SUBHEAD: Collapse can be an adaptive response to a rising spiral of crisis that can be ended in no other way.

By John Michael Greer on 28 April 2010 in The Archdruid Report -

(http://thearchdruidreport.blogspot.com/2010/04/costs-of-complexity.html)

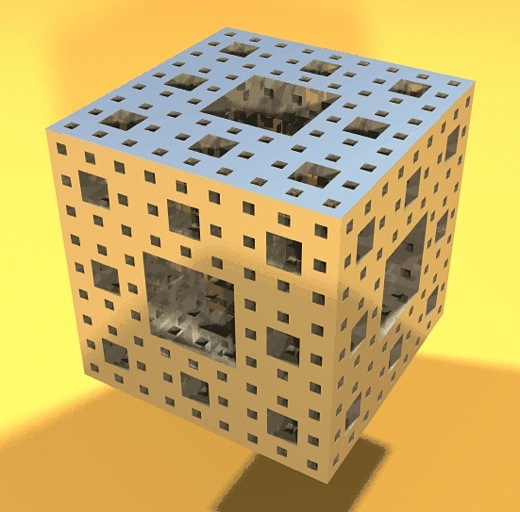

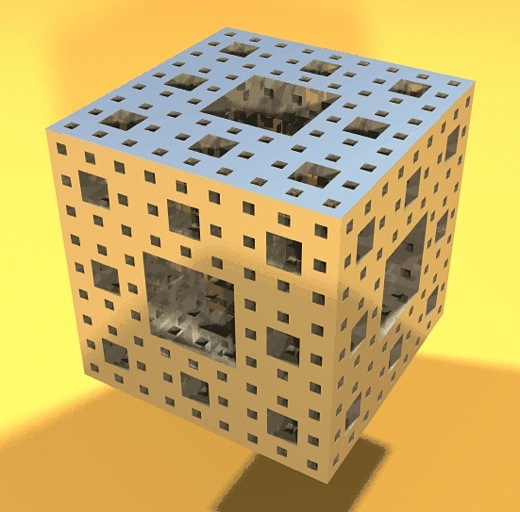

Image above: Computer generated model expressing an element of mathematical complexity. From (http://www.resonancepub.com/complexi.htm).

Image above: Computer generated model expressing an element of mathematical complexity. From (http://www.resonancepub.com/complexi.htm).

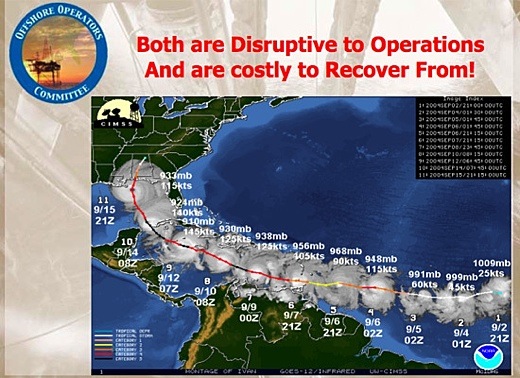

It’s a bit ironic, given the events now in the headlines, that I started last week’s post by commenting that it had been an interesting week for connoisseurs of decline and fall; it might have been better to say “You ain’t seen nothing yet.” About the time the volcanic ash from Iceland began settling out of Europe’s airspace, to begin with, another black cloud began to rise from the lava vents of Wall Street, caused by the spontaneous combustion of whatever might have been left of Goldman Sachs’ reputation for fiscal probity.

It’s a fascinating turn of events, not least because Goldman Sachs has been remarkably cozy with the last two presidential administrations here in the US. Still, that didn’t keep the SEC from filing fraud charges against the firm, and it didn’t prevent the publication of a flurry of highly damaging emails in which Goldman Sachs executives boasted about selling made-to-fail securities to widows and orphans – yes, that last phrase actually got used – and then taking out short contracts on those same securities, so that Goldman Sachs profited when the securities did what they were designed to do, and lost money.

For all the world like

Casablanca’s Captain Renault, Congress is shocked, shocked to find that Goldman Sachs is making money at its customers’ expense; the interesting question is whether this fine imitation of outrage is simply the sort of ritual theater governments use so often these days as a substitute for constructive action, or whether serious power shifts are under way.

My guess, for what it’s worth, is the latter. Despite cheerleading and doctored statistics from within the Beltway, the US economy is in deep and deepening trouble; foreclosures continue to climb, commercial real estate and second mortgages are shaping up to be the next big shocks, and the rolling collapse of state and local government finances shows no sign of slowing down.

The Goldman Sachs flacks who moved into power with the Obama administration promised to fix things; they have pretty clearly failed; and as the neoconservatives learned not long ago, intolerance for failure is very nearly the only thing on which the squabbling factions of the American political class can agree.

