SUBHEAD: What happens to a failed democracy is a period of chaos, followed by the rise of a talented despot.

By John Michael Greer on 27 May 2015 the Archdruid Report -

(http://thearchdruidreport.blogspot.com/2015/05/the-era-of-response.html)

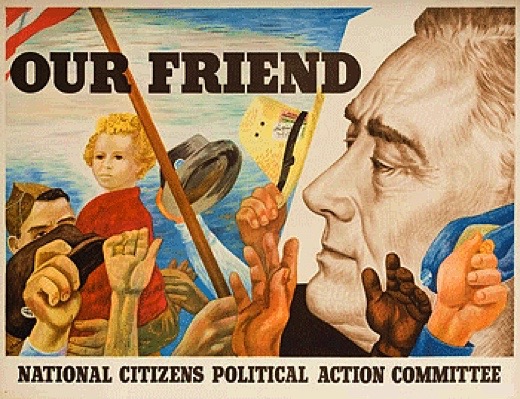

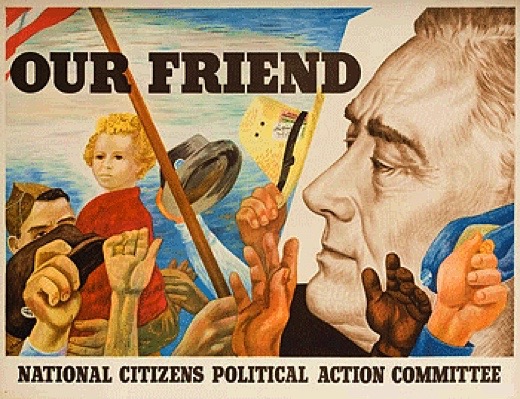

Image above: Poster supporting President Franklin Roosevelt and his New Deal revolution; a softer version of dictatorship than Germany or Russia. From (https://www.laprogressive.com/a-new-new-deal/).

The third stage of the process of collapse, following what I’ve called the eras of pretense and impact, is the era of response. It’s easy to misunderstand what this involves, because both of the previous eras have their own kinds of response to whatever is driving the collapse; it’s just that those kinds of response are more precisely nonresponses, attempts to make the crisis go away without addressing any of the things that are making it happen.

If you want a first-rate example of the standard nonresponse of the era of pretense, you’ll find one in the sunny streets of Miami, Florida right now. As a result of global climate change, sea level has gone up and the Gulf Stream has slowed down.

One consequence is that these days, whenever Miami gets a high tide combined with a stiff onshore wind, salt water comes boiling up through the storm sewers of the city all over the low-lying parts of town. The response of the Florida state government has been to ssue an order to all state employees that they’re not allowed to utter the phrase “climate change.”

That sort of thing is standard practice in an astonishing range of subjects in America these days. Consider the roles that the essentially nonexistent recovery from the housing-bubble crash of 2008-9 has played in political rhetoric since that time.

The current inmate of the White House has been insisting through most of two turns that happy days are here again, and the usual reams of doctored statistics have been churned out in an effort to convince people who know better that they’re just imagining that something is wrong with the economy.

We can expect to hear that same claim made in increasingly loud and confident tones right up until the day the bottom finally drops out.

With the end of the era of pretense and the arrival of the era of impact comes a distinct shift in the standard mode of nonresponse, which can be used quite neatly to time the transition from one era to another.

Where the nonresponses of the era of pretense insist that there’s nothing wrong and nobody has to do anything outside the realm of business as usual, the nonresponses of the era of impact claim just as forcefully that whatever’s gone wrong is a temporary difficulty and everything will be fine if we all unite to do even more of whatever activity defines business as usual.

That this normally amounts to doing more of whatever made the crisis happen in the first place, and thus reliably makes things worse is just one of the little ironies history has to offer.

What unites the era of pretense with the era of impact is the unshaken belief that in the final analysis, there’s nothing essentially wrong with the existing order of things.

Whatever little difficulties may show up from time to time may be ignored as irrelevant or talked out of existence, or they may have to be shoved aside by some concerted effort, but it’s inconceivable to most people in these two eras that the existing order of things is itself the source of society’s problems, and has to be changed in some way that goes beyond the cosmetic dimension.

