SUBHEAD: Resets occur when the price of everything that has been repressed, manipulated or obscured is repriced.

By Charles Hugh Smith on 29 October 2013 for Of Two Minds -

(http://www.oftwominds.com/blogoct13/reset10-13.html)

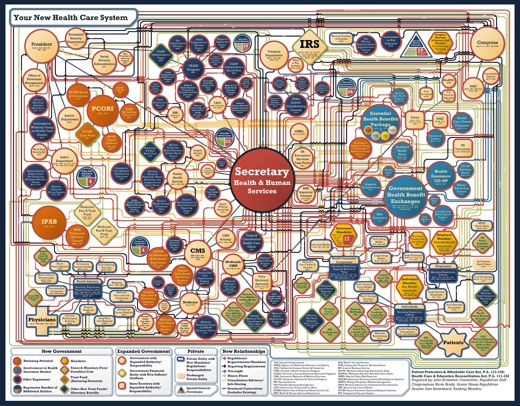

Image above: Actual organization chart of Federal health care. Way too complicated. Click to enlarge. From (http://lonelyconservative.com/2012/05/another-obamacare-failure-small-businesses-fail-to-apply-for-tax-credits/).

Resets occur when the price of everything that has been repressed, manipulated or obscured is repriced.

The global financial system will reset in 2014-2015, regardless of official pronouncements and financial media propaganda hyping the "recovery." Despite the wide spectrum of forecasts (from rosy to stormy), nobody knows precisely what will transpire in 2014-2015, so we must remain circumspect about any and all predictions-- especially our own.

Even as we are mindful of the risks of a forecast being wrong (and the righteous humility that befits any analysis), it seems increasingly self-evident that financial systems around the world are reaching extremes that generally presage violent resets to new equilibria--typically at much lower levels of complexity and energy consumption.

John Michael Greer has described the process of descending stair-step resets (my description, not his) as catabolic collapse. The system resets at a lower level and maintains the new equilibrium for some time before the next crisis/system failure triggers another reset.

There is much systems-analysis intelligence in Greer's concept: systems without interactive feedbacks may collapse suddenly in a heap, but more complex systems tend to stair-step down in a series of resets to lower levels of consumption and complexity--for example, the Roman Empire, which reset many times before reaching the near-collapse level of phantom legions, full-strength on official documents, defending phantom borders.

In the present, we can expect the overly costly, complex, inefficient, fraud-riddled U.S. sickcare (i.e. "healthcare") system to reset as providers (i.e. doctors and physicians' groups) opt out of ObamaCare, Medicare and Medicaid; like the phantom armies defending phantom borders of the crumbling Empire, the vast, centralized empire of sickcare will remain officially at full strength, but few will be able to find caregivers willing to provide care within the systems.

Just as much of the collateral supporting the stock, bond and housing bubbles is phantom, many other centralized systems will reset to phantom status. As local and state governments' revenues are increasingly diverted to fund public union employees' sickcare and pension benefits, the services provided by government will decline as the number of retirees swells and the number of government employees actually filling potholes, etc. drops.

Local government will offer services that are increasingly phantom, as stagnating tax revenues fund benefits for retirees rather than current services. On paper, cities will remain responsible for filling potholes, but in the real world, the potholes will go unfilled. In response, cities will ask taxpayers to approve bonds that cost triple the price of pay-as-you-go pothole filling, as a way to dodge the inevitable conflict between government retirees benefits and taxpayers burdened with decaying streets, schools, etc. and ever-higher taxes.

As for phantom collateral--the real value of the collateral will be undiscovered until people start selling assets in earnest. As long as everyone is buying, the phantom nature of the collateral is masked; it's only when everyone tries to get their money out of asset bubbles is the actual value of the underlying collateral discovered.

When assets go bidless, i.e. there are no buyers at any price, the phantom nature of the supposedly solid collateral is revealed. Price discovery is one way of describing reset; transparent pricing of risk is another way of saying the same thing.

When risk has been mispriced via state guarantees, fraud, willful obfuscation, complexity fortresses, etc., then the repricing of risk also resets the system.

Resets occur when the price of everything that has been repressed, manipulated or obscured is repriced. The greater the manipulation and financial repression, the more violent the reset. What been manipulated, obscured or repressed? Virtually everything: risk, credit, assets, labor, currency, you name it. Everything that has been manipulated by central banks and central states will be repriced.

Trust is difficult to price. Every reset erodes trust in the capacity of the centralized status quo to manipulate/repress price to its liking. Once trust in the system is lost, it cannot be purchased at any cost.