Meanwhile, another plume of smoke has been rising from Europe. Greece has had its credit rating cut to junk-bond levels; Portugal and Spain have suffered downgrades, and even rock-solid Germany has had trouble selling its bonds, as investors price in the economic burdens of bailing out countries that lack the political will to keep their expenditures in line with their national income.

If the response to this crisis is bungled badly enough, it’s not impossible that the survival of the Euro may be at risk; it’s still open to question whether a single currency will work without a single government to back and manage it, and the handwaving and bickering that has been the order of business in European capitals as the crisis has unfolded does not particularly inspire confidence.

Speaking of plumes of smoke, of course, calls to mind the third unfolding disaster of the last week, the wreck of the Deepwater Horizon drilling rig, which according to an announcement today is currently spewing around five thousand barrels of oil a day into the Gulf of Mexico.

The US Coast Guard has announced that it plans to light the spreading oil slick on fire, in the hope that enough of it will burn up to save the $2 billion a year Louisiana seafood industry from disaster.

Partisans of the “Drill, Baby, Drill!” approach to energy security take note: there are good practical and economic reasons why most of the US coast has long been off limits to oil drilling, and getting oil out of deposits nearly a mile underwater, and a good deal further than that under sea-bottom sediments, is not as foolproof a procedure as politicians and talk show hosts would like you to think.

These three smoke plumes, interestingly enough, have a factor in common, and it’s the theme I want to discuss in this week’s post – not least because a great many of the crises we’re likely to face as the age of cheap abundant energy comes to an end also share that factor. All three of them resulted when people in a situation of high complexity tried to solve the problems of that situation by adding on an additional layer of complexity.

Goldman Sachs, to begin with, has been in the business of making complex problems more complex for a very long time. One of the chapters of John Kenneth Galbraith’s excellent

The Great Crash 1929, a book which ought to be required reading for all those people who think they understand the stock market, is titled

“In Goldman, Sachs We Trust”; it’s an account of the preposterous investment vehicles (it does violence to the English language to call them “securities”) that Goldman Sachs floated in the 1929 stock market bubble.

Very little has changed since then, either. In 1929, Goldman Sachs sold shares of investment trusts that speculated in shares of other investment trusts; in 2009, they sold tranches of CDOs composed of tranches of other CDOs, and in both cases they served mostly as a means by which a lot of people lost a lot of money while Goldman Sachs did quite well.

You may be wondering why anybody would put their hard-earned money into an investment vehicle that consisted of a collection of bets that other investment vehicles would make money off yet a third set of investment vehicles. In 1929, the answer was raw greed, whipped up to monumental intensity by a very widespread attack of the delusion that brokers want to make you rich.

In 2009, the answer was more complex. For more than twenty years, beginning in the wake of the 1987 Wall Street crash, the financial agencies of the US government had been struggling to keep what was left of the American economy from imploding. One of the main tools used in this struggle was rock-bottom interest rates, which were brought into play whenever one speculative bubble popped and which then, with clockwork regularity, fed the new speculative bubble that followed.

One of the many problems set in motion by this strategy was that all the ordinary sources of investment income were reduced to paying chump change. Gone were the halcyon days when every bank in the United States paid 5.25% per annum on savings accounts by federal law. (It somehow seems to have escaped the attention of most economic historians that the end of that era coincided very precisely with the point at which most Americans stopped putting their money into savings accounts.)

As the Fed repeatedly bounced interest rates off the floor to jumpstart an increasingly reluctant economy, every person and institution dependent on investment income found themselves facing a sharp decrease in income.

The simple solution would have been to accept the austerity that this entailed, but for obvious reasons this was not popular; it’s worth remembering that “simple” is rarely the same thing as “easy.”

The alternative was to respond to this complex set of circumstances by adding another layer of complexity, and Goldman Sachs was ready to help them do so.

Complicated, risky investment strategies that promised high returns became the order of the day. In their eagerness to make more than chump change, a great many people thus became chumps.

The situation in Greece, and a great many other southern European countries, was similar. The same habits of economic manipulation that made the US economy so complex over the last two decades were just as popular in Europe, with the added complexity of a single currency far too rigidly structured to deal with the economic vagaries of more than a dozen fractious nation-states with different economic policies.

Add in the speculative boom in real estate that went bust in 2008, which flooded southern Europe with money and then took it all back with interest, and you have a very complex situation, one in which all the usual options were foreclosed by EU economic policy. There were several simple solutions, such as ditching the Euro and allowing a new Greek currency to find its market value, but once again, “simple” is not the same thing as “easy.”

The government of Greece responded to these complexities instead by adding another layer of complexity. It hired Goldman Sachs – no, I’m not making this up – to create a set of complicated investment vehicles that made the Greek national debt look smaller than it was, in order to get by the more onerous limits of EU economic policy. These vehicles proceeded to crash and burn in the grand style, and took the Greek economy with them.

