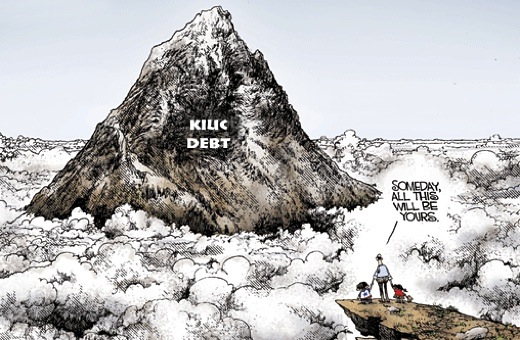

Image above: Political cartoon by Michael Ramirez altered with addition of "KIUC".

From (http://townhall.com/cartoons/cartoonist/MichaelRamirez/2010/02/1/)

By Coco Zickos on 8 February 2010 in The Garden Island -

http://thegardenisland.com/news/local/article_477142b2-147b-11df-b4ff-001cc4c002e0.html)

"Long-term plan doesn’t account enough for efficiency."

- Ben Sullivan, KIUC Board Member

Consumers are changing the way they utilize energy, says Brad Parsons of Kauaians for a Bright Energy Future.

This is exactly why he agrees with Kaua‘i Island Utility Cooperative first-year Board of Directors member Ben Sullivan’s decision to vote against the co-op’s 10-Year Financial Forecast at the board’s meeting January 26th. The forecast was approved by a 6-to-1 vote.

The load growth forecast was part of the required application process for KIUC to qualify for a $168 million loan that follows a four-year construction plan, KIUC President and CEO Randy Hee said Sunday. The Construction Work Plan includes transmission line work, renewable energy projects and a Kapaia facility which would have the ability to generate energy from petroleum or biodiesel fuels.

“It is far more than paperwork but is procedural in nature,” KIUC spokesperson Anne Barnes said regarding the forecast. “It does not constitute a commitment. It does allow for the necessary opportunity for access to capital, something that is critical to a utility.”

The additional loan amount would bump KIUC’s debt limit up from $350 million to $525 million.

Predicting continued load growth “assumes the trends of the old economy from two years ago and beyond,” Parsons said.

“The long-range forecast relies more on historical trends,” Barnes said. “The short term relies more on current trends.”

Two years of “considerable input from staff” and the knowledge of consultants from Black & Veatch, R.W. Beck, Stillwater Inc. and Energy Resource Planning led to the current decade-long forecast, or Equity Management Plan. Collectively, they studied the Integrated Resource Planning for capital projections, fuel forecasts, load forecasts, construction works in progress and long-range engineering plans, Barnes said.

“The incorporation of these studies became the financial forecast,” she said. Lower sales throughout the next four years were reflected “due to the recent bad economy.”

Parsons and others continue to point at how people are historically changing their ways. They are using their cars differently, development is not “continuing like it did in the past,” and visitor numbers have been declining, he said.

Last week Reuters reported that industrialized, wealthy countries “will never return to 2006 and 2007 levels” of oil use “because of more fuel efficiency and the use of alternatives,” according to the International Energy Agency’s chief economist.

“What we’ve seen over the years is Kaua‘i is growing,” Hee said when asked on what basis the forecast was measured, adding that the co-op “did account for a little dip to some extent.”

“Our history on Kaua‘i has been fairly constant growth,” he said.

The projection assumes pretty aggressive growth, Sullivan said during the board meeting. The question is what will happen if the growth does not actually occur as planned?

The impact of efficiency is not entirely being accounted for, he said.

“KIUC recognizes there is considerable risk in predicting the timing, extent and duration of economic recovery,” Barnes said. “But planning horizons in the utility industries can be as long as 10 years for capital improvements, renewable or otherwise. Hence, the necessity of long-range planning and access to capital.”

If plans follow through to build a proposed 10-megawatt solar thermal farm, as well as a 20-megawatt biomass-to-electricity plant on the Westside, “a substantial amount of power for the island” could potentially be supplied within the next decade, Barnes said. However, “due to capacity factors and other issues, determining actual output is not necessarily a simple mathematical calculation.”

