SUBHEAD: The world is about to find out that you really can't get something for nothing. It will be a harsh lesson.

By Jame Kunstler on 13 May 2013 for Kunstler.com -

(http://kunstler.com/blog/2013/05/no-mo-pomo.html)

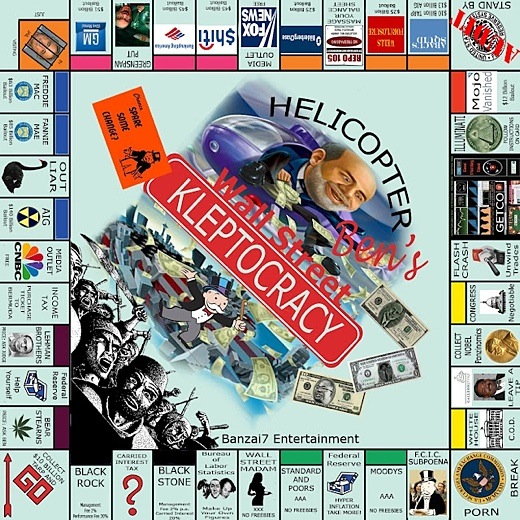

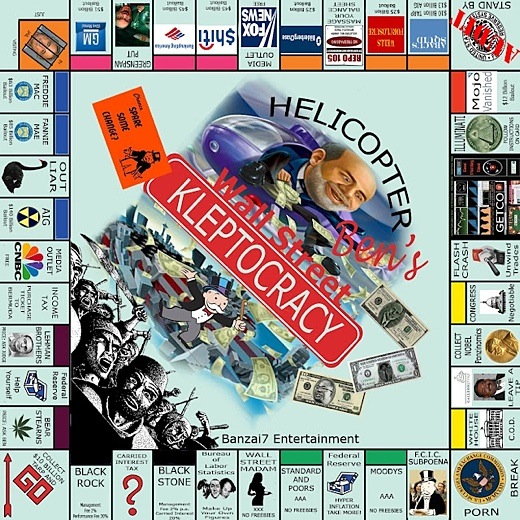

Image above: From (http://williambanzai7.blogspot.com/2010/09/wall-street-kleptocracy-game.html).

Whenever the Federal Reserve wants to tweak the dials of the economy -- or pretend that it can -- it turns first to its sock puppet at The Wall Street Journal, John Hilsenrath, and "leaks" a rumor of policy change (here). They like to do this late on Fridays when financial markets are about to close, so that market players will have a whole weekend to ponder the Fed's actions like medieval viziers reading goat entrails.

Last Friday's puddle of steaming guts was a supposed preview of the Fed's "exit strategy" from its reckless policy of "quantitative easing" or "money" creation (or "liquidity," if you like). In other words, they supposedly intend to stop juicing the financial markets with fake wealth, i.e. capital not accumulated from real productive activity, but just fictively created on computer hard drives.

For the past year they have been doing this to the tune of $85 billion a month, "buying" US Treasury bonds and bills and an assortment of miscellaneous securities (mostly trash that can't be pawned off on anyone else) through their so-called "primary dealer" bank cohorts, the too-big-to-fail usual suspects, who "earn" hefty transaction fees in the process of conveying all these pixels from Point A to Point B. These interventions are called Permanent Open Market Operations, or PoMo.

The theory all along has been that this $85 billion a month would seep down to Main Street to provoke spending (increasing the "velocity of money) and therefore "jump start" the economy. The theory has proven itself to be complete horseshit, of course. All it has done is suppress interest rates on bonds, depriving old people of income off their savings by so doing. It also artificially jacked up reckless lending on loans for houses, cars, and college degrees, juiced the share price of stocks, and boosted food prices.

Meanwhile, an increasingly former middle class languishes in a purgatory of foreclosure, penury, and desperation. The Fed can't really do anything to help them. It can only burden them with more easy-credit debt, especially their college-age children. But ours is a financialized economy and finance is too abstruse for most ordinary people to understand, so they just muddle along in a fog of dashed hopes and repossession.

Lately, though, the financial markets at the heart of the financialized economy -- that is, an economy based on buying and selling increasingly dubious "paper" assets rather than on capital formation through producing things of value -- are sending distress signals. The aforesaid efforts at economic dial-tweaking have only produced distortions and perversions in the basic functioning of the markets they're designed to tweak.

This is also complete horseshit because they could only accomplish controlled tweakings by somehow signaling their intentions beforehand through some lackey like Hilsenrath. Otherwise, they could not pretend to control the results of their actions. They might as well just throw spaghetti at the wall to see if it sticks. Unfortunately, the "halting steps" idea would only provide even more opportunities for selective, complex front-running, shorting, and gaming -- which is to say setting up more dangerous behavior with more uncertain and possibly destructive outcomes.

Anyway, there's no evidence at this moment that anyone believes what was leaked to Hilsenrath. It could easily be more smoke and mirrors aimed at concealing the fact that the Federal Reserve has no idea what it has been doing and fears the consequences.