When the inconceivable becomes inescapable, in turn, the second phase gives way to the third, and the era of response has arrived.

This doesn’t mean that everyone comes to grips with the real issues, and buckles down to the hard work that will be needed to rebuild society on a sounder footing.

Winston Churchill once noted with his customary wry humor that the American people can be counted on to do the right thing, once they have exhausted every other possibility.

He was of course quite correct, but the same rule can be applied with equal validity to every other nation this side of Utopia, too. The era of response, in practice, generally consists of a desperate attempt to find something that will solve the crisis du jour, other than the one thing that everyone knows will solve the crisis du jour but nobody wants to do.

Let’s return to the two examples we’ve been following so far, the outbreak of the Great Depression and the coming of the French Revolution. In the aftermath of the 1929 stock market crash, once the initial impact was over and the “sucker’s rally” of early 1930 had come and gone, the federal government and the various power centers and pressure groups that struggled for influence within its capacious frame were united in pursuit of a single goal: finding a way to restore prosperity without doing either of the things that had to be done in order to restore prosperity.

That task occupied the best minds in the US elite from the summer of 1930 straight through until April of 1933, and the mere fact that their attempts to accomplish this impossibility proved to be a wretched failure shouldn’t blind anyone to the Herculean efforts that were involved in the attempt.

The first of the two things that had to be tackled in order to restore prosperity was to do something about the drastic imbalance in the distribution of income in the United States.

As noted in previous posts, an economy dependent on consumer expenditures can’t thrive unless consumers have plenty of money to spend, and in the United States in the late 1920s, they didn’t—well, except for the very modest number of those who belonged to the narrow circles of the well-to-do.

It’s not often recalled these days just how ghastly the slums of urban America were in 1929, or how many rural Americans lived in squalid one-room shacks of the sort you pretty much have to travel to the Third World to see these days. Labor unions and strikes were illegal in 1920s America; concepts such as a minimum wage, sick pay, and health benefits didn’t exist, and the legal system was slanted savagely against the poor.

You can’t build prosperity in a consumer society when a good half of your citizenry can’t afford more than the basic necessities of life. That’s the predicament that America found clamped to the tender parts of its economic anatomy at the end of the 1920s.

In that decade, as in our time, the temporary solution was to inflate a vast speculative bubble, under the endearing delusion that this would flood the economy with enough unearned cash to make the lack of earned income moot. That worked over the short term and then blew up spectacularly, since a speculative bubble is simply a Ponzi scheme that the legal authorities refuse to prosecute as such, and inevitably ends the same way.

There were, of course, effective solutions to the problem of inadequate consumer income. They were exactly those measures that were taken once the era of response gave way to the era of breakdown; everyone knew what they were, and nobody with access to political or economic power was willing to see them put into effect, because those measures would require a modest decline in the relative wealth and political dominance of the rich as compared to everyone else.

Thus, as usually happens, they were postponed until the arrival of the era of breakdown made it impossible to avoid them any longer.

The second thing that had to be changed in order to restore prosperity was even more explosive, and I’m quite certain that some of my readers will screech like banshees the moment I mention it. The United States in 1929 had a precious metal-backed currency in the most literal sense of the term.

Paper bills in those days were quite literally receipts for a certain quantity of gold—1.5 grams, for much of the time the US spent on the gold standard. That sort of arrangement was standard in most of the world’s industrial nations; it was backed by a dogmatic orthodoxy all but universal among respectable economists; and it was strangling the US economy.

It’s fashionable among certain sects on the economic fringes these days to look back on the era of the gold standard as a kind of economic Utopia in which there were no booms and busts, just a warm sunny landscape of stability and prosperity until the wicked witches of the Federal Reserve came along and spoiled it all. That claim flies in the face of economic history.

During the entire period that the United States was on the gold standard, from 1873 to 1933, the US economy was a moonscape cratered by more than a dozen significant depressions. There’s a reason for that, and it’s relevant to our current situation—in a backhanded manner, admittedly.

Money, let us please remember, is not wealth. It’s a system of arbitrary tokens that represent real wealth—that is, actual, nonfinancial goods and services.