KIUC’s loan application was submitted soon after the January 26th board meeting and could take up to a year to be approved, Hee said.

.

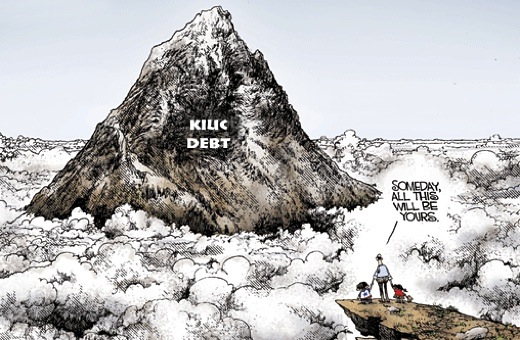

Image above: Political cartoon by Michael Ramirez altered with addition of "KIUC".

From (http://townhall.com/cartoons/cartoonist/MichaelRamirez/2010/02/1/)

By Coco Zickos on 8 February 2010 in The Garden Island -

http://thegardenisland.com/news/local/article_477142b2-147b-11df-b4ff-001cc4c002e0.html)

"Long-term plan doesn’t account enough for efficiency."

- Ben Sullivan, KIUC Board Member

Consumers are changing the way they utilize energy, says Brad Parsons of Kauaians for a Bright Energy Future.

This is exactly why he agrees with Kaua‘i Island Utility Cooperative first-year Board of Directors member Ben Sullivan’s decision to vote against the co-op’s 10-Year Financial Forecast at the board’s meeting January 26th. The forecast was approved by a 6-to-1 vote.

The load growth forecast was part of the required application process for KIUC to qualify for a $168 million loan that follows a four-year construction plan, KIUC President and CEO Randy Hee said Sunday. The Construction Work Plan includes transmission line work, renewable energy projects and a Kapaia facility which would have the ability to generate energy from petroleum or biodiesel fuels.

“It is far more than paperwork but is procedural in nature,” KIUC spokesperson Anne Barnes said regarding the forecast. “It does not constitute a commitment. It does allow for the necessary opportunity for access to capital, something that is critical to a utility.”

The additional loan amount would bump KIUC’s debt limit up from $350 million to $525 million.

Predicting continued load growth “assumes the trends of the old economy from two years ago and beyond,” Parsons said.

“The long-range forecast relies more on historical trends,” Barnes said. “The short term relies more on current trends.”

Two years of “considerable input from staff” and the knowledge of consultants from Black & Veatch, R.W. Beck, Stillwater Inc. and Energy Resource Planning led to the current decade-long forecast, or Equity Management Plan. Collectively, they studied the Integrated Resource Planning for capital projections, fuel forecasts, load forecasts, construction works in progress and long-range engineering plans, Barnes said.

“The incorporation of these studies became the financial forecast,” she said. Lower sales throughout the next four years were reflected “due to the recent bad economy.”

Parsons and others continue to point at how people are historically changing their ways. They are using their cars differently, development is not “continuing like it did in the past,” and visitor numbers have been declining, he said.

Last week Reuters reported that industrialized, wealthy countries “will never return to 2006 and 2007 levels” of oil use “because of more fuel efficiency and the use of alternatives,” according to the International Energy Agency’s chief economist.

“What we’ve seen over the years is Kaua‘i is growing,” Hee said when asked on what basis the forecast was measured, adding that the co-op “did account for a little dip to some extent.”

“Our history on Kaua‘i has been fairly constant growth,” he said.

The projection assumes pretty aggressive growth, Sullivan said during the board meeting. The question is what will happen if the growth does not actually occur as planned?

The impact of efficiency is not entirely being accounted for, he said.

“KIUC recognizes there is considerable risk in predicting the timing, extent and duration of economic recovery,” Barnes said. “But planning horizons in the utility industries can be as long as 10 years for capital improvements, renewable or otherwise. Hence, the necessity of long-range planning and access to capital.”

If plans follow through to build a proposed 10-megawatt solar thermal farm, as well as a 20-megawatt biomass-to-electricity plant on the Westside, “a substantial amount of power for the island” could potentially be supplied within the next decade, Barnes said. However, “due to capacity factors and other issues, determining actual output is not necessarily a simple mathematical calculation.”

