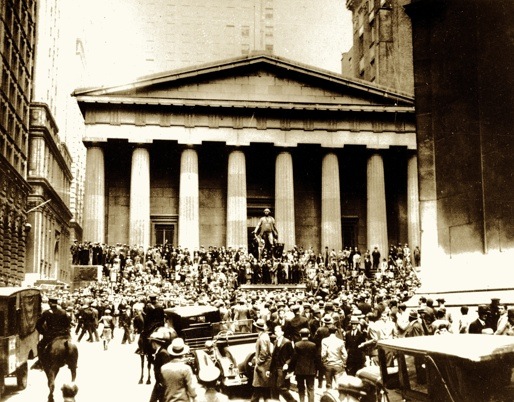

Image above: Confused crowd at the New York Stock Exchange as 1929 Crash was in progress. From (http://blogs.lancasteronline.com/flashbacklancaster/2008/10/29/crash-of-1929)

[Editor's Note: Banks don't have any flexibility to deal with potential foreign losses and desperate domestic speculation is frothing at the top. Today was a perfect case study in the 'animal spirts' of 'irrational exuberance.' With this compilation we are coining a new phrase, The 'Typo Crash' of 2010.]

By Staff on 6 May 2010 on CNBC.com -

(http://www.cnbc.com/id/36999483)

In one of the most dizzying half-hours in stock market history, the Dow plunged nearly 1,000 points before paring those losses—all apparently due to a trader error.

According to multiple sources, a trader entered a "b" for billion instead of an "m" for million in a trade possibly involving Procter & Gamble, a component in the Dow. (CNBC's Jim Cramer noted suspicious price movement in P&G stock on air during the height of the market selloff.)

[See video at http://www.cnbc.com/id/36999483 ]

Sources tell CNBC the erroneous trade may have been made at Citigroup.

"We, along with the rest of the financial industry, are investigating to find the source of today's market volatility," Citigroup said in a statement. "At this point we have no evidence that Citi was involved in any erroneous transaction."

According to a person familiar with the probe, one focus is on futures contracts tied to the Standard & Poor’s 500 stock index, known as E-mini S&P 500 futures, and in particular a two-minute window in which 16 billion of the futures were sold.

Citigroup’s total E-mini volume for the entire day was only 9 billion, suggesting that the origin of the trades was elsewhere, according to someone close to Citigroup’s own probe of the situation. The E-minis trade on the CME.

A CME spokesman said it found no problems with its systems.

The Nasdaq and New York Stock Exchange took the unusual step of declaring that they would cancel some trades that took place during the height of the selloff. Both markets said they will cancel all trades more than 60 percent above or below market that occurred between 2:40 p.m. and 3:00 p.m. New York time.

Other market sources said the erroneous trading involved the IWD exchange-traded fund or the S&P 500 Mini, according to Reuters. A person close to BlackRock, which manages the IWD, said there was no unusual trading in the iShares product.

Amid the sell-off, Procter & Gamble shares plummeted nearly 37 percent to $39.37 at 2:47 p.m. EDT, prompting the company to investigate whether any erroneous trades had occurred.

The shares are listed on the New York Stock Exchange, but the significantly lower share price was recorded on a different electronic trading venue.

"We don't know what caused it," said Procter & Gamble spokeswoman Jennifer Chelune. "We know that that was an electronic trade...and we're looking into it with Nasdaq and the other major electronic exchanges."

A different P&G spokesman had said earlier the company contacted the Securities and Exchange Commission, but Chelune said that he spoke in error.

One NYSE employee leaving the Big Board's headquarters in lower Manhattan said the P&G share plunge lay at the center of whatever happened.

"I'll give you a tip," the employee said, speaking on condition of anonymity. "P&G. Check out the low sale of the day. Something screwed up with the system. It traded down $30 at one point."

Nasdaq said it was working with other major markets to review the market activity that occurred between 2:00 p.m. and 3:00 p.m., when the market plunge happened.

