SUBHEAD: Decline is the new normal. The only remaining US growth industries are food-stamps and poverty.

By Steve Ludlum on 4 December 2010 in Economic Undertow -

(http://economic-undertow.blogspot.com/2010/12/new-era.html)

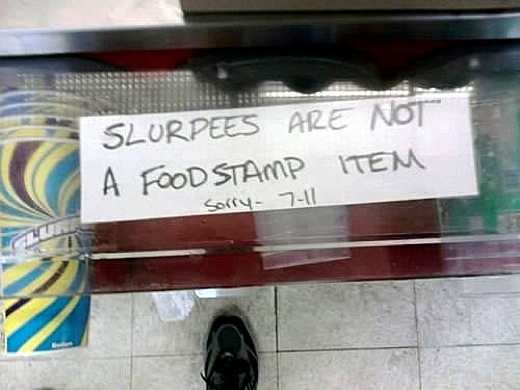

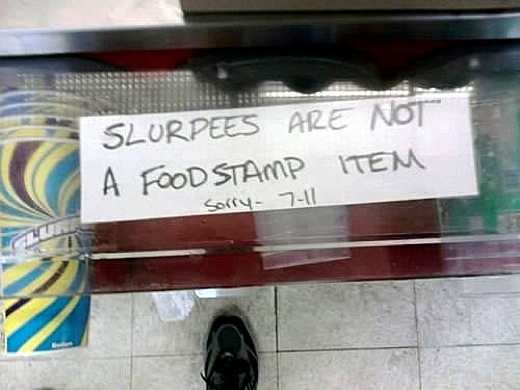

Image above: Seven-Eleven signals policy on Slurpee purchase payments. From (http://www.moonbattery.com/archives/2010/08/so-there-are-li.html).

Watch what happens next! Better 'put in' some canned beans, 100lbs of rice, some gallons of bottled water, onions, some silver coins, some extra socks and toilet paper. A good, working firearm might not be a bad idea, either. It might take awhile for the 'authorities' to put the food distribution system back to some sort of working order. Doing so will be that much harder after cell phones and the Internet go out.

Let's run the video tape back to summer of 2008. Much of the world's airline industry was at the edge of collapse during that period. So was the trucking industry in Europe due to extreme prices that made transport unprofitable.

The US trucking industry was on the knife edge, so was the international shipping industry. There were food shortages and riots. The US auto industry did indeed collapse, so did banks and most of shadow banking. In 2008, were were a lot richer, not so now! If deflation is suicide for a debtor what is inflation to an importer of 60% of its fuel supply?

Crash the dollar with 'devaluation' and the US becomes a non-industrial country in a heartbeat! The dollar is the only asset the US has to trade outside of 'Matrix' and 'Spiderman' movies. And $148 oil will destroy the waste-based USA-style economy completely.

Forget about $200 or $300 oil. We will never get there, world demand will collapse first. Our economy is running on intravenous infusions of Fed-administered adrenaline.

Our almighty business and finance institutions are ruins cobbled together with duct tape and coat-hanger wire. Finance's business plan is forbearance on its toxic assets and swindles perpetrated on its own customers. Social upheaval is another few percentage points of unemployment out of reach. As such, 2008 was just a trial run! Getting Brent futures above $100 dollars ought to do the trick.

The suicidal hedge funds and 'long only' speculators will do the rest, piling into crude just because the market is going up. The same thing is happening right now in gold. The economy is tolerant of insanely high gold prices. Not so with crude oil. Speculators would use the recent IEA World Energy Outlook and its 'Peak Oil' imprimatur to justify price increases.

The rise itself, the inevitable crash and the post-crash repegging of dollars to crude would drive a stake through the heart of finance both in the US and elsewhere. This is Bernanke's nightmare. It is also his unavoidable reality. You only have to kick in the door with $145 crude and the whole rotten structure will come crashing down.

Bernanke's reality: $146 isn't necessary, today's high prices are already doing the job, unraveling the "non- negotiable American Way of life" from the bottom up. It is beyond the grasp of the establishment and its thousands of economists to see what is taking place right under its collective nose!

The reason fuel prices are high is because all the easy crude has been wasted. There is nothing left but crude that is ever-more costly to produce and refine.