Every society produces a certain amount of real wealth each year, and those societies that use money thus need to have enough money in circulation to more or less correspond to the annual supply of real wealth. That sounds simple; in practice, though, it’s anything but.

Nowadays, for example, the amount of real wealth being produced in the United States each year is contracting steadily as more and more of the nation’s economic output has to be diverted into the task of keeping it supplied with fossil fuels. That’s happening, in turn, because of the limits to growth—the awkward but inescapable reality that you can’t extract infinite resources, or dump limitless wastes, on a finite planet.

The gimmick currently being used to keep fossil fuel extraction funded and cover the costs of the rising impact of environmental disruptions, without cutting into a culture of extravagance that only cheap abundant fossil fuel and a mostly intact biosphere can support, is to increase the money supply ad infinitum.

That’s become the bedrock of US economic policy since the 2008-9 crash. It’s not a gimmick with a long shelf life; as the mismatch between real wealth and the money supply balloons, distortions and discontinuities are surging out through the crawlspaces of our economic life, and crisis is the most likely outcome.

In the United States in the first half or so of the twentieth century, by contrast, the amount of real wealth being produced each year soared, largely because of the steady increases in fossil fuel energy being applied to every sphere of life. While the nation was on the gold standard, though, the total supply of money could only grow as fast as gold could be mined out of the ground, which wasn’t even close to fast enough.

So you had more goods and services being produced than there was money to pay for them; people who wanted goods and services couldn’t buy them because there wasn’t enough money to go around; business that wanted to expand and hire workers were unable to do so for the same reason. The result was that moonscape of economic disasters I mentioned a moment ago.

The necessary response at that time was to go off the gold standard. Nobody in power wanted to do this, partly because of the dogmatic economic orthodoxy noted earlier, and partly because a money shortage paid substantial benefits to those who had guaranteed access to money.

The rentier class—those people who lived off income from their investments—could count on stable or falling prices as long as the gold standard stayed in place, and the mere fact that the same stable or falling prices meant low wages, massive unemployment, and widespread destitution troubled them not at all. Since the rentier class included the vast majority of the US economic and political elite, in turn, going off the gold standard was unthinkable until it became unavoidable.

The period of the French revolution from the fall of the Bastille in 1789 to the election of the National Convention in 1792 was a period of the same kind, though driven by different forces.

Here the great problem was how to replace the Old Regime—not just the French monarchy, but the entire lumbering mass of political, economic, and social laws, customs, forms, and institutions that France had inherited from the Middle Ages and never quite gotten around to adapting to drastically changed conditions—with something that would actually work. It’s among the more interesting features of the resulting era of response that nearly every detail differed from the American example just outlined, and yet the results were remarkably similar.

Thus the leaders of the National Assembly who suddenly became the new rulers of France in the summer of 1789 had no desire whatsoever to retain the traditional economic arrangements that gave France’s former elites their stranglehold on an oversized share of the nation’s wealth.

The abolition of manorial rights that summer, together with the explosive rural uprisingsagainst feudal landlords and their chateaux in the wake of the Bastille’s fall, gutted the feudal system and left most of its former beneficiaries the choice between fleeing into exile and trying to find some way to make ends meet in a society that had no particular market for used aristocrats.

The problem faced by the National Assembly wasn’t that of prying the dead fingers of a failed system off the nation’s throat; it was that of trying to find some other basis for national unity and effective government.

It’s a surprisingly difficult challenge. Those of my readers who know their way around current events will already have guessed that an attempt was made to establish a copy of whatever system was most fashionable among liberals at the time, and that this attempt turned out to be an abject failure. What’s more, they’ll have been quite correct.

The National Assembly moved to establish a constitutional monarchy along British lines, bring in British economic institutions, and the like; it was all very popular among liberal circles in France and, naturally, in Britain as well, and it flopped.

Those who recall the outcome of the attempt to turn Iraq into a nice pseudo-American democracy in the wake of the US invasion will have a tolerably good sense of how the project unraveled.

One of the unwelcome but reliable facts of history is that democracy doesn’t transplant well. It thrives only where it grows up naturally, out of the civil institutions and social habits of a people; when liberal intellectuals try to impose it on a nation that hasn’t evolved the necessary foundations for it, the results are pretty much always a disaster. That latter was the situation in France at the time of the Revolution.