The exchange later said it was investigating potentially erroneous transactions involving multiple securities executed between 2:40 and 3:00 p.m.

Nasdaq also said participants should review their trading activity for potentially erroneous trades.

The massive selloff, which began shortly after 2 p.m. ET, amplified concerns about the spreading European debt crisis as the approval of austerity measures by the Greek Parliament sparked renewed rioting in Athens.

"There is simply a growing recognition that Greece has got to default," banking analyst Dick Bove told CNBC.com. "The riots in the streets showed the decision to repay the debt was not going to be made by the people in Germany, France and Switzerland—it's going to be made by people in Greece and they're not going to repay it."

There also is a growing sense that any collapse of Greece could trigger a wave of defaults across Europe and even the world.

"We've seen a crisis start in a country—Greece—become regional, impact the whole of the Euro zone and is on the verge of truly going global," El-Erian, CEO of the world's biggest bond fund, told CNBC shortly before the selloff began.

.

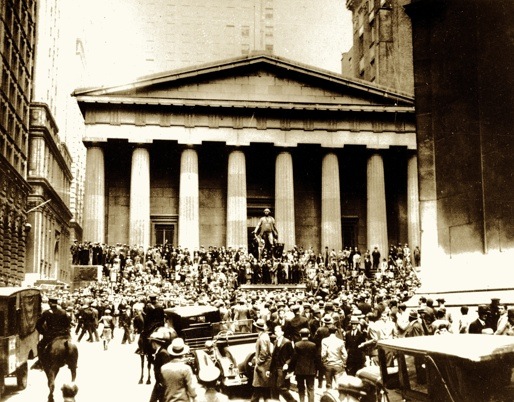

Image above: Confused crowd at the New York Stock Exchange as 1929 Crash was in progress. From (http://blogs.lancasteronline.com/flashbacklancaster/2008/10/29/crash-of-1929)

[Editor's Note: Banks don't have any flexibility to deal with potential foreign losses and desperate domestic speculation is frothing at the top. Today was a perfect case study in the 'animal spirts' of 'irrational exuberance.' With this compilation we are coining a new phrase, The 'Typo Crash' of 2010.]

By Staff on 6 May 2010 on CNBC.com -

(http://www.cnbc.com/id/36999483)

In one of the most dizzying half-hours in stock market history, the Dow plunged nearly 1,000 points before paring those losses—all apparently due to a trader error.

According to multiple sources, a trader entered a "b" for billion instead of an "m" for million in a trade possibly involving Procter & Gamble, a component in the Dow. (CNBC's Jim Cramer noted suspicious price movement in P&G stock on air during the height of the market selloff.)

[See video at http://www.cnbc.com/id/36999483 ]

Sources tell CNBC the erroneous trade may have been made at Citigroup.

"We, along with the rest of the financial industry, are investigating to find the source of today's market volatility," Citigroup said in a statement. "At this point we have no evidence that Citi was involved in any erroneous transaction."

According to a person familiar with the probe, one focus is on futures contracts tied to the Standard & Poor’s 500 stock index, known as E-mini S&P 500 futures, and in particular a two-minute window in which 16 billion of the futures were sold.

Citigroup’s total E-mini volume for the entire day was only 9 billion, suggesting that the origin of the trades was elsewhere, according to someone close to Citigroup’s own probe of the situation. The E-minis trade on the CME.

A CME spokesman said it found no problems with its systems.

The Nasdaq and New York Stock Exchange took the unusual step of declaring that they would cancel some trades that took place during the height of the selloff. Both markets said they will cancel all trades more than 60 percent above or below market that occurred between 2:40 p.m. and 3:00 p.m. New York time.

Other market sources said the erroneous trading involved the IWD exchange-traded fund or the S&P 500 Mini, according to Reuters. A person close to BlackRock, which manages the IWD, said there was no unusual trading in the iShares product.

