SUBHEAD: If we were serious about global warming, we'd immediately put a halt to all economic expansion.

By Chris Martenson on 24 December 2009 in ChrisMartenson.com - (http://www.chrismartenson.com/blog/copenhagen-agreement-economic-growth-you-cant-have-both/33022)

Image above: Peugeot-Citroen automotive assembly line in 2008. From http://www.psa-peugeot-citroen-press.co.uk/releases-2008.php

I want to point out that a massive discrepancy exists between the official pronouncements emerging from Copenhagen on carbon emissions and recent government actions to spur economic growth.

Before and during Copenhagen (and after, too, we can be sure), politicians and central bankers across the globe have worked tirelessly to return the global economy to a path of growth.

We need more jobs, we are told; we need economic growth, we need more people consuming more things. Growth is the ever-constant word on politicians' lips. Official actions amounting to tens of trillions of dollars speak to the fact that this is, in fact, our number-one global priority.

But the consensus coming out of Copenhagen is that carbon emissions have to be reduced by a vast amount over the next few decades.

These two ideas are mutually exclusive. You can't have both.

Economic growth requires energy, and most of our energy comes from hydrocarbons - coal, oil, and natural gas. Burning those fuel sources releases carbon. Therefore, increasing economic activity will release more carbon. It is a very simple concept.

Nobody has yet articulated how it is that we will reconcile both economic growth and reduced use of hydrocarbon energy. And so the proposed actions coming out of Copenhagen are not grounded in reality, and they are set dead against trillions of dollars of spending.

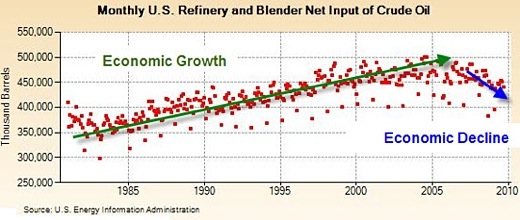

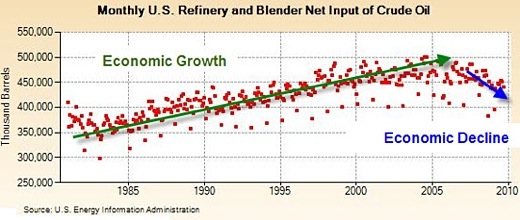

There is only one thing that we know about which has curbed, and even reversed, the flow of carbon into the atmosphere, and that is the recent economic contraction.

This is hard proof of the connection between the economy and energy. It should serve as proof that any desire to grow the economy is also an explicit call to increase the amount of carbon being expelled into the atmosphere.

The idea of salvation via the electric plug-in car or other renewable energy is a fantasy. The reality is that any new technology takes decades to reach full market penetration, and we haven't even really begun to introduce any yet. Time, scale, and cost must be weighed when considering any new technology's potential to have a significant impact on our energy-use patterns.

For example, a recent study concluded that another 20 years would be required for electric vehicles to have a significant impact on US gasoline consumption.

But this study, as good as it was in calculating the time, scale, and cost parameters of technology innovation and penetration, still left out the issue of resource scarcity. Is there enough lithium in the world to build all these cars? Neodymium? This is a fourth issue that deserves careful consideration, given the scale of the overall issue.

But even if we did manage to build hundreds of millions of plug-in vehicles, where would the electricity come from? Many people mistakenly think that we are well on our way to substantially providing our electricity needs using renewable sources such as wind and solar. We are not.

Again it turns out that supplanting even a fraction of our current electricity production with renewables will also take us decades. And even that presumes that we have a functioning economy in which to mine, construct, transport and erect these fancy new technologies. Time, scale, and cost all factor in as challenges to significant penetration of new energy technologies as well.

So where will all the new energy for economic growth come from? The answer, unsurprisingly, is from the already-installed carbon-chomping coal, oil, and natural gas infrastructure. That is the implicit assumption that lies behind the calls for renewed economic growth.