What happened thereafter is what almost always happens to a failed democratic experiment: a period of chaos, followed by the rise of a talented despot who’s smart and ruthless enough to impose order on a chaotic situation and allow new, pragmatic institutions to emerge to replace those destroyed by clueless democratic idealists.

In many cases, though by no means all, those pragmatic institutions have ended up providing a bridge to a future democracy, but that’s another matter.

Here again, those of my readers who have been paying attention to current events already know this; the collapse of the Soviet Union was followed in classic form by a failed democracy, a period of chaos, and the rise of a talented despot. It’s a curious detail of history that the despots in question are often rather short.

Russia has had the great good fortune to find, as its despot du jour, a canny realist who has successfully brought it back from the brink of collapse and reestablished it as a major power with a body count considerably smaller than usual.

France was rather less fortunate; the despot it found, Napoleon Bonaparte, turned out to be a megalomaniac with an Alexander the Great complex who proceeded to plunge Europe into a quarter century of cataclysmic war. Mind you, things could have been even worse; when Germany ended up in a similar situation, what it got was Adolf Hitler.

Charismatic strongmen are a standard endpoint for the era of response, but they properly belong to the era that follows, the era of breakdown, which will be discussed next week. What I want to explore here is how an era of response might work out in the future immediately before us, as the United States topples from its increasingly unsteady imperial perch and industrial civilization as a whole slams facefirst into the limits to growth.

The examples just cited outline the two most common patterns by which the era of response works itself out.

Every time a government tries to cope with a crisis by claiming that it doesn’t exist, every time some member of the well-to-do tries to dismiss the collective burdens its culture of executive kleptocracy imposes on the country by flinging abuse at critics, every time institutions that claim to uphold the rule of law defend the rule of entrenched privilege instead, the United States takes another step closer to the revolutionary abyss.

I use that last word advisedly. It’s a common superstition in every troubled age that any change must be for the better—that the overthrow of a bad system must by definition lead to the establishment of a better one. This simply isn’t true.

The vast majority of revolutions have established governments that were far more abusive than the ones they replaced. The exceptions have generally been those that brought about a social upheaval without wrecking the political system: where, for example, an election rather than a coup d’etat or a mass rising put the revolutionaries in power, and the political institutions of an earlier time remained in place with only such reshaping as new necessities required.

We could still see that sort of transformation as the United States sees the end of its age of empire and has to find its way back to a less arrogant and extravagant way of functioning in the world.

I don’t think it’s likely, but I think it’s possible, and it would probably be a good deal less destructive than the other alternative. It’s worth remembering, though, that history is under no obligation to give us the future we think we want.

.

By John Michael Greer on 27 May 2015 the Archdruid Report -

(http://thearchdruidreport.blogspot.com/2015/05/the-era-of-response.html)

Image above: Poster supporting President Franklin Roosevelt and his New Deal revolution; a softer version of dictatorship than Germany or Russia. From (https://www.laprogressive.com/a-new-new-deal/).

The third stage of the process of collapse, following what I’ve called the eras of pretense and impact, is the era of response. It’s easy to misunderstand what this involves, because both of the previous eras have their own kinds of response to whatever is driving the collapse; it’s just that those kinds of response are more precisely nonresponses, attempts to make the crisis go away without addressing any of the things that are making it happen.

If you want a first-rate example of the standard nonresponse of the era of pretense, you’ll find one in the sunny streets of Miami, Florida right now. As a result of global climate change, sea level has gone up and the Gulf Stream has slowed down.

One consequence is that these days, whenever Miami gets a high tide combined with a stiff onshore wind, salt water comes boiling up through the storm sewers of the city all over the low-lying parts of town. The response of the Florida state government has been to ssue an order to all state employees that they’re not allowed to utter the phrase “climate change.”

That sort of thing is standard practice in an astonishing range of subjects in America these days. Consider the roles that the essentially nonexistent recovery from the housing-bubble crash of 2008-9 has played in political rhetoric since that time.