Amid the sell-off, Procter & Gamble shares plummeted nearly 37 percent to $39.37 at 2:47 p.m. EDT, prompting the company to investigate whether any erroneous trades had occurred.

The shares are listed on the New York Stock Exchange, but the significantly lower share price was recorded on a different electronic trading venue.

"We don't know what caused it," said Procter & Gamble spokeswoman Jennifer Chelune. "We know that that was an electronic trade...and we're looking into it with Nasdaq and the other major electronic exchanges."

A different P&G spokesman had said earlier the company contacted the Securities and Exchange Commission, but Chelune said that he spoke in error.

One NYSE employee leaving the Big Board's headquarters in lower Manhattan said the P&G share plunge lay at the center of whatever happened.

"I'll give you a tip," the employee said, speaking on condition of anonymity. "P&G. Check out the low sale of the day. Something screwed up with the system. It traded down $30 at one point."

Nasdaq said it was working with other major markets to review the market activity that occurred between 2:00 p.m. and 3:00 p.m., when the market plunge happened.

The exchange later said it was investigating potentially erroneous transactions involving multiple securities executed between 2:40 and 3:00 p.m.

Nasdaq also said participants should review their trading activity for potentially erroneous trades.

The massive selloff, which began shortly after 2 p.m. ET, amplified concerns about the spreading European debt crisis as the approval of austerity measures by the Greek Parliament sparked renewed rioting in Athens.

"There is simply a growing recognition that Greece has got to default," banking analyst Dick Bove told CNBC.com. "The riots in the streets showed the decision to repay the debt was not going to be made by the people in Germany, France and Switzerland—it's going to be made by people in Greece and they're not going to repay it."

There also is a growing sense that any collapse of Greece could trigger a wave of defaults across Europe and even the world.

"We've seen a crisis start in a country—Greece—become regional, impact the whole of the Euro zone and is on the verge of truly going global," El-Erian, CEO of the world's biggest bond fund, told CNBC shortly before the selloff began.

.

'Typo Crash' of 2010

SUBHEAD: Stock sell-off may have been triggered by a trader's typo. A mere sell "b" (billion) instead of a "m" (million) keystroke error, or so we are told.

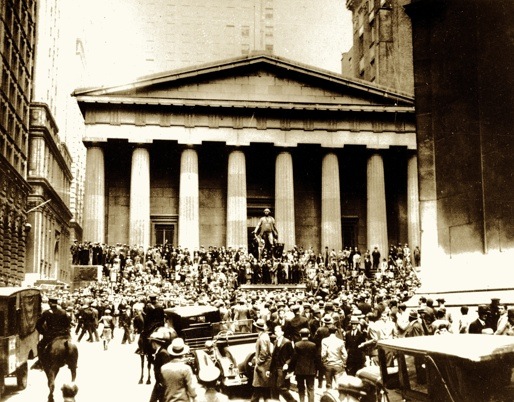

Image above: Confused crowd at the New York Stock Exchange as 1929 Crash was in progress. From (http://blogs.lancasteronline.com/flashbacklancaster/2008/10/29/crash-of-1929)

[Editor's Note: Banks don't have any flexibility to deal with potential foreign losses and desperate domestic speculation is frothing at the top. Today was a perfect case study in the 'animal spirts' of 'irrational exuberance.' With this compilation we are coining a new phrase, The 'Typo Crash' of 2010.]

By Staff on 6 May 2010 on CNBC.com -

(http://www.cnbc.com/id/36999483)

In one of the most dizzying half-hours in stock market history, the Dow plunged nearly 1,000 points before paring those losses—all apparently due to a trader error.

According to multiple sources, a trader entered a "b" for billion instead of an "m" for million in a trade possibly involving Procter & Gamble, a component in the Dow. (CNBC's Jim Cramer noted suspicious price movement in P&G stock on air during the height of the market selloff.)

[See video at http://www.cnbc.com/id/36999483 ]

Sources tell CNBC the erroneous trade may have been made at Citigroup.