It's The Money, Stupid

As noted here routinely in my writings and in the Crash Course, we have an exponential monetary system. One mandatory feature of our current exponential monetary system is the need for perpetual growth. Not just any kind of growth; exponential growth. That's the price for paying interest on money loaned into existence. Without that growth, our monetary system shudders to a halt and shifts into reverse, operating especially poorly and threatening to melt down the entire economic edifice.

This is so well understood, explicitly or implicitly, throughout all the layers of society and in our various institutions, that you will only ever hear politicians and bankers talking about the "need" for growth.

In fact, they are correct; our system does need growth. All debt-based money systems require growth. That is the resulting feature of loaning one's money into existence. That's the long and the short of the entire story. The growth may seem modest, perhaps a few percent per year ('That's all, honest!'), but therein lies the rub. Any continuous percentage growth is still exponential growth.

Exponential growth means not just a little bit more each year, but a constantly growing amount each year. It is a story of more. Every year needs slightly more than the prior year - that's the requirement.

The Gap

Nobody has yet reconciled the vast intellectual and practical gap that exists between our addiction to exponential growth and the carbon reduction rhetoric coming out of Copenhagen. I've yet to see any credible plan that illustrates how we can grow our economy without using more energy.

Is it somehow possible to grow an economy without using more energy? Let's explore that concept for a bit.

What does it mean to "grow an economy?" Essentially, it means more jobs for more people producing and consuming more things. That's it. An economy, as we measure it, consists of delivering the needs and wants of people in ever-larger quantities. It's those last three words - ever-larger quantities - that defines the whole problem.

For example, suppose our economy consisted only of building houses. If the same number of houses were produced each year, we'd say that the economy was not growing. It wouldn't matter whether the number was four hundred thousand or four million; if the same number of new homes were produced each year, year after year, this would be considered a very bad thing, because it would mean our economy was not growing.

The same is true for cars, hair brushes, big-screen TVs, grape juice, and everything else you can think of that makes up our current economy. Each year, more needs to be sold than the year before, or the magic economic-stimulus wands will come out to ward off the Evil Spirits of No Growth.

If our economy were to grow at the same rate as the population, it would grow by around 1% per year. This is still exponential growth, but it is far short of the 3%-4% that policymakers consider both desirable and necessary. Why the gap? Why do we work so hard to ensure that 1% more people consume 3% more stuff each year?

Out of Service

It's not that 3% is the right number for the land or the people who live upon it. The target of 3% is driven by our monetary system, which needs a certain rate of exponential growth each year in order to cover the interest expense due each year on the already outstanding loans. The needs of our monetary system are driving our economic decisions, not the needs of the people, let alone the needs of the planet. We are in service to our money system, not the other way around.

Today we have a burning need for an economic model that can operate tolerably well without growth. But ours can't, and so we actually find ourselves in the uncomfortable position of pitting human needs against the money system and observing that the money system is winning the battle.

The Federal Reserve exists solely to assure that the monetary system has what it needs to function. That is their focus, their role, and their primary concern. I assume that they assume that by taking care of the monetary system, everything else will take care of itself. I think their assumption is archaic and wrong.

Regardless, our primary institutions and governing systems are in service to a monetary system that is dysfunctional. It was my having this outlook, this lens, more than any other, that allowed me to foresee what so many economists missed. Only by examining the system from a new, and very wide, angle can the enormous flaws in the system be seen.

Economy & Energy

Now let's get back to our main problem of economic growth and energy use (a.k.a. carbon production).

There is simply no way to build houses, produce televisions, grow and transport grape juice, and market hair brushes without consuming energy in the process. That's just a cold, hard reality. We need liquid fuel to extract, transform, and transport products to market. More people living in more houses means we need more electricity.

Sure, we can be more efficient in our use of energy, but unless our efficiency gains are exceeding the rate of economic growth, more energy will be used, not less. In the long run, if we were being 3% more efficient in our use of fuel and growing our economy at 3%, this would mean burning the same amount of fuel each year. Unfortunately, fuel-efficiency gains are well known to run slower than economic growth. For example, the average fuel efficiency of the US car fleet (as measured by the CAFE standards) has increased by 18% over the past 25 years, while the economy has grown by 331%. Naturally, our fuel consumption has grown, not fallen, over that time, despite the efficiency gains.

