks of ecological catastrophe that increase with growthism and technological impatience.

Our vision and policies should be based on an integrated view of the economy as a subsystem of the finite and non-growing ecosphere. Three different theoretical understandings have grounded such attempts at integration, and all three start from the vision of the economy as a subsystem of the ecosphere and thus recognize limits to growth. They differ, however, in the way they each treat the boundary between the economy and the rest of the ecosystem, and these differences have large policy consequences for how we adjust to limits.

Figure 4. From original article.

Economic imperialism seeks to expand the boundary of the economic subsystem until it encompasses the entire ecosphere. The goal is one system, the macroeconomy as the Whole. This is accomplished by the complete internalization of all external costs and benefits into prices. Those myriad aspects of the biosphere not customarily traded in markets are treated as if they were by imputation of “shadow prices”—the economist’s best estimate of what the price of the function or thing would be if it were traded in a competitive market.

Everything in the ecosphere is theoretically rendered comparable in terms of its priced ability to help or hinder individuals in satisfying their wants. Implicitly, the end pursued is an ever-greater level of consumption, and the way to effectively achieve this end is growth in the aggregate exchange value of marketed final goods and services (GDP).

Economic imperialism is essentially the neoclassical approach. Subjective individual preferences, however whimsical or uninstructed, are taken as the ultimate source of value. This is a perverse value judgment, not the absence of value judgments, as economists normally treat it. Since subjective wants are thought to be infinite in the aggregate, as well as sovereign, the scale of activities devoted to satisfying them tends to expand. The expansion is considered legitimate as long as “all costs are internalized into prices.”

While costs should certainly be internalized into prices, this should not become an excuse for allowing excessive takeover of the ecosphere by economic growth. Unfortunately, many of the costs of growth that we have experienced have come as surprises. We cannot internalize them if we cannot first imagine and foresee them.

Furthermore, even after some external costs have become quite visible (e.g., climate change), internalization has been very slow, partial, and much resisted. Profit-maximizing firms have an incentive to externalize costs. As long as the evolutionary fitness of the environment to support life is not perceived by economists as a value, it is likely to be destroyed in the imperialistic quest to subject every molecule and photon in creation to the pecuniary rules of present value maximization.

There is no doubt that once the scale of the economy has grown to the point that formerly free environmental goods and services become scarce, it is better that they should have a positive price reflecting their scarcity than to continue to be priced at zero. But the prior question remains:

Are we better off at the new larger scale with formerly free goods correctly priced, or at the old smaller scale with free goods also correctly priced (at zero)? In both cases, the prices are right. This question of optimal macro scale is neither answered nor even asked by either neoclassical or Keynesian economics in their blind quest for growth.

Ecological reductionism begins with the true insight that humans and markets are not exempt from the laws of nature. It then proceeds to the false inference that human action is totally explainable by and reducible to the laws of nature. It seeks to explain whatever happens within the economic subsystem by exactly the same natural laws that it applies to the rest of the ecosystem. It subsumes the economic subsystem indifferently into the natural system, erasing its boundary.

Taken to the extreme, this view purports to explain everything by a materialist deterministic system that has no room for purpose or will. This is a sensible vision from which to study the ecology of a coral reef or a rainforest. But if one adopts it for studying the human economy, one is stuck with the inconvenient policy implication that policy can make no difference.

Ecology has inherited from its parent discipline, biology, a measure of modern biology’s mechanistic philosophy. This stems from a neo-Darwinian fundamentalism that is often uncritically accepted by many leading biologists as a deterministic metaphysics validated by science, rather than as a fruitful working hypothesis for doing science.

Determinism is totally at odds with purposeful policy of any kind, and consequently with any economic thought aiming at policy. A happy marriage between economics and ecology, as in “ecological economics,” must overcome this latent incompatibility. Economic imperialism reduces everything to human will and utility, neglecting objective constraints of the natural world.

Ecological reductionism sees only deterministic natural laws, and imperiously extends these into materialist “explanations” of human will and consciousness as mere illusions. It is a tragic irony that the discipline whose scientific findings have done most to awaken us to the environmental dangers we face is also the discipline whose metaphysical presuppositions have done most to weaken our will to respond to these dangers through purposeful policy.5

Economic imperialism and ecological reductionism are both monistic visions, albeit rather opposite monisms. The monistic quest for a single entity or principle by which to explain everything leads to excessive reductionism on both sides.

Certainly, science should strive for the most reduced or parsimonious explanation possible without ignoring the facts. But respect for the basic empirical facts of natural laws on the one hand, and self-conscious purpose and will on the other hand, should lead us to a kind of practical dualism.

After all, that our world should consist of two fundamental features offers no greater inherent improbability than that it should rest on only one. How these two fundamental features of our world (material cause and final cause) interact is a venerable mystery—precisely the mystery that the monists of both kinds are seeking to avoid.

But economists are too much in the middle of things to adopt either extreme. They are better off denying the tidy-mindedness of either monism than denying the facts that point to an untidy dualism.