The current inmate of the White House has been insisting through most of two turns that happy days are here again, and the usual reams of doctored statistics have been churned out in an effort to convince people who know better that they’re just imagining that something is wrong with the economy.

We can expect to hear that same claim made in increasingly loud and confident tones right up until the day the bottom finally drops out.

With the end of the era of pretense and the arrival of the era of impact comes a distinct shift in the standard mode of nonresponse, which can be used quite neatly to time the transition from one era to another.

Where the nonresponses of the era of pretense insist that there’s nothing wrong and nobody has to do anything outside the realm of business as usual, the nonresponses of the era of impact claim just as forcefully that whatever’s gone wrong is a temporary difficulty and everything will be fine if we all unite to do even more of whatever activity defines business as usual.

That this normally amounts to doing more of whatever made the crisis happen in the first place, and thus reliably makes things worse is just one of the little ironies history has to offer.

What unites the era of pretense with the era of impact is the unshaken belief that in the final analysis, there’s nothing essentially wrong with the existing order of things.

Whatever little difficulties may show up from time to time may be ignored as irrelevant or talked out of existence, or they may have to be shoved aside by some concerted effort, but it’s inconceivable to most people in these two eras that the existing order of things is itself the source of society’s problems, and has to be changed in some way that goes beyond the cosmetic dimension.

When the inconceivable becomes inescapable, in turn, the second phase gives way to the third, and the era of response has arrived.

This doesn’t mean that everyone comes to grips with the real issues, and buckles down to the hard work that will be needed to rebuild society on a sounder footing.

Winston Churchill once noted with his customary wry humor that the American people can be counted on to do the right thing, once they have exhausted every other possibility.

He was of course quite correct, but the same rule can be applied with equal validity to every other nation this side of Utopia, too. The era of response, in practice, generally consists of a desperate attempt to find something that will solve the crisis du jour, other than the one thing that everyone knows will solve the crisis du jour but nobody wants to do.

Let’s return to the two examples we’ve been following so far, the outbreak of the Great Depression and the coming of the French Revolution. In the aftermath of the 1929 stock market crash, once the initial impact was over and the “sucker’s rally” of early 1930 had come and gone, the federal government and the various power centers and pressure groups that struggled for influence within its capacious frame were united in pursuit of a single goal: finding a way to restore prosperity without doing either of the things that had to be done in order to restore prosperity.

That task occupied the best minds in the US elite from the summer of 1930 straight through until April of 1933, and the mere fact that their attempts to accomplish this impossibility proved to be a wretched failure shouldn’t blind anyone to the Herculean efforts that were involved in the attempt.

The first of the two things that had to be tackled in order to restore prosperity was to do something about the drastic imbalance in the distribution of income in the United States.

As noted in previous posts, an economy dependent on consumer expenditures can’t thrive unless consumers have plenty of money to spend, and in the United States in the late 1920s, they didn’t—well, except for the very modest number of those who belonged to the narrow circles of the well-to-do.

It’s not often recalled these days just how ghastly the slums of urban America were in 1929, or how many rural Americans lived in squalid one-room shacks of the sort you pretty much have to travel to the Third World to see these days. Labor unions and strikes were illegal in 1920s America; concepts such as a minimum wage, sick pay, and health benefits didn’t exist, and the legal system was slanted savagely against the poor.

You can’t build prosperity in a consumer society when a good half of your citizenry can’t afford more than the basic necessities of life. That’s the predicament that America found clamped to the tender parts of its economic anatomy at the end of the 1920s.

In that decade, as in our time, the temporary solution was to inflate a vast speculative bubble, under the endearing delusion that this would flood the economy with enough unearned cash to make the lack of earned income moot. That worked over the short term and then blew up spectacularly, since a speculative bubble is simply a Ponzi scheme that the legal authorities refuse to prosecute as such, and inevitably ends the same way.

There were, of course, effective solutions to the problem of inadequate consumer income. They were exactly those measures that were taken once the era of response gave way to the era of breakdown; everyone knew what they were, and nobody with access to political or economic power was willing to see them put into effect, because those measures would require a modest decline in the relative wealth and political dominance of the rich as compared to everyone else.

Thus, as usually happens, they were postponed until the arrival of the era of breakdown made it impossible to avoid them any longer.