"We, along with the rest of the financial industry, are investigating to find the source of today's market volatility," Citigroup said in a statement. "At this point we have no evidence that Citi was involved in any erroneous transaction."

According to a person familiar with the probe, one focus is on futures contracts tied to the Standard & Poor’s 500 stock index, known as E-mini S&P 500 futures, and in particular a two-minute window in which 16 billion of the futures were sold.

Citigroup’s total E-mini volume for the entire day was only 9 billion, suggesting that the origin of the trades was elsewhere, according to someone close to Citigroup’s own probe of the situation. The E-minis trade on the CME.

A CME spokesman said it found no problems with its systems.

The Nasdaq and New York Stock Exchange took the unusual step of declaring that they would cancel some trades that took place during the height of the selloff. Both markets said they will cancel all trades more than 60 percent above or below market that occurred between 2:40 p.m. and 3:00 p.m. New York time.

Other market sources said the erroneous trading involved the IWD exchange-traded fund or the S&P 500 Mini, according to Reuters. A person close to BlackRock, which manages the IWD, said there was no unusual trading in the iShares product.

Amid the sell-off, Procter & Gamble shares plummeted nearly 37 percent to $39.37 at 2:47 p.m. EDT, prompting the company to investigate whether any erroneous trades had occurred.

The shares are listed on the New York Stock Exchange, but the significantly lower share price was recorded on a different electronic trading venue.

"We don't know what caused it," said Procter & Gamble spokeswoman Jennifer Chelune. "We know that that was an electronic trade...and we're looking into it with Nasdaq and the other major electronic exchanges."

A different P&G spokesman had said earlier the company contacted the Securities and Exchange Commission, but Chelune said that he spoke in error.

One NYSE employee leaving the Big Board's headquarters in lower Manhattan said the P&G share plunge lay at the center of whatever happened.

"I'll give you a tip," the employee said, speaking on condition of anonymity. "P&G. Check out the low sale of the day. Something screwed up with the system. It traded down $30 at one point."

Nasdaq said it was working with other major markets to review the market activity that occurred between 2:00 p.m. and 3:00 p.m., when the market plunge happened.

The exchange later said it was investigating potentially erroneous transactions involving multiple securities executed between 2:40 and 3:00 p.m.

Nasdaq also said participants should review their trading activity for potentially erroneous trades.

The massive selloff, which began shortly after 2 p.m. ET, amplified concerns about the spreading European debt crisis as the approval of austerity measures by the Greek Parliament sparked renewed rioting in Athens.

"There is simply a growing recognition that Greece has got to default," banking analyst Dick Bove told CNBC.com. "The riots in the streets showed the decision to repay the debt was not going to be made by the people in Germany, France and Switzerland—it's going to be made by people in Greece and they're not going to repay it."

There also is a growing sense that any collapse of Greece could trigger a wave of defaults across Europe and even the world.

"We've seen a crisis start in a country—Greece—become regional, impact the whole of the Euro zone and is on the verge of truly going global," El-Erian, CEO of the world's biggest bond fund, told CNBC shortly before the selloff began.

.

Image above: Confused crowd at the New York Stock Exchange as 1929 Crash was in progress. From (http://blogs.lancasteronline.com/flashbacklancaster/2008/10/29/crash-of-1929)

[Editor's Note: Banks don't have any flexibility to deal with potential foreign losses and desperate domestic speculation is frothing at the top. Today was a perfect case study in the 'animal spirts' of 'irrational exuberance.' With this compilation we are coining a new phrase, The 'Typo Crash' of 2010.]

By Staff on 6 May 2010 on CNBC.com -

(http://www.cnbc.com/id/36999483)

In one of the most dizzying half-hours in stock market history, the Dow plunged nearly 1,000 points before paring those losses—all apparently due to a trader error.