So the bottom line is this: There is no possible way to both have economic growth (as we've known it in the past) and cut carbon emissions. At least not without doing things very differently.

Things like enforcing extremely high fuel efficiency standards on the automakers, investing heavily in electric rail transport, and moving things around as much as possible by water, and then rail, and finally trucks as a last resort. Things like enforcing building standards that would create super-insulated structures to utilize the sun for heating as much as possible. Where we live, work, and shop would all be reconfigured.

Since we're not doing any of these things in any sort of a credible manner, history suggests that if it comes down to either cutting carbon or growing the economy, the economy will win that battle every time.

We can find examples everywhere - fishermen will deplete their ancestral fishing grounds to earn the money to pay back their boat loan and send their kids to college. Corporations will sacrifice long-term health to make their quarterly numbers. Politicians will promise exorbitant pension benefits to public employees with no plans for how those payments will be made. And so on.

Historically, short-term economic decisions have always trumped long-term considerations.

Again, my purpose here is not to take on the issue of global warming, nor to challenge the IPCC's conclusions, but instead to point out that the political rhetoric on the economy is utterly at odds with the idea of cutting carbon emissions.

So which will it be, cut carbon or spur economic growth?

To hold both at the same time as twin goals is the textbook definition of cognitive dissonance. No wonder people are confused.

And the good news?

The good news for people worried about ever-increasing carbon emissions from here to eternity is that we'll probably never get all the coal and oil out of the ground to burn. Our exponentially-designed economic system will gasp a final breath through a dwindling energy straw long before we manage to extract the remaining dregs. A slumping economy will prevent oil from being extracted from 35,000 feet under the ocean and coal from being pulled up from 4,000 feet under the ground.

Even without the economic dislocation effects, the dire IPCC carbon projections for carbon dioxide accumulation would require the world's extraction and use of coal to climb by more than 600% over the rest of the century, which is pure fantasy.

A 40% growth in coal use? Maybe. 600%? No way. So take heart; the worst projections will have to be scaled back considerably, based on lack of hydrocarbons to burn.

The Political Conundrum

The truth of the matter is that a steady decline in energy use is going to result in a steady decline in the economy and a steady (hopefully) decline in living standards. There will simply be less surplus energy to go around. Many service-related jobs will simply disappear, as they will become unaffordable and unnecessary in a world shaped by reduced energy (here are some examples).

But no politician will ever willingly come out and state this, because it will mean large, uncomfortable adjustments for many people. So instead we get schizophrenic words and policies working at cross-purposes (i.e., cutting carbon and growing our economy) when we should be vigorously dealing with reality.

Our monetary system is out of step with reality, and the sooner we admit that, the better. We need an economic model that can operate without the requirement of exponential growth. Can we live prosperous lives in a stable, non-growing economy? Of course we can.

But first we have to admit to ourselves that the source of the trouble is debt-based money. And we need to begin the long, slow process of reorienting our culture, priorities, and values away from growth in service of an ill-fated money system and towards a workable, livable economy that serves humanity, preserves the world, and conforms to reality. It will require refashioning our system of money.

The problem here is that the political system is completely captured by the current practitioners of the existing monetary system. How can we ever expect the people who owe their livelihoods to the continuation of a given system to recognize the need for its reformation? Is this too much to expect?

I suspect it is, and this is why I have been working to educate people like you about the larger story that lurks within the connection of the economy, energy, and the environment. With this recognition comes the opportunity to refashion your finances, thoughts, plans, and hopes - now, on your own terms, rather than later, on some other terms.

If We Were Serious…

If we were really serious about global warming, we'd immediately put a halt to all economic expansion until we figured out how to grow our economy without growing our use of carbon-based energy. We'd probably also get serious about controlling population growth, since that is the ultimate driver of consumption and planetary stress.

In addition, we'd have already begun a crash program in energy conservation and efficiency, beginning with transportation and heating/cooling. These are areas where we have plenty of solutions laying about; all we need is the proper motivation to begin using them.