The second thing that had to be changed in order to restore prosperity was even more explosive, and I’m quite certain that some of my readers will screech like banshees the moment I mention it. The United States in 1929 had a precious metal-backed currency in the most literal sense of the term.

Paper bills in those days were quite literally receipts for a certain quantity of gold—1.5 grams, for much of the time the US spent on the gold standard. That sort of arrangement was standard in most of the world’s industrial nations; it was backed by a dogmatic orthodoxy all but universal among respectable economists; and it was strangling the US economy.

It’s fashionable among certain sects on the economic fringes these days to look back on the era of the gold standard as a kind of economic Utopia in which there were no booms and busts, just a warm sunny landscape of stability and prosperity until the wicked witches of the Federal Reserve came along and spoiled it all. That claim flies in the face of economic history.

During the entire period that the United States was on the gold standard, from 1873 to 1933, the US economy was a moonscape cratered by more than a dozen significant depressions. There’s a reason for that, and it’s relevant to our current situation—in a backhanded manner, admittedly.

Money, let us please remember, is not wealth. It’s a system of arbitrary tokens that represent real wealth—that is, actual, nonfinancial goods and services.

Every society produces a certain amount of real wealth each year, and those societies that use money thus need to have enough money in circulation to more or less correspond to the annual supply of real wealth. That sounds simple; in practice, though, it’s anything but.

Nowadays, for example, the amount of real wealth being produced in the United States each year is contracting steadily as more and more of the nation’s economic output has to be diverted into the task of keeping it supplied with fossil fuels. That’s happening, in turn, because of the limits to growth—the awkward but inescapable reality that you can’t extract infinite resources, or dump limitless wastes, on a finite planet.

The gimmick currently being used to keep fossil fuel extraction funded and cover the costs of the rising impact of environmental disruptions, without cutting into a culture of extravagance that only cheap abundant fossil fuel and a mostly intact biosphere can support, is to increase the money supply ad infinitum.

That’s become the bedrock of US economic policy since the 2008-9 crash. It’s not a gimmick with a long shelf life; as the mismatch between real wealth and the money supply balloons, distortions and discontinuities are surging out through the crawlspaces of our economic life, and crisis is the most likely outcome.

In the United States in the first half or so of the twentieth century, by contrast, the amount of real wealth being produced each year soared, largely because of the steady increases in fossil fuel energy being applied to every sphere of life. While the nation was on the gold standard, though, the total supply of money could only grow as fast as gold could be mined out of the ground, which wasn’t even close to fast enough.

So you had more goods and services being produced than there was money to pay for them; people who wanted goods and services couldn’t buy them because there wasn’t enough money to go around; business that wanted to expand and hire workers were unable to do so for the same reason. The result was that moonscape of economic disasters I mentioned a moment ago.

The necessary response at that time was to go off the gold standard. Nobody in power wanted to do this, partly because of the dogmatic economic orthodoxy noted earlier, and partly because a money shortage paid substantial benefits to those who had guaranteed access to money.

The rentier class—those people who lived off income from their investments—could count on stable or falling prices as long as the gold standard stayed in place, and the mere fact that the same stable or falling prices meant low wages, massive unemployment, and widespread destitution troubled them not at all. Since the rentier class included the vast majority of the US economic and political elite, in turn, going off the gold standard was unthinkable until it became unavoidable.

The period of the French revolution from the fall of the Bastille in 1789 to the election of the National Convention in 1792 was a period of the same kind, though driven by different forces.

Here the great problem was how to replace the Old Regime—not just the French monarchy, but the entire lumbering mass of political, economic, and social laws, customs, forms, and institutions that France had inherited from the Middle Ages and never quite gotten around to adapting to drastically changed conditions—with something that would actually work. It’s among the more interesting features of the resulting era of response that nearly every detail differed from the American example just outlined, and yet the results were remarkably similar.

Thus the leaders of the National Assembly who suddenly became the new rulers of France in the summer of 1789 had no desire whatsoever to retain the traditional economic arrangements that gave France’s former elites their stranglehold on an oversized share of the nation’s wealth.