The remaining perspective is the steady-state subsystem. It does not attempt to eliminate the subsystem boundary, either by expanding it to coincide with the whole system or by reducing it to nothing. Rather, it affirms both the interdependence and the qualitative difference between the human economy and the natural ecosystem. The boundary must be recognized and drawn in the right place.

The scale of the human subsystem defined by the boundary has an optimum, and the throughput by which the ecosphere physically maintains and replenishes the economic subsystem must be ecologically sustainable.

The goal of the economy is to minimize the low-entropy used up to attain a sufficient standard of living—by sifting it slowly and carefully through efficient technologies aimed at important purposes. The economy should not be viewed as an idiot machine dedicated to maximizing waste. Its ultimate purpose is the maintenance and enjoyment of life for a long time (not forever) at a sufficient level of wealth for a good (not luxurious) life.

The idea of a steady-state economy comes from classical economics, and was most developed by John Stuart Mill (1857), who referred to it as the “stationary state.”6 In such a state, the population and the capital stock would no longer grow, although the art of living would continue to improve. The constancy of these two physical stocks defined the scale of the economic subsystem.

Birth rates would be equal to death rates and production rates equal to depreciation rates. Today, we add that both rates should be equal at low levels rather than high levels because we value longevity of people and durability of artifacts, and wish to minimize throughput, subject to maintenance of sufficient stocks for a good life.

Ecological economics should seek to develop the steady-state vision and get beyond the dead ends of both economic imperialism and ecological reductionism. Ten policies for moving toward a steady-state economy appear below. Many could be adopted independently and gradually, although they cohere in the sense that some compensate for the shortcomings of others. Of course, the question of the desired level of steady-state economy is crucial, and local, regional, and global ecological limits must be considered in fashioning effective policies.

- (Developing Cap-Auction-Trade systems for basic resources (especially fossil fuels): Set caps for natural resource according to three key rules: (1) renewable resources should not be depleted faster than they regenerate, (2) nonrenewable resources should not be depleted faster than renewable substitutes are developed, and (3) wastes from all resource use should not be returned to the ecosystem faster than they can be absorbed and reconstituted by natural systems. This approach achieves sustainable scale and market efficiency, avoids rebound effects, and raises auction revenue for replacing regressive taxes.

- Tax shifting: Shift the tax base from “value added” (labor and capital) to that to which value is added, i.e., natural resource throughput, the source of social costs such as pollution and adverse public health effects. Such taxes will also encourage efficient resource use.

- Limiting inequality: Establish minimum and maximum income limits, maintaining differences large enough to preserve incentives but small enough to suppress the plutocratic tendencies of market economies.

- Reforming the banking sector: Move from a fractional reserve banking system to 100% reserve requirements on demand deposits. Money would no longer be mainly interest-bearing debt created by private banks, but non-interest-bearing government debt issued by the Treasury. Every dollar loaned for investment would be a dollar previously saved by someone else, restoring the classical balance between investment and abstinence from consumption, and dampening boom and bust cycles.

- Managing trade for the public good: Move from free trade and free capital mobility to balanced and regulated international trade. While the interdependence of national economies is inevitable, their integration into one global economy is not. Free trade undercuts domestic cost-internalization policies, leading to a race to the bottom. Free capital mobility invalidates the basic comparative advantage argument for free trade in goods.7

- Expanding leisure time: Reduce conventional work time in favor of part-time work, personal work, and leisure, thereby embracing well-being as a core metric of prosperity while reducing the drive for limitless production.

- Stabilizing population: Work toward a balance in which births plus in-migrants equals deaths plus out-migrants, and in which every birth is a wanted birth.

- Reforming national accounts: Separate GDP into a cost account and a benefits account so that throughput growth can be stopped when marginal costs equal marginal benefits.

- Restoring full employment: Restore the US Full Employment Act of 1945 and its equivalent in other nations in order to make full employment once again the end, and economic growth the temporary means. Un/under-employment is the price we pay for growth from automation, off-shoring, deregulated trade, and a cheap-labor immigration policy. Under steady-state conditions, productivity improvements would lead to expanded leisure time rather than unemployment.

- Advancing just global governance: Seek world community as a federation of national communities, not the dissolution of nations into a single “world without borders.”

Globalization by free trade, free capital mobility, and free migration dissolves national community, leaving nothing to federate. Such globalization is individualism writ large—a post-national corporate feudalism in a global commons. Instead, strengthen the original Bretton Woods vision of interdependent national economies, and resist the WTO vision of a single integrated global economy.

Respect the principle of subsidiarity: although climate change and arms control require global institutions, basic law enforcement and infrastructure maintenance remain local issues. Focus our limited capacity for global cooperation on those needs and functions that truly require it.

It is one thing to suggest a general outline of policies, but it is something else entirely to say how we will secure the will, strength, and clarity of purpose to carry out these policies—especially when we have treated growth as the summum bonum for the past century.

Such will requires a major change in philosophical vision and ethical practice, a shift that is hardly guaranteed even in light of the increasingly perilous circumstances in which the planet finds itself.