According to multiple sources, a trader entered a "b" for billion instead of an "m" for million in a trade possibly involving Procter & Gamble, a component in the Dow. (CNBC's Jim Cramer noted suspicious price movement in P&G stock on air during the height of the market selloff.)

[See video at http://www.cnbc.com/id/36999483 ]

Sources tell CNBC the erroneous trade may have been made at Citigroup.

"We, along with the rest of the financial industry, are investigating to find the source of today's market volatility," Citigroup said in a statement. "At this point we have no evidence that Citi was involved in any erroneous transaction."

According to a person familiar with the probe, one focus is on futures contracts tied to the Standard & Poor’s 500 stock index, known as E-mini S&P 500 futures, and in particular a two-minute window in which 16 billion of the futures were sold.

Citigroup’s total E-mini volume for the entire day was only 9 billion, suggesting that the origin of the trades was elsewhere, according to someone close to Citigroup’s own probe of the situation. The E-minis trade on the CME.

A CME spokesman said it found no problems with its systems.

The Nasdaq and New York Stock Exchange took the unusual step of declaring that they would cancel some trades that took place during the height of the selloff. Both markets said they will cancel all trades more than 60 percent above or below market that occurred between 2:40 p.m. and 3:00 p.m. New York time.

Other market sources said the erroneous trading involved the IWD exchange-traded fund or the S&P 500 Mini, according to Reuters. A person close to BlackRock, which manages the IWD, said there was no unusual trading in the iShares product.

Amid the sell-off, Procter & Gamble shares plummeted nearly 37 percent to $39.37 at 2:47 p.m. EDT, prompting the company to investigate whether any erroneous trades had occurred.

The shares are listed on the New York Stock Exchange, but the significantly lower share price was recorded on a different electronic trading venue.

"We don't know what caused it," said Procter & Gamble spokeswoman Jennifer Chelune. "We know that that was an electronic trade...and we're looking into it with Nasdaq and the other major electronic exchanges."

A different P&G spokesman had said earlier the company contacted the Securities and Exchange Commission, but Chelune said that he spoke in error.

One NYSE employee leaving the Big Board's headquarters in lower Manhattan said the P&G share plunge lay at the center of whatever happened.

"I'll give you a tip," the employee said, speaking on condition of anonymity. "P&G. Check out the low sale of the day. Something screwed up with the system. It traded down $30 at one point."

Nasdaq said it was working with other major markets to review the market activity that occurred between 2:00 p.m. and 3:00 p.m., when the market plunge happened.

The exchange later said it was investigating potentially erroneous transactions involving multiple securities executed between 2:40 and 3:00 p.m.

Nasdaq also said participants should review their trading activity for potentially erroneous trades.

The massive selloff, which began shortly after 2 p.m. ET, amplified concerns about the spreading European debt crisis as the approval of austerity measures by the Greek Parliament sparked renewed rioting in Athens.

"There is simply a growing recognition that Greece has got to default," banking analyst Dick Bove told CNBC.com. "The riots in the streets showed the decision to repay the debt was not going to be made by the people in Germany, France and Switzerland—it's going to be made by people in Greece and they're not going to repay it."

There also is a growing sense that any collapse of Greece could trigger a wave of defaults across Europe and even the world.

"We've seen a crisis start in a country—Greece—become regional, impact the whole of the Euro zone and is on the verge of truly going global," El-Erian, CEO of the world's biggest bond fund, told CNBC shortly before the selloff began.

.

Image above: Confused crowd at the New York Stock Exchange as 1929 Crash was in progress. From (http://blogs.lancasteronline.com/flashbacklancaster/2008/10/29/crash-of-1929)

[Editor's Note: Banks don't have any flexibility to deal with potential foreign losses and desperate domestic speculation is frothing at the top. Today was a perfect case study in the 'animal spirts' of 'irrational exuberance.' With this compilation we are coining a new phrase, The 'Typo Crash' of 2010.]

