SUBHEAD: Hawaii hotel real estate speculation boom returns with $1.85 billion loan from Goldman Sachs.

By Nadja Brandt on 11 December 2012 for Bloomberg News -

(http://www.bloomberg.com/news/2012-12-11/hawaii-real-estate-paradise-returns-with-goldman-loan-mortgages.html)

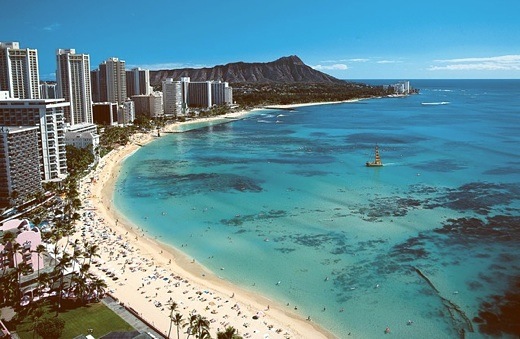

Image above: A view of Waikiki beach is seen from the Sheraton Waikiki on the island of Oahu, Hawaii. From original article.

Hawaii, buffeted in the aftermath of the U.S. recession and Japan’s tsunami, is benefiting from a travel rebound that’s sent tourism revenue to a record and spurred real estate investments across the islands.

Goldman Sachs Group Inc. (GS) last month announced a $1.85 billion loan for a once-distressed hotel portfolio that has five Hawaiian properties, including the Sheraton Waikiki and the Westin Moana Surfrider in Honolulu. Companies from Walt Disney Co. to Starwood Hotels & Resorts Worldwide Inc. (HOT) are expanding resorts. On the Big Island, the first new residential development in at least five years is starting construction.

Property investors and lenders are seeking to take advantage of increased demand from affluent Asian travelers and visitors from Northern California enriched by the technology- industry boom, according to Honolulu-based Hospitality Advisors LLC, an industry consulting firm. Oahu, which attracts the most visitors of Hawaii’s eight major islands, has the highest hotel occupancy among the top 25 U.S. markets, research firm STR said.

“What’s driving Hawaii now, particularly Oahu, is the resurgence of the Japanese market -- there was a lot of pent-up demand after the tsunami -- and substantial growth in Chinese and Korean numbers because of the increase in wealth in those regions,” said Joseph Toy, president of Hospitality Advisors.

Lodging and tourist-industry revenue, including room rentals and food and retail sales, rose 15 percent to a record $3.62 billion this year through Sept. 30, according to Hospitality Advisors. That compared with a low of $2.59 billion in the first nine months of 2009, when the U.S. was in a recession after the credit crisis.

Japan Tsunami

Travel was also reduced by the March 2011 Japanese earthquake and tsunami that killed thousands of people and led to the worst nuclear crisis since Chernobyl, according to Hawaii’s tourism board. Mary MacNeill, managing director at Fitch Ratings, predicted at the time that the disaster would set back a recovery by one to two years.

“Tourism bounced back sooner than expected,” she said in an e-mail last week. “The Japanese tourism decline was not as great as originally expected. In addition, other markets, particularly China and Korea, had a large increase in travel to Hawaii.”

The average property value for Oahu hotels probably will climb 24 percent to $547,764 a room by 2015, according to HVS and STR, developers of an index that tracks supply and demand, profit and loss forecasts, and investment yields. Oahu’s projected per-room value is the second-highest among 65 major U.S. markets, after New York City, the firms said.

Strong Comeback

“This market has come back so strongly after the downturn,” Suzanne Mellen, a San Francisco-based senior managing director at hospitality-consulting firm HVS, said in a telephone interview. The firm conducted appraisals of the hotels for the Goldman Sachs financing.

That deal involved hotels owned by private-equity firm Cerberus Capital Management LP and known as the Kyo-ya portfolio in the commercial-mortgage backed security market. The loan backed by the properties was sent to special servicing in April 2011 after the hotels’ value dropped. Special servicers negotiate with landlords on behalf of bondholders and decide whether to modify a loan or foreclose.

Cash flow at the properties has almost doubled since 2009, Deutsche Bank AG analysts said in a May research note. That month, Cerberus sought to replace debt after a deal struck with New York-based Goldman Sachs in 2011 failed to close, three people familiar with the transaction said at the time.