There is one thing that we know for sure in this strange period when bankers have tried to manage reality in the absence of truth: that advanced industrial-technological economies designed to run on $20-a-barrel oil can't run on $100-a-barrel oil, and that is why the US economy was subject to financialization in the first place -- to offset declining productive activity by an attempt to get something for nothing.

Notice that this macro-trend coincided exactly with the rise of legalized gambling all over America. That is how the idea that you could get something for nothing got to be normal.

The world is about to find out that you really can't get something for nothing. It will be a harsh lesson.

.

By Jame Kunstler on 13 May 2013 for Kunstler.com -

(http://kunstler.com/blog/2013/05/no-mo-pomo.html)

Image above: From (http://williambanzai7.blogspot.com/2010/09/wall-street-kleptocracy-game.html).

Whenever the Federal Reserve wants to tweak the dials of the economy -- or pretend that it can -- it turns first to its sock puppet at The Wall Street Journal, John Hilsenrath, and "leaks" a rumor of policy change (here). They like to do this late on Fridays when financial markets are about to close, so that market players will have a whole weekend to ponder the Fed's actions like medieval viziers reading goat entrails.

Last Friday's puddle of steaming guts was a supposed preview of the Fed's "exit strategy" from its reckless policy of "quantitative easing" or "money" creation (or "liquidity," if you like). In other words, they supposedly intend to stop juicing the financial markets with fake wealth, i.e. capital not accumulated from real productive activity, but just fictively created on computer hard drives.

For the past year they have been doing this to the tune of $85 billion a month, "buying" US Treasury bonds and bills and an assortment of miscellaneous securities (mostly trash that can't be pawned off on anyone else) through their so-called "primary dealer" bank cohorts, the too-big-to-fail usual suspects, who "earn" hefty transaction fees in the process of conveying all these pixels from Point A to Point B. These interventions are called Permanent Open Market Operations, or PoMo.

The theory all along has been that this $85 billion a month would seep down to Main Street to provoke spending (increasing the "velocity of money) and therefore "jump start" the economy. The theory has proven itself to be complete horseshit, of course. All it has done is suppress interest rates on bonds, depriving old people of income off their savings by so doing. It also artificially jacked up reckless lending on loans for houses, cars, and college degrees, juiced the share price of stocks, and boosted food prices.

Meanwhile, an increasingly former middle class languishes in a purgatory of foreclosure, penury, and desperation. The Fed can't really do anything to help them. It can only burden them with more easy-credit debt, especially their college-age children. But ours is a financialized economy and finance is too abstruse for most ordinary people to understand, so they just muddle along in a fog of dashed hopes and repossession.

Lately, though, the financial markets at the heart of the financialized economy -- that is, an economy based on buying and selling increasingly dubious "paper" assets rather than on capital formation through producing things of value -- are sending distress signals. The aforesaid efforts at economic dial-tweaking have only produced distortions and perversions in the basic functioning of the markets they're designed to tweak.

- They pervert the "price discovery" mechanism by dumping "free money" into equity markets.

- They distort "risk premiums" by steering money out of savings, where it earns less than nothing, into riskier investments subject to the vagaries of everything from weather (commodity markets) to control fraud (bank stocks) to geopolitics (Toyota stock).

- They debauch market expectations in general by implying permanent artificial life-support.

- They promote market gaming such as front-running equity prices via high frequency trading on computers, naked shorting (pretending to borrow shares that, in fact, do not exist) and the abuse of futures markets -- lately illustrated in the ongoing smash of paper gold and silver contracts, with the side effect of driving yet more money into stock markets.

- Finally, they undermine the meaning and value of money itself, which is the most dangerous game of all because when people lose confidence in their national currency, nations dissolve in political chaos.

This is also complete horseshit because they could only accomplish controlled tweakings by somehow signaling their intentions beforehand through some lackey like Hilsenrath. Otherwise, they could not pretend to control the results of their actions. They might as well just throw spaghetti at the wall to see if it sticks. Unfortunately, the "halting steps" idea would only provide even more opportunities for selective, complex front-running, shorting, and gaming -- which is to say setting up more dangerous behavior with more uncertain and possibly destructive outcomes.

Anyway, there's no evidence at this moment that anyone believes what was leaked to Hilsenrath. It could easily be more smoke and mirrors aimed at concealing the fact that the Federal Reserve has no idea what it has been doing and fears the consequences.

There is one thing that we know for sure in this strange period when bankers have tried to manage reality in the absence of truth: that advanced industrial-technological economies designed to run on $20-a-barrel oil can't run on $100-a-barrel oil, and that is why the US economy was subject to financialization in the first place -- to offset declining productive activity by an attempt to get something for nothing.

Notice that this macro-trend coincided exactly with the rise of legalized gambling all over America. That is how the idea that you could get something for nothing got to be normal.

The world is about to find out that you really can't get something for nothing. It will be a harsh lesson.

.

No comments :

Post a Comment