KIUC’s loan application was submitted soon after the January 26th board meeting and could take up to a year to be approved, Hee said.

.

KIUC moves to increase already high debt levels

SUBHEAD: In preparation for buying another fossil fuel generator, KIUC relies on out-dated demand forecasts, a setup for bad decision-making.

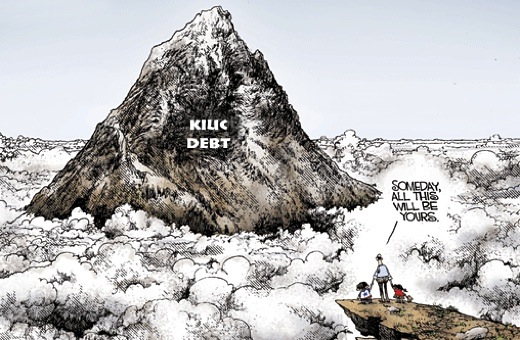

Image above: Political cartoon by Michael Ramirez altered with addition of "KIUC".

From (http://townhall.com/cartoons/cartoonist/MichaelRamirez/2010/02/1/)

By Coco Zickos on 8 February 2010 in The Garden Island -

http://thegardenisland.com/news/local/article_477142b2-147b-11df-b4ff-001cc4c002e0.html)

"Long-term plan doesn’t account enough for efficiency."

- Ben Sullivan, KIUC Board Member

Consumers are changing the way they utilize energy, says Brad Parsons of Kauaians for a Bright Energy Future.

This is exactly why he agrees with Kaua‘i Island Utility Cooperative first-year Board of Directors member Ben Sullivan’s decision to vote against the co-op’s 10-Year Financial Forecast at the board’s meeting January 26th. The forecast was approved by a 6-to-1 vote.

The load growth forecast was part of the required application process for KIUC to qualify for a $168 million loan that follows a four-year construction plan, KIUC President and CEO Randy Hee said Sunday. The Construction Work Plan includes transmission line work, renewable energy projects and a Kapaia facility which would have the ability to generate energy from petroleum or biodiesel fuels.

“It is far more than paperwork but is procedural in nature,” KIUC spokesperson Anne Barnes said regarding the forecast. “It does not constitute a commitment. It does allow for the necessary opportunity for access to capital, something that is critical to a utility.”

The additional loan amount would bump KIUC’s debt limit up from $350 million to $525 million.

Predicting continued load growth “assumes the trends of the old economy from two years ago and beyond,” Parsons said.

“The long-range forecast relies more on historical trends,” Barnes said. “The short term relies more on current trends.”

Two years of “considerable input from staff” and the knowledge of consultants from Black & Veatch, R.W. Beck, Stillwater Inc. and Energy Resource Planning led to the current decade-long forecast, or Equity Management Plan. Collectively, they studied the Integrated Resource Planning for capital projections, fuel forecasts, load forecasts, construction works in progress and long-range engineering plans, Barnes said.

“The incorporation of these studies became the financial forecast,” she said. Lower sales throughout the next four years were reflected “due to the recent bad economy.”

Parsons and others continue to point at how people are historically changing their ways. They are using their cars differently, development is not “continuing like it did in the past,” and visitor numbers have been declining, he said.

Last week Reuters reported that industrialized, wealthy countries “will never return to 2006 and 2007 levels” of oil use “because of more fuel efficiency and the use of alternatives,” according to the International Energy Agency’s chief economist.

“What we’ve seen over the years is Kaua‘i is growing,” Hee said when asked on what basis the forecast was measured, adding that the co-op “did account for a little dip to some extent.”

“Our history on Kaua‘i has been fairly constant growth,” he said.

The projection assumes pretty aggressive growth, Sullivan said during the board meeting. The question is what will happen if the growth does not actually occur as planned?

The impact of efficiency is not entirely being accounted for, he said.

“KIUC recognizes there is considerable risk in predicting the timing, extent and duration of economic recovery,” Barnes said. “But planning horizons in the utility industries can be as long as 10 years for capital improvements, renewable or otherwise. Hence, the necessity of long-range planning and access to capital.”