By Staff on 6 May 2010 on CNBC.com -

(http://www.cnbc.com/id/36999483)

In one of the most dizzying half-hours in stock market history, the Dow plunged nearly 1,000 points before paring those losses—all apparently due to a trader error.

According to multiple sources, a trader entered a "b" for billion instead of an "m" for million in a trade possibly involving Procter & Gamble, a component in the Dow. (CNBC's Jim Cramer noted suspicious price movement in P&G stock on air during the height of the market selloff.)

[See video at http://www.cnbc.com/id/36999483 ]

Sources tell CNBC the erroneous trade may have been made at Citigroup.

"We, along with the rest of the financial industry, are investigating to find the source of today's market volatility," Citigroup said in a statement. "At this point we have no evidence that Citi was involved in any erroneous transaction."

According to a person familiar with the probe, one focus is on futures contracts tied to the Standard & Poor’s 500 stock index, known as E-mini S&P 500 futures, and in particular a two-minute window in which 16 billion of the futures were sold.

Citigroup’s total E-mini volume for the entire day was only 9 billion, suggesting that the origin of the trades was elsewhere, according to someone close to Citigroup’s own probe of the situation. The E-minis trade on the CME.

A CME spokesman said it found no problems with its systems.

The Nasdaq and New York Stock Exchange took the unusual step of declaring that they would cancel some trades that took place during the height of the selloff. Both markets said they will cancel all trades more than 60 percent above or below market that occurred between 2:40 p.m. and 3:00 p.m. New York time.

Other market sources said the erroneous trading involved the IWD exchange-traded fund or the S&P 500 Mini, according to Reuters. A person close to BlackRock, which manages the IWD, said there was no unusual trading in the iShares product.

Amid the sell-off, Procter & Gamble shares plummeted nearly 37 percent to $39.37 at 2:47 p.m. EDT, prompting the company to investigate whether any erroneous trades had occurred.

The shares are listed on the New York Stock Exchange, but the significantly lower share price was recorded on a different electronic trading venue.

"We don't know what caused it," said Procter & Gamble spokeswoman Jennifer Chelune. "We know that that was an electronic trade...and we're looking into it with Nasdaq and the other major electronic exchanges."

A different P&G spokesman had said earlier the company contacted the Securities and Exchange Commission, but Chelune said that he spoke in error.

One NYSE employee leaving the Big Board's headquarters in lower Manhattan said the P&G share plunge lay at the center of whatever happened.

"I'll give you a tip," the employee said, speaking on condition of anonymity. "P&G. Check out the low sale of the day. Something screwed up with the system. It traded down $30 at one point."

Nasdaq said it was working with other major markets to review the market activity that occurred between 2:00 p.m. and 3:00 p.m., when the market plunge happened.

The exchange later said it was investigating potentially erroneous transactions involving multiple securities executed between 2:40 and 3:00 p.m.

Nasdaq also said participants should review their trading activity for potentially erroneous trades.

The massive selloff, which began shortly after 2 p.m. ET, amplified concerns about the spreading European debt crisis as the approval of austerity measures by the Greek Parliament sparked renewed rioting in Athens.

"There is simply a growing recognition that Greece has got to default," banking analyst Dick Bove told CNBC.com. "The riots in the streets showed the decision to repay the debt was not going to be made by the people in Germany, France and Switzerland—it's going to be made by people in Greece and they're not going to repay it."

There also is a growing sense that any collapse of Greece could trigger a wave of defaults across Europe and even the world.

"We've seen a crisis start in a country—Greece—become regional, impact the whole of the Euro zone and is on the verge of truly going global," El-Erian, CEO of the world's biggest bond fund, told CNBC shortly before the selloff began.

.

Image above: Confused crowd at the New York Stock Exchange as 1929 Crash was in progress. From (http://blogs.lancasteronline.com/flashbacklancaster/2008/10/29/crash-of-1929)

[Editor's Note: Banks don't have any flexibility to deal with potential foreign losses and desperate domestic speculation is frothing at the top. Today was a perfect case study in the 'animal spirts' of 'irrational exuberance.' With this compilation we are coining a new phrase, The 'Typo Crash' of 2010.]