Since we're not doing any of these things, I can only conclude that we are not really serious about actually doing anything about global warming. The trouble is that the new taxes that are being proposed are deadly serious. If these taxes are anything like past government taxes, they will be announced using very impressive language, but will ultimately disappear into fungible government coffers, where unnecessary things dwell like wars without defined goals and bridges to nowhere.

So besides the keen interest of governments across the world in raising new taxes, I have not yet detected credible signs that any of them are taking climate change to heart.

In the end, you cannot really be serious about climate change (as it has been presented) if you are simultaneously promoting economic growth.

You can't have both.

By Chris Martenson on 24 December 2009 in ChrisMartenson.com - (http://www.chrismartenson.com/blog/copenhagen-agreement-economic-growth-you-cant-have-both/33022)

Image above: Peugeot-Citroen automotive assembly line in 2008. From http://www.psa-peugeot-citroen-press.co.uk/releases-2008.php

I want to point out that a massive discrepancy exists between the official pronouncements emerging from Copenhagen on carbon emissions and recent government actions to spur economic growth.

Before and during Copenhagen (and after, too, we can be sure), politicians and central bankers across the globe have worked tirelessly to return the global economy to a path of growth.

We need more jobs, we are told; we need economic growth, we need more people consuming more things. Growth is the ever-constant word on politicians' lips. Official actions amounting to tens of trillions of dollars speak to the fact that this is, in fact, our number-one global priority.

But the consensus coming out of Copenhagen is that carbon emissions have to be reduced by a vast amount over the next few decades.

These two ideas are mutually exclusive. You can't have both.

Economic growth requires energy, and most of our energy comes from hydrocarbons - coal, oil, and natural gas. Burning those fuel sources releases carbon. Therefore, increasing economic activity will release more carbon. It is a very simple concept.

Nobody has yet articulated how it is that we will reconcile both economic growth and reduced use of hydrocarbon energy. And so the proposed actions coming out of Copenhagen are not grounded in reality, and they are set dead against trillions of dollars of spending.

There is only one thing that we know about which has curbed, and even reversed, the flow of carbon into the atmosphere, and that is the recent economic contraction.

This is hard proof of the connection between the economy and energy. It should serve as proof that any desire to grow the economy is also an explicit call to increase the amount of carbon being expelled into the atmosphere.

The idea of salvation via the electric plug-in car or other renewable energy is a fantasy. The reality is that any new technology takes decades to reach full market penetration, and we haven't even really begun to introduce any yet. Time, scale, and cost must be weighed when considering any new technology's potential to have a significant impact on our energy-use patterns.

For example, a recent study concluded that another 20 years would be required for electric vehicles to have a significant impact on US gasoline consumption.

Meaningful Numbers of Plug-In Hybrids Are Decades Away

The mass-introduction of the plug-in hybrid electric car is still a few decades away, according to new analysis by the National Research Council.Twenty to thirty years is the normal length of time for any new technology to scale up and fully penetrate a large market.

The study, released on Monday, also found that the next generation of plug-in hybrids could require hundreds of billions of dollars in government subsidies to take off.

Even then, plug-in hybrids would not have a significant impact on the nation’s oil consumption or carbon emissions before 2030. Savings in oil imports would also be modest, according to the report, which was financed with the help of the Energy Department.

But this study, as good as it was in calculating the time, scale, and cost parameters of technology innovation and penetration, still left out the issue of resource scarcity. Is there enough lithium in the world to build all these cars? Neodymium? This is a fourth issue that deserves careful consideration, given the scale of the overall issue.

But even if we did manage to build hundreds of millions of plug-in vehicles, where would the electricity come from? Many people mistakenly think that we are well on our way to substantially providing our electricity needs using renewable sources such as wind and solar. We are not.

Al Gore's well-intentioned challenge that we produce "100 percent of our electricity from renewable energy and truly clean carbon-free sources within 10 years" represents a widely held delusion that we can't afford to harbor.

The delusion is shared by the Minnesota Legislature, which is requiring the state's largest utility, Xcel Energy, to get at least 24 percent of its energy from wind by 2020.