Similar vehicles were sold by quite a number of brokerages – Goldman Sachs was far from the only player here – to national, provincial, and municipal governments all over Europe, and to state and local governments in the US as well, and yes, they’ve been blowing up right and left; I don’t think vehicles so flammable have been seen in such numbers since the Ford Pinto was recalled.

As far as I know, Goldman Sachs had nothing to do with the Deepwater Horizon drilling platform. Still, the entire strategy of pursuing petroleum production in deep waters is an attempt to solve a hideously complex problem – the problem of Peak Oil – by adding on another layer of complexity.

There’s a simple response to Peak Oil, of course; it consists of using less petroleum, making do with less energy per capita, and learning to live within our means. Once again, though, “simple” doesn’t mean “easy,” any more than it means “enjoyable” or “politically acceptable.”

The result is that we’re pursuing oil wherever we can find it, no matter how complex or risky the prospect might be.

Deepwater drilling is one example. It’s complicated stuff, far more expensive and demanding than the methods used to extract oil that happens to be conveniently located under dry land, and when the standard problems faced by oilmen everywhere crop up, responding to those problems involves a whole new world of complexity and risk.

One of those standard problems is the risk of a blowout: a sudden surge of crude oil and natural gas that can come bursting up through a well at any point between the moment it’s first drilled and the moment the relatively sturdy structure that handles production is in place.

That’s almost certainly what happened to Deepwater Horizon. It’s a common enough event in drilling for oil, and it’s dangerous even when it happens on dry land and there’s someplace for the drilling crew to run.

When the well begins almost a mile underwater, though, there’s the additional problem that nobody has the tools to handle a deepwater blowout if the underwater valves meant to shut it off at the wellhead should fail.

That’s also happened to Deepwater Horizon, and if the current efforts to trigger the valves via robot submersibles don’t succeed – and they’ve shown no sign of succeeding so far – the only option left to the BP response crews is to jerry-rig techniques designed for shallow waters and hope they can be made to work 5000 feet under the sea.

In the meantime, five thousand barrels a day of crude oil fountain out into the Gulf from the crumpled pipe.

In all three of these cases, the decision to add an additional layer of complexity to an already complex problem was an attempt to maintain business as usual, while the simpler option that was refused would have required the decision makers to abandon business as usual and accept a degree of austerity and limitation very few people find congenial these days.

That’s not inherent in the relationship between complexity and simplicity, but it does tend to be a very common feature of the way that relationship works out in practice just now.

We have an extraordinarily complex society; for some three centuries, attempts to manage problems by increasing complexity have paid off more often than not, which is why we have such a complex society; and this has led to the kind of superstition discussed in last week’s post – the unthinking assumption that what worked in the past will continue to work in the present and the future.

As Joseph Tainter has pointed out in his useful book

The Collapse of Complex Societies, though, increases in complexity are subject to the same law of diminishing returns as anything else, and sooner or later a society that responds to every challenge by adding a new layer of complexity will reach the point that adding more complexity causes more problems than it solves. Several observations concerning Tainter’s insight are worth making here.

First, the diminishing returns of complexity apply to specifics as well as generalities, and for statistical reasons, the specifics will usually show up first. A society that has overloaded itself with complexity will tend to heap up more complexity in some areas of life than others, and one or more of these areas may well tip over into dysfunction sooner than others. Thus a society that is hammered by repeated crises of the same kind, and tries to solve them with layers of additional complexity that consistently seem to make the problem worse, may be at risk of tipping over into a wider dysfunction of which the visible crises are merely symptomatic.

Second, if a society has driven itself past the point of negative returns on complexity, and continues to try to add complexity to solve the resulting problems, it risks establishing a disastrous feedback loop in which its attempts to solve its problems become the major source of its problems. This can also apply to specifics as well as generalities, and show up first in particular aspects of a society’s collective life.

Third, one of the ironies faced by a society that has reached the point of negative returns on complexity as a means of problem-solving is that thereafter, the only way it can solve its problems is by not solving its problems. Any attempt to impose additional complexity will simply make matters worse, while allowing some particularly problematic heap of complexity to crash and burn may just reduce the complexity of the whole system to a point at which something constructive can actually be done. In the extreme case, where an entire society has pushed itself past the point of negative returns on complexity, collapse can be an adaptive response to a rising spiral of crisis that can be ended in no other way.

Finally, all these considerations apply just as much to the level of the individual, family, and community as they do to civilizations as whole systems, and it’s possible to use simplification on the level of the individual, family, and community to counter at least some of the consequences of complexity run amok. We’ll talk more about how that might work next week.

.