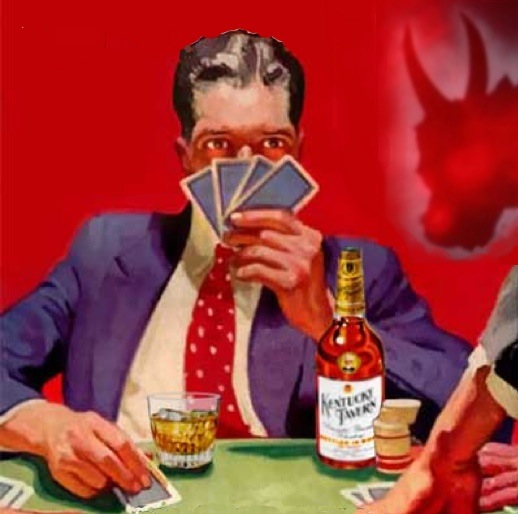

Image above: Collage of Minotaur playing Tim Geithner for a fool.

From http://www.drunkard.com/issues/07_05/0705_poker_guide.htm

Modified by Juan Wilson.

Image above: Collage of Minotaur playing Tim Geithner for a fool.

From http://www.drunkard.com/issues/07_05/0705_poker_guide.htm

Modified by Juan Wilson.

By Eliot Spitzer on 23 November 2009 in Slate Magazine - (http://www.slate.com/id/2236460)

The issue has been festering for months: Why were AIG's counterparties—including Goldman Sachs, JPMorgan Chase, and UBS—paid 100 cents on the dollar when the feds rescued the insurance giant, helping raise the cost of the bailout to nearly $200 billion? A new report issued by Special Inspector General Neil Barofsky now reveals that government officials, notably then-New York Fed President and current Treasury Secretary Timothy Geithner, grievously damaged the nation and capitulated to the very banks they should have been supervising.

Barofsky's report reads like a case study in failed negotiation. The New York Fed didn't have the backbone to stand up to Wall Street, didn't understand its capacity to protect taxpayers, and didn't appreciate that its responsibility was to taxpayers.

Geithner and the Fed have proffered a series of spurious reasons for their willingness to pay AIG's counterparties—the leading Wall Street banks—in full while demanding concessions from every other entity with whom the Treasury or the Fed dealt. Geithner suggested he could not use the threat of AIG's default in the absence of a federal bailout to get concessions from AIG's creditors. Why not?

That is exactly what the government did with the auto industry, and rightly so. The entity providing financing to a near-bankrupt institution must always seek contributions from everyone else at risk. The fact that the Fed had a strong predisposition against letting AIG go into bankruptcy didn't mean the Fed shouldn't have used every opportunity to wrangle concessions from the other parties. For Geithner to say it would have been "unethical" to negotiate for concessions is sheer silliness. It is akin to saying that having decided that you are willing to pay up to $250,000 for a house, it is unethical to negotiate to buy it for $225,000.

Geithner also claims that using the possibility of AIG's default as a negotiating opportunity would have cast doubt on the government's commitment to financial stability. What? Seeking to get other parties to share the burden demonstrates a lack of commitment to restoring financial stability and market-based realities? Pressuring Goldman and the other counterparties to offer concessions would have forced them to absorb the consequences of making suspect deals with an insurance company that was essentially a Ponzi scheme. Forcing them to give concessions would have been one small step toward ending the moral hazard the Fed had allowed to flourish for years.

Geithner also claims that refusal to pay 100 cents on the dollar might have been misinterpreted by the rating agencies and so cast a shadow on AIG's credit rating. Huh? AIG was flat-lining. The only way to restore its credit rating was for the government to bail it out—and to negotiate the best possible deal while doing so.

Perhaps most remarkable is that Geithner claims the "sanctity of contract" prevented renegotiating with the counterparties. But the government wasn't a party to these contracts! The government was stepping in with taxpayer money to save a broken company on terms to be set by the government. The counterparties had the contractual right to refuse the terms, throw AIG into bankruptcy, and suffer the consequences. In a workout context, the entity with cash—here, the government—can set the terms, and the other parties can either accept those terms or walk over to bankruptcy court. The government had absolutely no contractual obligation to do anything.

Also amazing is Geithner's assertion that he and the Fed were acting on behalf of AIG. Perhaps nothing is more fundamental than knowing whom you represent. Geithner and the Fed were supposed to be acting on behalf of taxpayers and citizens, not AIG. Their effort was supposed to get the best result for taxpayers: preserving the structure of the economy and stopping a free fall. That—not preserving AIG's market value—was the rationale for intervention. Once tax dollars were at stake, Geithner should have been asking how to achieve the best economic result while minimizing taxpayers' exposure.

Geithner has tried to deflect some of this criticism by suggesting that it is "untainted by experience." I would suggest that it is Geithner who displays lack of experience in his dealing with the financial community. He doesn't know how to negotiate, doesn't understand what cards he holds, and doesn't understand the need for fundamental reform.

See also: Ea O Ka Aina: Financial Follies 2.0 10/8/09

No comments :

Post a Comment