One of the most frequently ignored energy issues is the time required to bring forth a major new fuel to the world's energy supply. Until the mid-19th century, burning wood powered the world. Then coal gradually surpassed wood into the first part of the 20th century. Oil was discovered in the 1860s, but it was a century before it surpassed coal as our largest energy fuel.

Trillions of dollars are now invested in the world's infrastructure to mine, process and deliver coal, oil and natural gas. As distinguished professor Vaclav Smil of the University of Manitoba recently put it, "It is delusional to think that the United States can install in a decade wind and solar generating capacity equivalent to that of thermal power plants that took nearly 60 years to construct."

Texas has three times the name plate wind capacity of any other state — 8,000-plus megawatts. The Electric Reliability Council of Texas manages the Texas electric grids. ERCOT reports that its unpredictable wind farms actually supply just a little more than 700 MW during summer power demand, and provide just 1 percent of Texas' power needs of about 72,000 MW.

ERCOT's 2015 forecast still has wind at just more than 1 percent despite plans for many more turbines.

For the United States, the Energy Information Administration is forecasting wind and solar together will supply less than 3 percent of our electric energy in 2020.

Again it turns out that supplanting even a fraction of our current electricity production with renewables will also take us decades. And even that presumes that we have a functioning economy in which to mine, construct, transport and erect these fancy new technologies. Time, scale, and cost all factor in as challenges to significant penetration of new energy technologies as well.

So where will all the new energy for economic growth come from? The answer, unsurprisingly, is from the already-installed carbon-chomping coal, oil, and natural gas infrastructure. That is the implicit assumption that lies behind the calls for renewed economic growth.

It's The Money, Stupid

As noted here routinely in my writings and in the Crash Course, we have an exponential monetary system. One mandatory feature of our current exponential monetary system is the need for perpetual growth. Not just any kind of growth; exponential growth. That's the price for paying interest on money loaned into existence. Without that growth, our monetary system shudders to a halt and shifts into reverse, operating especially poorly and threatening to melt down the entire economic edifice.

This is so well understood, explicitly or implicitly, throughout all the layers of society and in our various institutions, that you will only ever hear politicians and bankers talking about the "need" for growth.

In fact, they are correct; our system does need growth. All debt-based money systems require growth. That is the resulting feature of loaning one's money into existence. That's the long and the short of the entire story. The growth may seem modest, perhaps a few percent per year ('That's all, honest!'), but therein lies the rub. Any continuous percentage growth is still exponential growth.

Exponential growth means not just a little bit more each year, but a constantly growing amount each year. It is a story of more. Every year needs slightly more than the prior year - that's the requirement.

The Gap

Nobody has yet reconciled the vast intellectual and practical gap that exists between our addiction to exponential growth and the carbon reduction rhetoric coming out of Copenhagen. I've yet to see any credible plan that illustrates how we can grow our economy without using more energy.

Is it somehow possible to grow an economy without using more energy? Let's explore that concept for a bit.

What does it mean to "grow an economy?" Essentially, it means more jobs for more people producing and consuming more things. That's it. An economy, as we measure it, consists of delivering the needs and wants of people in ever-larger quantities. It's those last three words - ever-larger quantities - that defines the whole problem.

For example, suppose our economy consisted only of building houses. If the same number of houses were produced each year, we'd say that the economy was not growing. It wouldn't matter whether the number was four hundred thousand or four million; if the same number of new homes were produced each year, year after year, this would be considered a very bad thing, because it would mean our economy was not growing.

The same is true for cars, hair brushes, big-screen TVs, grape juice, and everything else you can think of that makes up our current economy. Each year, more needs to be sold than the year before, or the magic economic-stimulus wands will come out to ward off the Evil Spirits of No Growth.

If our economy were to grow at the same rate as the population, it would grow by around 1% per year. This is still exponential growth, but it is far short of the 3%-4% that policymakers consider both desirable and necessary. Why the gap? Why do we work so hard to ensure that 1% more people consume 3% more stuff each year?