If plans follow through to build a proposed 10-megawatt solar thermal farm, as well as a 20-megawatt biomass-to-electricity plant on the Westside, “a substantial amount of power for the island” could potentially be supplied within the next decade, Barnes said. However, “due to capacity factors and other issues, determining actual output is not necessarily a simple mathematical calculation.”

KIUC’s loan application was submitted soon after the January 26th board meeting and could take up to a year to be approved, Hee said.

.

Image above: Political cartoon by Michael Ramirez altered with addition of "KIUC".

From (http://townhall.com/cartoons/cartoonist/MichaelRamirez/2010/02/1/)

By Coco Zickos on 8 February 2010 in The Garden Island -

http://thegardenisland.com/news/local/article_477142b2-147b-11df-b4ff-001cc4c002e0.html)

"Long-term plan doesn’t account enough for efficiency."

- Ben Sullivan, KIUC Board Member

Consumers are changing the way they utilize energy, says Brad Parsons of Kauaians for a Bright Energy Future.

This is exactly why he agrees with Kaua‘i Island Utility Cooperative first-year Board of Directors member Ben Sullivan’s decision to vote against the co-op’s 10-Year Financial Forecast at the board’s meeting January 26th. The forecast was approved by a 6-to-1 vote.

The load growth forecast was part of the required application process for KIUC to qualify for a $168 million loan that follows a four-year construction plan, KIUC President and CEO Randy Hee said Sunday. The Construction Work Plan includes transmission line work, renewable energy projects and a Kapaia facility which would have the ability to generate energy from petroleum or biodiesel fuels.

“It is far more than paperwork but is procedural in nature,” KIUC spokesperson Anne Barnes said regarding the forecast. “It does not constitute a commitment. It does allow for the necessary opportunity for access to capital, something that is critical to a utility.”

The additional loan amount would bump KIUC’s debt limit up from $350 million to $525 million.

Predicting continued load growth “assumes the trends of the old economy from two years ago and beyond,” Parsons said.

“The long-range forecast relies more on historical trends,” Barnes said. “The short term relies more on current trends.”

Two years of “considerable input from staff” and the knowledge of consultants from Black & Veatch, R.W. Beck, Stillwater Inc. and Energy Resource Planning led to the current decade-long forecast, or Equity Management Plan. Collectively, they studied the Integrated Resource Planning for capital projections, fuel forecasts, load forecasts, construction works in progress and long-range engineering plans, Barnes said.

“The incorporation of these studies became the financial forecast,” she said. Lower sales throughout the next four years were reflected “due to the recent bad economy.”

Parsons and others continue to point at how people are historically changing their ways. They are using their cars differently, development is not “continuing like it did in the past,” and visitor numbers have been declining, he said.

Last week Reuters reported that industrialized, wealthy countries “will never return to 2006 and 2007 levels” of oil use “because of more fuel efficiency and the use of alternatives,” according to the International Energy Agency’s chief economist.

“What we’ve seen over the years is Kaua‘i is growing,” Hee said when asked on what basis the forecast was measured, adding that the co-op “did account for a little dip to some extent.”

“Our history on Kaua‘i has been fairly constant growth,” he said.

The projection assumes pretty aggressive growth, Sullivan said during the board meeting. The question is what will happen if the growth does not actually occur as planned?

The impact of efficiency is not entirely being accounted for, he said.

“KIUC recognizes there is considerable risk in predicting the timing, extent and duration of economic recovery,” Barnes said. “But planning horizons in the utility industries can be as long as 10 years for capital improvements, renewable or otherwise. Hence, the necessity of long-range planning and access to capital.”

If plans follow through to build a proposed 10-megawatt solar thermal farm, as well as a 20-megawatt biomass-to-electricity plant on the Westside, “a substantial amount of power for the island” could potentially be supplied within the next decade, Barnes said. However, “due to capacity factors and other issues, determining actual output is not necessarily a simple mathematical calculation.”

KIUC’s loan application was submitted soon after the January 26th board meeting and could take up to a year to be approved, Hee said.

.