Deflation may be suicide but so is fuel price inflation. Deflation is a hunger strike. Inflation and run-away crude prices are a gun in the mouth. Bernanke is not stupid. His game isn't inflation, anyway, it is putting money in his friend's pockets by trading their worthless 'assets' for cash. If the big shots want cash there must be something to it. Talking down the dollar is PR for the 'little peeple'. US and Brent crude are now at yearly highs and with the latter + $91 a barrel. The price of crude right now is so high it's scary.

How can high prices be supported by a world economy that is on the ropes? In the US and in parts of the developed world there are two more-or-less separate economies occupying the same geographic space: a finance economy that exists to make money with money. This economy is in the grip of hyper-inflation, fueled by super-easy zero-interest-rate monetary policy, fiscal excess, foreign exchange manipulation and blown-out moral hazard.

The parallel economy is the physical or 'real' economy which is made up of the business of providing goods and services out of raw materials.

This economy is in severe deflation. The two-way economy picture is what most analysts' miss. Within the finance economy, almost all the markets are bull markets. They have to be, it is the only way the Bernanke Money Laundry can operate; worthless assets paid for with margin are swapped for cash.

Bear markets are undesirable because they suck all the liquidity out of markets forcing prices down. This defeats the purpose of the money laundry which aims to swap assets at some sort of par. Bernanke's deal is to retrieve what assets can be swapped for cash as long as the market participants are disciplined and don't panic.

While Bernanke's nonsense is taking place, high 'asset' prices for energy are rendering downstream business activities unprofitable for the 'real' economy.

This loss of profitability is one reason for the ascent of finance in the first place. It is also a reason for finance's increasing instability. The right foot of asset price inflation presses on the gas pedal of the finance economy while the left foot simultaneously pushes down on the brake pedal of the real economy. It is the inflation in finance that captures the attention of analysts who fail to note the deflation that is obvious in property, wages and other important sectors of the real economy. High asset prices don't push up wages but instead allocate customers out of markets and into tent cities.

With the customers go business profits. Ruin of the real economy leaves money speculation as the only pathway to yield. Success of the US economy as a whole going forward depends increasingly upon it winning a finance lottery: one that has America's once-marvelous physical economy lurching toward energy insolvency.

Because the Establishment does not recognize the two economies as separate entities it disregards the effects of asset price hyper-inflation until it is too late. Losses in the real economy effect finance as they must show up somewhere, either in unemployment or in reduced top-line revenue for companies. Finance incentives are perverse: business bottom-line profits are made by interest rate or stock speculations.

Companies hire money and fire work forces. These tactics create the illusion of productivity increases while real output remains flat or declines. Companies can -- and do -- book profits but without expanding customer bases the companies eventually shrivel and die. The alternative is for 'real' companies to take on the characteristics of finance companies.

Devoid of top-line business growth and profits, companies become hedge funds then zombies dependent upon cheap credit -- adrenaline -- directly or indirectly from central banks. Profits are earned by shuffling funds between accounts, evading taxes and hiding others' top- line profits overseas. Parts of the real economy have adapted to the steady increase in crude prices since 2004. Most if not all businesses dependent upon $20 oil have already failed.

The weight these failures and their laid-off employees has been lifted. Businesses requiring $30 oil are also long gone as are those dependent upon $40 and $50 oil. In the current real economy, businesses pick their spots.

The penalty for higher fuel prices still falls on employees, who tend to be replaced by automation, or whose jobs follow profits overseas or who are not replaced at all. High priced machines using higher priced fuels are still a bargain compared to humans which waste even more fuel than so far do the production machines that replace them.

Many of the machines' costs are shifted elsewhere by subsidies and tax benefits. The outcome in real terms is still decline as the absent workers and absent wages represent sales and profits that have vanished forever. Decline is the new normal. The only remaining growth industry in the US is food stamps and poverty.

This chart is from the estimable Bill McBride @ Calculated Risk indicates the decline in US automobile sales from the plateau that ended in 2008. Even as the media insists on auto sales 'recovery!' the market for US cars has shrunk by a third.

The same is true in most US real estate markets; certainly true in labor markets, also in wages, as has been the case for job openings for recent college graduates Wages for college-educated are declining as well.

Declining wages are a large component of deflation. Without high wages there is shrinking final demand to support higher prices. Value-sucking finance is becoming an expensive luxury that the real economy cannot afford to support much longer. Unfortunately, finance has obtained a privileged position within the establishment, it can create (an illusion of) wealth and political largess that the physical economy cannot provide.