Out of Service

It's not that 3% is the right number for the land or the people who live upon it. The target of 3% is driven by our monetary system, which needs a certain rate of exponential growth each year in order to cover the interest expense due each year on the already outstanding loans. The needs of our monetary system are driving our economic decisions, not the needs of the people, let alone the needs of the planet. We are in service to our money system, not the other way around.

Today we have a burning need for an economic model that can operate tolerably well without growth. But ours can't, and so we actually find ourselves in the uncomfortable position of pitting human needs against the money system and observing that the money system is winning the battle.

The Federal Reserve exists solely to assure that the monetary system has what it needs to function. That is their focus, their role, and their primary concern. I assume that they assume that by taking care of the monetary system, everything else will take care of itself. I think their assumption is archaic and wrong.

Regardless, our primary institutions and governing systems are in service to a monetary system that is dysfunctional. It was my having this outlook, this lens, more than any other, that allowed me to foresee what so many economists missed. Only by examining the system from a new, and very wide, angle can the enormous flaws in the system be seen.

Economy & Energy

Now let's get back to our main problem of economic growth and energy use (a.k.a. carbon production).

There is simply no way to build houses, produce televisions, grow and transport grape juice, and market hair brushes without consuming energy in the process. That's just a cold, hard reality. We need liquid fuel to extract, transform, and transport products to market. More people living in more houses means we need more electricity.

Sure, we can be more efficient in our use of energy, but unless our efficiency gains are exceeding the rate of economic growth, more energy will be used, not less. In the long run, if we were being 3% more efficient in our use of fuel and growing our economy at 3%, this would mean burning the same amount of fuel each year. Unfortunately, fuel-efficiency gains are well known to run slower than economic growth. For example, the average fuel efficiency of the US car fleet (as measured by the CAFE standards) has increased by 18% over the past 25 years, while the economy has grown by 331%. Naturally, our fuel consumption has grown, not fallen, over that time, despite the efficiency gains.

So the bottom line is this: There is no possible way to both have economic growth (as we've known it in the past) and cut carbon emissions. At least not without doing things very differently.

Things like enforcing extremely high fuel efficiency standards on the automakers, investing heavily in electric rail transport, and moving things around as much as possible by water, and then rail, and finally trucks as a last resort. Things like enforcing building standards that would create super-insulated structures to utilize the sun for heating as much as possible. Where we live, work, and shop would all be reconfigured.

Since we're not doing any of these things in any sort of a credible manner, history suggests that if it comes down to either cutting carbon or growing the economy, the economy will win that battle every time.

We can find examples everywhere - fishermen will deplete their ancestral fishing grounds to earn the money to pay back their boat loan and send their kids to college. Corporations will sacrifice long-term health to make their quarterly numbers. Politicians will promise exorbitant pension benefits to public employees with no plans for how those payments will be made. And so on.

Historically, short-term economic decisions have always trumped long-term considerations.

Again, my purpose here is not to take on the issue of global warming, nor to challenge the IPCC's conclusions, but instead to point out that the political rhetoric on the economy is utterly at odds with the idea of cutting carbon emissions.

So which will it be, cut carbon or spur economic growth?

To hold both at the same time as twin goals is the textbook definition of cognitive dissonance. No wonder people are confused.

And the good news?

The good news for people worried about ever-increasing carbon emissions from here to eternity is that we'll probably never get all the coal and oil out of the ground to burn. Our exponentially-designed economic system will gasp a final breath through a dwindling energy straw long before we manage to extract the remaining dregs. A slumping economy will prevent oil from being extracted from 35,000 feet under the ocean and coal from being pulled up from 4,000 feet under the ground.

Even without the economic dislocation effects, the dire IPCC carbon projections for carbon dioxide accumulation would require the world's extraction and use of coal to climb by more than 600% over the rest of the century, which is pure fantasy.

If emissions from coal are to increase by 600 percent this cannot occur without the USA – that has the world’s largest coal finds – increasing its coal production by the same amount. In an article published in May 2009 in the International Journal of Coal Geology we have studied the historical trends and future possible production of coal in the USA.