Image above: Political cartoon by Michael Ramirez altered with addition of "KIUC".

From (http://townhall.com/cartoons/cartoonist/MichaelRamirez/2010/02/1/)

By Coco Zickos on 8 February 2010 in The Garden Island -

http://thegardenisland.com/news/local/article_477142b2-147b-11df-b4ff-001cc4c002e0.html)

"Long-term plan doesn’t account enough for efficiency."

- Ben Sullivan, KIUC Board Member

Consumers are changing the way they utilize energy, says Brad Parsons of Kauaians for a Bright Energy Future.

This is exactly why he agrees with Kaua‘i Island Utility Cooperative first-year Board of Directors member Ben Sullivan’s decision to vote against the co-op’s 10-Year Financial Forecast at the board’s meeting January 26th. The forecast was approved by a 6-to-1 vote.

The load growth forecast was part of the required application process for KIUC to qualify for a $168 million loan that follows a four-year construction plan, KIUC President and CEO Randy Hee said Sunday. The Construction Work Plan includes transmission line work, renewable energy projects and a Kapaia facility which would have the ability to generate energy from petroleum or biodiesel fuels.

“It is far more than paperwork but is procedural in nature,” KIUC spokesperson Anne Barnes said regarding the forecast. “It does not constitute a commitment. It does allow for the necessary opportunity for access to capital, something that is critical to a utility.”

The additional loan amount would bump KIUC’s debt limit up from $350 million to $525 million.

Predicting continued load growth “assumes the trends of the old economy from two years ago and beyond,” Parsons said.

“The long-range forecast relies more on historical trends,” Barnes said. “The short term relies more on current trends.”

Two years of “considerable input from staff” and the knowledge of consultants from Black & Veatch, R.W. Beck, Stillwater Inc. and Energy Resource Planning led to the current decade-long forecast, or Equity Management Plan. Collectively, they studied the Integrated Resource Planning for capital projections, fuel forecasts, load forecasts, construction works in progress and long-range engineering plans, Barnes said.

“The incorporation of these studies became the financial forecast,” she said. Lower sales throughout the next four years were reflected “due to the recent bad economy.”

Parsons and others continue to point at how people are historically changing their ways. They are using their cars differently, development is not “continuing like it did in the past,” and visitor numbers have been declining, he said.

Last week Reuters reported that industrialized, wealthy countries “will never return to 2006 and 2007 levels” of oil use “because of more fuel efficiency and the use of alternatives,” according to the International Energy Agency’s chief economist.

“What we’ve seen over the years is Kaua‘i is growing,” Hee said when asked on what basis the forecast was measured, adding that the co-op “did account for a little dip to some extent.”

“Our history on Kaua‘i has been fairly constant growth,” he said.

The projection assumes pretty aggressive growth, Sullivan said during the board meeting. The question is what will happen if the growth does not actually occur as planned?

The impact of efficiency is not entirely being accounted for, he said.

“KIUC recognizes there is considerable risk in predicting the timing, extent and duration of economic recovery,” Barnes said. “But planning horizons in the utility industries can be as long as 10 years for capital improvements, renewable or otherwise. Hence, the necessity of long-range planning and access to capital.”

If plans follow through to build a proposed 10-megawatt solar thermal farm, as well as a 20-megawatt biomass-to-electricity plant on the Westside, “a substantial amount of power for the island” could potentially be supplied within the next decade, Barnes said. However, “due to capacity factors and other issues, determining actual output is not necessarily a simple mathematical calculation.”

KIUC’s loan application was submitted soon after the January 26th board meeting and could take up to a year to be approved, Hee said.

.

Image above: Political cartoon by Michael Ramirez altered with addition of "KIUC".

From (http://townhall.com/cartoons/cartoonist/MichaelRamirez/2010/02/1/)

By Coco Zickos on 8 February 2010 in The Garden Island -

http://thegardenisland.com/news/local/article_477142b2-147b-11df-b4ff-001cc4c002e0.html)

"Long-term plan doesn’t account enough for efficiency."

- Ben Sullivan, KIUC Board Member

Consumers are changing the way they utilize energy, says Brad Parsons of Kauaians for a Bright Energy Future.