By Staff on 6 May 2010 on CNBC.com -

(http://www.cnbc.com/id/36999483)

In one of the most dizzying half-hours in stock market history, the Dow plunged nearly 1,000 points before paring those losses—all apparently due to a trader error.

According to multiple sources, a trader entered a "b" for billion instead of an "m" for million in a trade possibly involving Procter & Gamble, a component in the Dow. (CNBC's Jim Cramer noted suspicious price movement in P&G stock on air during the height of the market selloff.)

[See video at http://www.cnbc.com/id/36999483 ]

Sources tell CNBC the erroneous trade may have been made at Citigroup.

"We, along with the rest of the financial industry, are investigating to find the source of today's market volatility," Citigroup said in a statement. "At this point we have no evidence that Citi was involved in any erroneous transaction."

According to a person familiar with the probe, one focus is on futures contracts tied to the Standard & Poor’s 500 stock index, known as E-mini S&P 500 futures, and in particular a two-minute window in which 16 billion of the futures were sold.

Citigroup’s total E-mini volume for the entire day was only 9 billion, suggesting that the origin of the trades was elsewhere, according to someone close to Citigroup’s own probe of the situation. The E-minis trade on the CME.

A CME spokesman said it found no problems with its systems.

The Nasdaq and New York Stock Exchange took the unusual step of declaring that they would cancel some trades that took place during the height of the selloff. Both markets said they will cancel all trades more than 60 percent above or below market that occurred between 2:40 p.m. and 3:00 p.m. New York time.

Other market sources said the erroneous trading involved the IWD exchange-traded fund or the S&P 500 Mini, according to Reuters. A person close to BlackRock, which manages the IWD, said there was no unusual trading in the iShares product.

Amid the sell-off, Procter & Gamble shares plummeted nearly 37 percent to $39.37 at 2:47 p.m. EDT, prompting the company to investigate whether any erroneous trades had occurred.

The shares are listed on the New York Stock Exchange, but the significantly lower share price was recorded on a different electronic trading venue.

"We don't know what caused it," said Procter & Gamble spokeswoman Jennifer Chelune. "We know that that was an electronic trade...and we're looking into it with Nasdaq and the other major electronic exchanges."

A different P&G spokesman had said earlier the company contacted the Securities and Exchange Commission, but Chelune said that he spoke in error.

One NYSE employee leaving the Big Board's headquarters in lower Manhattan said the P&G share plunge lay at the center of whatever happened.

"I'll give you a tip," the employee said, speaking on condition of anonymity. "P&G. Check out the low sale of the day. Something screwed up with the system. It traded down $30 at one point."

Nasdaq said it was working with other major markets to review the market activity that occurred between 2:00 p.m. and 3:00 p.m., when the market plunge happened.

The exchange later said it was investigating potentially erroneous transactions involving multiple securities executed between 2:40 and 3:00 p.m.

Nasdaq also said participants should review their trading activity for potentially erroneous trades.

The massive selloff, which began shortly after 2 p.m. ET, amplified concerns about the spreading European debt crisis as the approval of austerity measures by the Greek Parliament sparked renewed rioting in Athens.

"There is simply a growing recognition that Greece has got to default," banking analyst Dick Bove told CNBC.com. "The riots in the streets showed the decision to repay the debt was not going to be made by the people in Germany, France and Switzerland—it's going to be made by people in Greece and they're not going to repay it."

There also is a growing sense that any collapse of Greece could trigger a wave of defaults across Europe and even the world.

"We've seen a crisis start in a country—Greece—become regional, impact the whole of the Euro zone and is on the verge of truly going global," El-Erian, CEO of the world's biggest bond fund, told CNBC shortly before the selloff began.

.

No comments :

Post a Comment