The production of high-grade anthracite is decreasing while the production of brown coal in Wyoming is increasing. Future coal production is completely dependent on new coal mining in the state of Montana. According to the constitution of the USA, federal authorities cannot force Montana to produce coal. In Montana they do not want to produce coal since the mining will destroy the environment and large areas of agricultural land.

If the constitution is changed and mining of coal in Montana does occur it is possible for the USA to increase its coal production by 40% but not by 100%. An increase of 600% is pure fantasy.

Today, the world’s largest coal producer is China. Its reserves of coal are half the size of the USA’s and China has no possibility of increasing its coal production by 100%. A 600% increase there is also pure fantasy. Russia, with the world’s second largest coal reserves, can increase its production significantly but the untouched Russian coal reserves lie in central Siberia in an area without infrastructure.

Russia is not dependent on this coal for its own energy needs but if mining did begin there some time after 2050 it could only ever be equivalent to a small fraction of today’s global production. Therefore, it is impossible for global coal production to increase by 100% and 600% is, once again, pure fantasy.

A 40% growth in coal use? Maybe. 600%? No way. So take heart; the worst projections will have to be scaled back considerably, based on lack of hydrocarbons to burn.

The Political Conundrum

The truth of the matter is that a steady decline in energy use is going to result in a steady decline in the economy and a steady (hopefully) decline in living standards. There will simply be less surplus energy to go around. Many service-related jobs will simply disappear, as they will become unaffordable and unnecessary in a world shaped by reduced energy (here are some examples).

But no politician will ever willingly come out and state this, because it will mean large, uncomfortable adjustments for many people. So instead we get schizophrenic words and policies working at cross-purposes (i.e., cutting carbon and growing our economy) when we should be vigorously dealing with reality.

Our monetary system is out of step with reality, and the sooner we admit that, the better. We need an economic model that can operate without the requirement of exponential growth. Can we live prosperous lives in a stable, non-growing economy? Of course we can.

But first we have to admit to ourselves that the source of the trouble is debt-based money. And we need to begin the long, slow process of reorienting our culture, priorities, and values away from growth in service of an ill-fated money system and towards a workable, livable economy that serves humanity, preserves the world, and conforms to reality. It will require refashioning our system of money.

The problem here is that the political system is completely captured by the current practitioners of the existing monetary system. How can we ever expect the people who owe their livelihoods to the continuation of a given system to recognize the need for its reformation? Is this too much to expect?

I suspect it is, and this is why I have been working to educate people like you about the larger story that lurks within the connection of the economy, energy, and the environment. With this recognition comes the opportunity to refashion your finances, thoughts, plans, and hopes - now, on your own terms, rather than later, on some other terms.

If We Were Serious…

If we were really serious about global warming, we'd immediately put a halt to all economic expansion until we figured out how to grow our economy without growing our use of carbon-based energy. We'd probably also get serious about controlling population growth, since that is the ultimate driver of consumption and planetary stress.

In addition, we'd have already begun a crash program in energy conservation and efficiency, beginning with transportation and heating/cooling. These are areas where we have plenty of solutions laying about; all we need is the proper motivation to begin using them.

Since we're not doing any of these things, I can only conclude that we are not really serious about actually doing anything about global warming. The trouble is that the new taxes that are being proposed are deadly serious. If these taxes are anything like past government taxes, they will be announced using very impressive language, but will ultimately disappear into fungible government coffers, where unnecessary things dwell like wars without defined goals and bridges to nowhere.

So besides the keen interest of governments across the world in raising new taxes, I have not yet detected credible signs that any of them are taking climate change to heart.

In the end, you cannot really be serious about climate change (as it has been presented) if you are simultaneously promoting economic growth.

You can't have both.

1 comment :

"All debt-based money systems require growth. That is the resulting feature of loaning one's money into existence. The growth may seem modest, perhaps a few percent per year ('That's all, honest!'), but therein lies the rub. Any continuous percentage growth is still exponential growth.'

Jct: LETS is a debt-based money system lending the money into existence and there are no problems. The growth you speak of is due to the interest, not due to the fact the IOU is based on debt.

Exponential growth means not just a little bit more each year, but a constantly growing amount each year. It

Post a Comment