The abolition of manorial rights that summer, together with the explosive rural uprisingsagainst feudal landlords and their chateaux in the wake of the Bastille’s fall, gutted the feudal system and left most of its former beneficiaries the choice between fleeing into exile and trying to find some way to make ends meet in a society that had no particular market for used aristocrats.

The problem faced by the National Assembly wasn’t that of prying the dead fingers of a failed system off the nation’s throat; it was that of trying to find some other basis for national unity and effective government.

It’s a surprisingly difficult challenge. Those of my readers who know their way around current events will already have guessed that an attempt was made to establish a copy of whatever system was most fashionable among liberals at the time, and that this attempt turned out to be an abject failure. What’s more, they’ll have been quite correct.

The National Assembly moved to establish a constitutional monarchy along British lines, bring in British economic institutions, and the like; it was all very popular among liberal circles in France and, naturally, in Britain as well, and it flopped.

Those who recall the outcome of the attempt to turn Iraq into a nice pseudo-American democracy in the wake of the US invasion will have a tolerably good sense of how the project unraveled.

One of the unwelcome but reliable facts of history is that democracy doesn’t transplant well. It thrives only where it grows up naturally, out of the civil institutions and social habits of a people; when liberal intellectuals try to impose it on a nation that hasn’t evolved the necessary foundations for it, the results are pretty much always a disaster. That latter was the situation in France at the time of the Revolution.

What happened thereafter is what almost always happens to a failed democratic experiment: a period of chaos, followed by the rise of a talented despot who’s smart and ruthless enough to impose order on a chaotic situation and allow new, pragmatic institutions to emerge to replace those destroyed by clueless democratic idealists.

In many cases, though by no means all, those pragmatic institutions have ended up providing a bridge to a future democracy, but that’s another matter.

Here again, those of my readers who have been paying attention to current events already know this; the collapse of the Soviet Union was followed in classic form by a failed democracy, a period of chaos, and the rise of a talented despot. It’s a curious detail of history that the despots in question are often rather short.

Russia has had the great good fortune to find, as its despot du jour, a canny realist who has successfully brought it back from the brink of collapse and reestablished it as a major power with a body count considerably smaller than usual.

France was rather less fortunate; the despot it found, Napoleon Bonaparte, turned out to be a megalomaniac with an Alexander the Great complex who proceeded to plunge Europe into a quarter century of cataclysmic war. Mind you, things could have been even worse; when Germany ended up in a similar situation, what it got was Adolf Hitler.

Charismatic strongmen are a standard endpoint for the era of response, but they properly belong to the era that follows, the era of breakdown, which will be discussed next week. What I want to explore here is how an era of response might work out in the future immediately before us, as the United States topples from its increasingly unsteady imperial perch and industrial civilization as a whole slams facefirst into the limits to growth.

The examples just cited outline the two most common patterns by which the era of response works itself out.

- In the first pattern, the old elite retains its grip on power, and fumbles around with increasing desperation for a response to the crisis.

- In the second, the old elite is shoved aside, and the new holders of power are left floundering in a political vacuum.

Every time a government tries to cope with a crisis by claiming that it doesn’t exist, every time some member of the well-to-do tries to dismiss the collective burdens its culture of executive kleptocracy imposes on the country by flinging abuse at critics, every time institutions that claim to uphold the rule of law defend the rule of entrenched privilege instead, the United States takes another step closer to the revolutionary abyss.

I use that last word advisedly. It’s a common superstition in every troubled age that any change must be for the better—that the overthrow of a bad system must by definition lead to the establishment of a better one. This simply isn’t true.

The vast majority of revolutions have established governments that were far more abusive than the ones they replaced. The exceptions have generally been those that brought about a social upheaval without wrecking the political system: where, for example, an election rather than a coup d’etat or a mass rising put the revolutionaries in power, and the political institutions of an earlier time remained in place with only such reshaping as new necessities required.

We could still see that sort of transformation as the United States sees the end of its age of empire and has to find its way back to a less arrogant and extravagant way of functioning in the world.

I don’t think it’s likely, but I think it’s possible, and it would probably be a good deal less destructive than the other alternative. It’s worth remembering, though, that history is under no obligation to give us the future we think we want.

.

No comments :

Post a Comment