Having compromised governments worldwide, it has become almost impossible for currently-constituted governments to properly remediate finance's excesses and failures. In this sense, suicide at some level is baked into Marie Antoinette's cake. .

By Steve Ludlum on 4 December 2010 in Economic Undertow -

(http://economic-undertow.blogspot.com/2010/12/new-era.html)

Image above: Seven-Eleven signals policy on Slurpee purchase payments. From (http://www.moonbattery.com/archives/2010/08/so-there-are-li.html).

"Buy some silver and put JP Morgan-Chase out of its misery." - Max KeiserSeems JP is naked shorting silver and has large exposure. Buying metal is supposed to cause JP to cover its shorts and lose a couple hundred million dollars. OUCH! That has to hurt!

Not so fast, Jesse! Suicide might be painless but what are the alternatives? Forget the silver, buy a longer-dated Brent crude futures contract. Better yet, buy a hundred of them. Put crude futures into contango where they belong. Follow Mr. Bernanke and his drive to inflate crude prices up to $148 a barrel."For a nation that is a net debtor, deflation is tantamount to suicide. But other nations, most recently Germany in the past century, committed a form of national suicide in service to hubris, and an elite few, and a mistaken understanding of what constitutes a civil society and what it means to be human." - Jesse @ Cafe Americain

Watch what happens next! Better 'put in' some canned beans, 100lbs of rice, some gallons of bottled water, onions, some silver coins, some extra socks and toilet paper. A good, working firearm might not be a bad idea, either. It might take awhile for the 'authorities' to put the food distribution system back to some sort of working order. Doing so will be that much harder after cell phones and the Internet go out.

Let's run the video tape back to summer of 2008. Much of the world's airline industry was at the edge of collapse during that period. So was the trucking industry in Europe due to extreme prices that made transport unprofitable.

The US trucking industry was on the knife edge, so was the international shipping industry. There were food shortages and riots. The US auto industry did indeed collapse, so did banks and most of shadow banking. In 2008, were were a lot richer, not so now! If deflation is suicide for a debtor what is inflation to an importer of 60% of its fuel supply?

Crash the dollar with 'devaluation' and the US becomes a non-industrial country in a heartbeat! The dollar is the only asset the US has to trade outside of 'Matrix' and 'Spiderman' movies. And $148 oil will destroy the waste-based USA-style economy completely.

Forget about $200 or $300 oil. We will never get there, world demand will collapse first. Our economy is running on intravenous infusions of Fed-administered adrenaline.

Our almighty business and finance institutions are ruins cobbled together with duct tape and coat-hanger wire. Finance's business plan is forbearance on its toxic assets and swindles perpetrated on its own customers. Social upheaval is another few percentage points of unemployment out of reach. As such, 2008 was just a trial run! Getting Brent futures above $100 dollars ought to do the trick.

The suicidal hedge funds and 'long only' speculators will do the rest, piling into crude just because the market is going up. The same thing is happening right now in gold. The economy is tolerant of insanely high gold prices. Not so with crude oil. Speculators would use the recent IEA World Energy Outlook and its 'Peak Oil' imprimatur to justify price increases.

The rise itself, the inevitable crash and the post-crash repegging of dollars to crude would drive a stake through the heart of finance both in the US and elsewhere. This is Bernanke's nightmare. It is also his unavoidable reality. You only have to kick in the door with $145 crude and the whole rotten structure will come crashing down.

Bernanke's reality: $146 isn't necessary, today's high prices are already doing the job, unraveling the "non- negotiable American Way of life" from the bottom up. It is beyond the grasp of the establishment and its thousands of economists to see what is taking place right under its collective nose!

The reason fuel prices are high is because all the easy crude has been wasted. There is nothing left but crude that is ever-more costly to produce and refine.

Deflation may be suicide but so is fuel price inflation. Deflation is a hunger strike. Inflation and run-away crude prices are a gun in the mouth. Bernanke is not stupid. His game isn't inflation, anyway, it is putting money in his friend's pockets by trading their worthless 'assets' for cash. If the big shots want cash there must be something to it. Talking down the dollar is PR for the 'little peeple'. US and Brent crude are now at yearly highs and with the latter + $91 a barrel. The price of crude right now is so high it's scary.