.

By Charles Hugh Smith on 29 October 2013 for Of Two Minds -

(http://www.oftwominds.com/blogoct13/reset10-13.html)

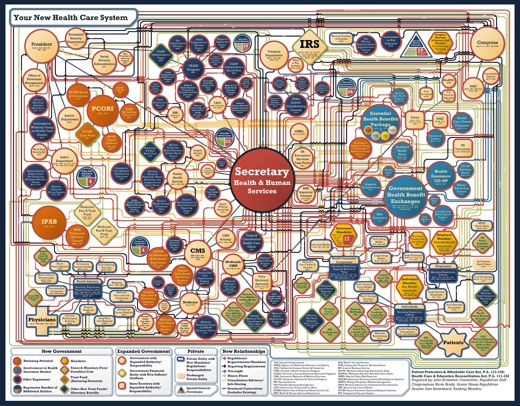

Image above: Actual organization chart of Federal health care. Way too complicated. Click to enlarge. From (http://lonelyconservative.com/2012/05/another-obamacare-failure-small-businesses-fail-to-apply-for-tax-credits/).

Resets occur when the price of everything that has been repressed, manipulated or obscured is repriced.

The global financial system will reset in 2014-2015, regardless of official pronouncements and financial media propaganda hyping the "recovery." Despite the wide spectrum of forecasts (from rosy to stormy), nobody knows precisely what will transpire in 2014-2015, so we must remain circumspect about any and all predictions-- especially our own.

Even as we are mindful of the risks of a forecast being wrong (and the righteous humility that befits any analysis), it seems increasingly self-evident that financial systems around the world are reaching extremes that generally presage violent resets to new equilibria--typically at much lower levels of complexity and energy consumption.

John Michael Greer has described the process of descending stair-step resets (my description, not his) as catabolic collapse. The system resets at a lower level and maintains the new equilibrium for some time before the next crisis/system failure triggers another reset.

There is much systems-analysis intelligence in Greer's concept: systems without interactive feedbacks may collapse suddenly in a heap, but more complex systems tend to stair-step down in a series of resets to lower levels of consumption and complexity--for example, the Roman Empire, which reset many times before reaching the near-collapse level of phantom legions, full-strength on official documents, defending phantom borders.

In the present, we can expect the overly costly, complex, inefficient, fraud-riddled U.S. sickcare (i.e. "healthcare") system to reset as providers (i.e. doctors and physicians' groups) opt out of ObamaCare, Medicare and Medicaid; like the phantom armies defending phantom borders of the crumbling Empire, the vast, centralized empire of sickcare will remain officially at full strength, but few will be able to find caregivers willing to provide care within the systems.

Just as much of the collateral supporting the stock, bond and housing bubbles is phantom, many other centralized systems will reset to phantom status. As local and state governments' revenues are increasingly diverted to fund public union employees' sickcare and pension benefits, the services provided by government will decline as the number of retirees swells and the number of government employees actually filling potholes, etc. drops.

Local government will offer services that are increasingly phantom, as stagnating tax revenues fund benefits for retirees rather than current services. On paper, cities will remain responsible for filling potholes, but in the real world, the potholes will go unfilled. In response, cities will ask taxpayers to approve bonds that cost triple the price of pay-as-you-go pothole filling, as a way to dodge the inevitable conflict between government retirees benefits and taxpayers burdened with decaying streets, schools, etc. and ever-higher taxes.

As for phantom collateral--the real value of the collateral will be undiscovered until people start selling assets in earnest. As long as everyone is buying, the phantom nature of the collateral is masked; it's only when everyone tries to get their money out of asset bubbles is the actual value of the underlying collateral discovered.

When assets go bidless, i.e. there are no buyers at any price, the phantom nature of the supposedly solid collateral is revealed. Price discovery is one way of describing reset; transparent pricing of risk is another way of saying the same thing.

When risk has been mispriced via state guarantees, fraud, willful obfuscation, complexity fortresses, etc., then the repricing of risk also resets the system.

Resets occur when the price of everything that has been repressed, manipulated or obscured is repriced. The greater the manipulation and financial repression, the more violent the reset. What been manipulated, obscured or repressed? Virtually everything: risk, credit, assets, labor, currency, you name it. Everything that has been manipulated by central banks and central states will be repriced.

Trust is difficult to price. Every reset erodes trust in the capacity of the centralized status quo to manipulate/repress price to its liking. Once trust in the system is lost, it cannot be purchased at any cost.

.

No comments :

Post a Comment