This is exactly why he agrees with Kaua‘i Island Utility Cooperative first-year Board of Directors member Ben Sullivan’s decision to vote against the co-op’s 10-Year Financial Forecast at the board’s meeting January 26th. The forecast was approved by a 6-to-1 vote.

The load growth forecast was part of the required application process for KIUC to qualify for a $168 million loan that follows a four-year construction plan, KIUC President and CEO Randy Hee said Sunday. The Construction Work Plan includes transmission line work, renewable energy projects and a Kapaia facility which would have the ability to generate energy from petroleum or biodiesel fuels.

“It is far more than paperwork but is procedural in nature,” KIUC spokesperson Anne Barnes said regarding the forecast. “It does not constitute a commitment. It does allow for the necessary opportunity for access to capital, something that is critical to a utility.”

The additional loan amount would bump KIUC’s debt limit up from $350 million to $525 million.

Predicting continued load growth “assumes the trends of the old economy from two years ago and beyond,” Parsons said.

“The long-range forecast relies more on historical trends,” Barnes said. “The short term relies more on current trends.”

Two years of “considerable input from staff” and the knowledge of consultants from Black & Veatch, R.W. Beck, Stillwater Inc. and Energy Resource Planning led to the current decade-long forecast, or Equity Management Plan. Collectively, they studied the Integrated Resource Planning for capital projections, fuel forecasts, load forecasts, construction works in progress and long-range engineering plans, Barnes said.

“The incorporation of these studies became the financial forecast,” she said. Lower sales throughout the next four years were reflected “due to the recent bad economy.”

Parsons and others continue to point at how people are historically changing their ways. They are using their cars differently, development is not “continuing like it did in the past,” and visitor numbers have been declining, he said.

Last week Reuters reported that industrialized, wealthy countries “will never return to 2006 and 2007 levels” of oil use “because of more fuel efficiency and the use of alternatives,” according to the International Energy Agency’s chief economist.

“What we’ve seen over the years is Kaua‘i is growing,” Hee said when asked on what basis the forecast was measured, adding that the co-op “did account for a little dip to some extent.”

“Our history on Kaua‘i has been fairly constant growth,” he said.

The projection assumes pretty aggressive growth, Sullivan said during the board meeting. The question is what will happen if the growth does not actually occur as planned?

The impact of efficiency is not entirely being accounted for, he said.

“KIUC recognizes there is considerable risk in predicting the timing, extent and duration of economic recovery,” Barnes said. “But planning horizons in the utility industries can be as long as 10 years for capital improvements, renewable or otherwise. Hence, the necessity of long-range planning and access to capital.”

If plans follow through to build a proposed 10-megawatt solar thermal farm, as well as a 20-megawatt biomass-to-electricity plant on the Westside, “a substantial amount of power for the island” could potentially be supplied within the next decade, Barnes said. However, “due to capacity factors and other issues, determining actual output is not necessarily a simple mathematical calculation.”

KIUC’s loan application was submitted soon after the January 26th board meeting and could take up to a year to be approved, Hee said.

.

INDEX:

Consumption

,

Debt

,

Energy

,

KIUC

,

Planning

2 comments :

That headline you added is pretty irresponsible. Do you actually understand the impact of debt-equity ratio on utility rates, especially WHO pays the rates? It is NOT like a personal mortgage on your home; If a utility drives debt down it has to do it with today’s dollars. The impact is to drive rates up for today’s rate payers to benefit ratepayers down the road. Ideally the debt aligns with the life of the equipment, for a utility most of the infrastructure is 20 – 30 years so that’s how you want to structure the debt. You want a smart grid, how many hundreds of millions of dollars do you think that is going to cost? How do you want to pay for it if not debt amortized over the life of the equipment purchased?

Walt,

We spent way too much to bail out Kauai Electric. A sweet deal for a bankrupt private utility. As a result KIUC has been hobbled and has never had a chance to act as a cooperative.

I don't want a smart grid. The grid is a luxury we soon won't be able to afford.

I want KIUC to encourage distributed power generation by members. That goes for food and water distribution as well.

Juan

Post a Comment