How can high prices be supported by a world economy that is on the ropes? In the US and in parts of the developed world there are two more-or-less separate economies occupying the same geographic space: a finance economy that exists to make money with money. This economy is in the grip of hyper-inflation, fueled by super-easy zero-interest-rate monetary policy, fiscal excess, foreign exchange manipulation and blown-out moral hazard.

The parallel economy is the physical or 'real' economy which is made up of the business of providing goods and services out of raw materials.

This economy is in severe deflation. The two-way economy picture is what most analysts' miss. Within the finance economy, almost all the markets are bull markets. They have to be, it is the only way the Bernanke Money Laundry can operate; worthless assets paid for with margin are swapped for cash.

Bear markets are undesirable because they suck all the liquidity out of markets forcing prices down. This defeats the purpose of the money laundry which aims to swap assets at some sort of par. Bernanke's deal is to retrieve what assets can be swapped for cash as long as the market participants are disciplined and don't panic.

While Bernanke's nonsense is taking place, high 'asset' prices for energy are rendering downstream business activities unprofitable for the 'real' economy.

This loss of profitability is one reason for the ascent of finance in the first place. It is also a reason for finance's increasing instability. The right foot of asset price inflation presses on the gas pedal of the finance economy while the left foot simultaneously pushes down on the brake pedal of the real economy. It is the inflation in finance that captures the attention of analysts who fail to note the deflation that is obvious in property, wages and other important sectors of the real economy. High asset prices don't push up wages but instead allocate customers out of markets and into tent cities.

With the customers go business profits. Ruin of the real economy leaves money speculation as the only pathway to yield. Success of the US economy as a whole going forward depends increasingly upon it winning a finance lottery: one that has America's once-marvelous physical economy lurching toward energy insolvency.

Because the Establishment does not recognize the two economies as separate entities it disregards the effects of asset price hyper-inflation until it is too late. Losses in the real economy effect finance as they must show up somewhere, either in unemployment or in reduced top-line revenue for companies. Finance incentives are perverse: business bottom-line profits are made by interest rate or stock speculations.

Companies hire money and fire work forces. These tactics create the illusion of productivity increases while real output remains flat or declines. Companies can -- and do -- book profits but without expanding customer bases the companies eventually shrivel and die. The alternative is for 'real' companies to take on the characteristics of finance companies.

Devoid of top-line business growth and profits, companies become hedge funds then zombies dependent upon cheap credit -- adrenaline -- directly or indirectly from central banks. Profits are earned by shuffling funds between accounts, evading taxes and hiding others' top- line profits overseas. Parts of the real economy have adapted to the steady increase in crude prices since 2004. Most if not all businesses dependent upon $20 oil have already failed.

The weight these failures and their laid-off employees has been lifted. Businesses requiring $30 oil are also long gone as are those dependent upon $40 and $50 oil. In the current real economy, businesses pick their spots.

The penalty for higher fuel prices still falls on employees, who tend to be replaced by automation, or whose jobs follow profits overseas or who are not replaced at all. High priced machines using higher priced fuels are still a bargain compared to humans which waste even more fuel than so far do the production machines that replace them.

Many of the machines' costs are shifted elsewhere by subsidies and tax benefits. The outcome in real terms is still decline as the absent workers and absent wages represent sales and profits that have vanished forever. Decline is the new normal. The only remaining growth industry in the US is food stamps and poverty.

This chart is from the estimable Bill McBride @ Calculated Risk indicates the decline in US automobile sales from the plateau that ended in 2008. Even as the media insists on auto sales 'recovery!' the market for US cars has shrunk by a third.

The same is true in most US real estate markets; certainly true in labor markets, also in wages, as has been the case for job openings for recent college graduates Wages for college-educated are declining as well.

Declining wages are a large component of deflation. Without high wages there is shrinking final demand to support higher prices. Value-sucking finance is becoming an expensive luxury that the real economy cannot afford to support much longer. Unfortunately, finance has obtained a privileged position within the establishment, it can create (an illusion of) wealth and political largess that the physical economy cannot provide.

Having compromised governments worldwide, it has become almost impossible for currently-constituted governments to properly remediate finance's excesses and failures. In this sense, suicide at some level is baked into Marie Antoinette's cake. .

No comments :

Post a Comment