As a way to contemplate such a change, consider the “ends-means pyramid” in Figure 5. The policies suggested above belong in the middle, under “Political Economy.” At the base of the pyramid are our ultimate means (low-entropy matter-energy)—that which we require to satisfy our wants, but which we cannot make, only use up.

We use these ultimate means directly, guided by technology, to produce intermediate means (e.g., artifacts, commodities, services) that directly satisfy our needs. These intermediate means are allocated by political economy to serve our intermediate ends (e.g., health, comfort, education), ethically ranked by how strongly they contribute to the Ultimate End under existing circumstances.

We can perceive the Ultimate End only vaguely, but in order to ethically rank our intermediate ends, we must compare them to some ultimate criterion. We cannot avoid philosophical and theological inquiry into the Ultimate End just because it is difficult. To prioritize requires that something go in first place.

Figure 5. From original article.

The middle position of economics is significant. Economics traditionally deals with the allocation of given intermediate means to satisfy a given hierarchy of intermediate ends. It takes the technological problem of converting ultimate means into intermediate means and the ethical problem of ranking intermediate ends with reference to an Ultimate End as solved.

All economics has to do, then, is efficiently allocate given means among a given hierarchy of ends. In neglecting the Ultimate End and ethics, economics has been too materialistic; in neglecting ultimate physical means and technology, it has not been materialistic enough.

Ultimate political economy (stewardship) is the total problem of using ultimate means to best serve the Ultimate End, no longer taking technology and ethics as given, but as steps in the total problem to be solved. The overall problem is too large to be tackled without breaking it down into its pieces. But without a vision of the total problem, the pieces do not fit together.

The dark base of the pyramid represents the relatively solid and consensual knowledge of various sources of low-entropy matter-energy. The light apex of the pyramid represents the fact that our knowledge of the Ultimate End is uncertain and not nearly as consensual as physics.

The single apex will annoy pluralists who think that there are many “ultimate ends.” Grammatically and logically, however, “ultimate” requires the singular. Yet there is certainly room for more than one perception of the nature of the singular Ultimate End, and much need for tolerance and patience in reasoning together about it.

The Ultimate End, whatever it may be, cannot be growth. A better starting point for reasoning together is John Ruskin’s aphorism that “there is no wealth but life.” How might that insight be restated as an economic policy goal? I would suggest the following: maximizing the cumulative number of lives ever to be lived over time at a level of per capita wealth sufficient for a good life.

This leaves open the traditional ethical question of what is a good life, while conditioning its answer to the realities of ecology and the economics of sufficiency. At a minimum, it seems a more reasonable approximation than the current impossible goal of “ever more things for ever more people forever.”

This essay has been adapted from a speech delivered on the occasion of the Blue Planet Prize, Tokyo, November 2014.

Endnotes

- Dieter Helm, The State of Natural Capital: Restoring our Natural Assets (London: UK Natural Capital Committee, 2014).

- This is despite notable contributions from Nicholas Georgescu-Roegen and Kenneth Boulding. See Nicholas Georgescu-Roegen, The Entropy Law and the Economic Process (Cambridge, MA: Harvard University Press, 1971); Kenneth Boulding, “The Economics of the Coming Spaceship Earth,” in Environmental Quality in a Growing Economy, ed. H. Jarrett (Baltimore: Johns Hopkins University Press, 1966), 3-14.

- Tim Jackson, Prosperity without Growth: Economics for a Finite Planet (London: Earthscan, 2009), 67–71.

- As indicated by the GPI (Genuine Progress Indicator) and its forerunner the ISEW (Index of Sustainable Economic Welfare). For an informative survey, see Ida Kubiszewski, Robert Costanza, Carol Franco, Philip Lawn, John Talberth, Tim Jackson, and Camille Aylmer, “Beyond GDP: Measuring and Achieving Global Genuine Progress,” Ecological Economics 93 (September 2013): 57-68.

- This contradiction is most apparent in the work of acclaimed naturalist and environmentalist Edward O. Wilson, who strongly affirms both materialistic determinism and environmental activism. He recognizes the contradiction and, unable to resolve it, has simply chosen to live with it. See Wendell Berry, Life is a Miracle (An Essay Against Modern Superstition) (Washington, DC: Counterpoint Press, 2000), 26. See also Chapter 23 in Herman Daly, Ecological Economics and Sustainable Development (Cheltenham, UK: Edward Elgar, 2007).

- John Stuart Mill, Principles of Political Economy IV.VII.I (London, 1848).

- Capitalists are interested in maximizing absolute profits and therefore seek to minimize absolute costs. If capital is mobile between nations, it will move to the nation with lowest absolute costs. Only if capital is internationally immobile will capitalists bother to compare internal cost ratios of countries and choose to specialize in the domestic products having the lowest relative cost compared to other nations, and to trade that good (in which they have a comparative advantage) for other goods. In other words, comparative advantage is a second-best policy that capitalists will follow only when the first-best policy of following absolute advantage is blocked by international capital immobility. For more on this, see Chapter 18 in Herman Daly and Joshua Farley, Ecological Economics (Washington, DC: Island Press, 2004).

.

No comments :

Post a Comment