CMBS Demand

The new financing will include a mortgage and mezzanine loans. A portion of the debt may be sold as bonds as investor demand for CMBS surges. Wall Street banks issued about $16 billion of securities tied to everything from mobile home parks to skyscrapers in the fourth quarter, a post-credit-crisis record, according to JPMorgan Chase & Co. Sales are on pace to reach $46 billion in 2012, almost 50 percent more than last year, the analysts said.

“We’re going to let the financing speak for itself,” Michael DuVally, a Goldman Sachs spokesman, said in an e-mail. John Dillard, a spokesman for Cerberus with Weber Shandwick in New York, didn’t return a telephone call and e-mail seeking comment.

“These properties are completely irreplaceable because of the restrictive Waikiki zoning laws that make any new builds nearly impossible, and they are incredible cash cows,” Mellen said. “You can’t be better located than these hotels, sitting right on the beach in Hawaii.”

Redeveloping Hotels

Many lodging investors are limited to redeveloping existing hotels, rather than constructing new ones, because of strict environmental and zoning laws meant to prevent overbuilding in Hawaii, especially near beaches, Mellen said.

“It is the highest barrier of entry market I can think of,” she said. “People say New York is a high-barrier market or San Francisco, but I think Hawaii is much worse.”

In August, Walt Disney (DIS) announced plans to expand its Aulani Resort on Oahu, just one year after its opening, for an undisclosed amount. The Burbank, California-based company plans to add a third swimming pool and a splash zone for kids, and has already added more lawn space for weddings. The new pool and splash zone are scheduled for completion in mid-2013.

Starwood Hotels last month said it completed work at four properties: the $188 million redevelopment of the Sheraton Waikiki, the $6.5 million renovation of the Sheraton Maui Resort & Spa, the $16 million upgrade of the Sheraton Kauai Resort and the $20 million refurbishment of the Sheraton Kona Resort & Spa at Keauhou Bay.

Hawaii Flights

The work is intended to help meet “the increased demand for high-quality accommodations as business and leisure travel to the Hawaiian islands continues to grow,” the Stamford, Connecticut-based company said in a statement.

This year through September, total seats on flights to Hawaii rose 7.3 percent, including a 47 percent increase in scheduled seats from Asian countries, according to data from the Hawaii Tourism Authority. Seats from the Oceania region, which includes Australia and New Zealand, climbed 30 percent, and from Japan they rose 13 percent. Scheduled seats from the U.S. West Coast rose 4.1 percent.

Any airline cutbacks or economic slumps in countries such as China or Japan may quickly upset Hawaii’s recovery, according to Stephen Hennis, a director at Boulder, Colorado-based STR Analytics.

Very Susceptible

“The fact that you can only get to Hawaii by plane or boat makes it more susceptible to cutbacks by airlines,” he said. “And its dependence on discretionary spending makes it very susceptible to economic changes in the regions it gets most of its visitors from.”

The state’s visitor arrivals this year through September climbed 9.6 percent to 5.97 million, according to a Hawaii Tourism Authority study. The biggest increases came from Japan, with a jump of about 16 percent, and the category that includes China and Korea, which had a 27 percent gain.

Hawaii’s gross domestic product is expected to rise 2.4 percent next year, compared with a projected 1.6 percent increase in 2012 and a decline of 0.2 percent in 2011, according to data from the state Department of Business, Economic Development and Tourism. GDP probably will climb 2.5 percent in both 2014 and 2015, according to the agency.

While Hawaii’s recovery is driven largely by tourism, real estate categories other than lodging also are improving.

“The ripple effect on other aspects of the Hawaiian economy is phenomenal,” said Mellen of HVS.

Building Volume

Building-permit volume in the state, including residential and industrial applications, climbed 33 percent to $1.2 billion worth of projects this year through September, according to data from Colliers International, a Seattle-based real estate services company. That’s the highest level since 2007, when permits for a record $1.35 billion worth of development were filed in each of the comparable periods.

In Honolulu, construction of a dozen condominium projects with a total of about 3,000 units is expected to begin in the next three years -- about the same growth pace as in the peak years of 2006 and 2007, said Michael Hamasu, a Honolulu-based director of consulting and research at Colliers.

On Maui, two residential communities -- Kehalani and Maui Lani -- are under construction, and on Oahu, a couple of large residential projects are being developed, including Ho’opili, a planned community by Fort Worth, Texas-based D.R. Horton Inc. (DHI)’s Schuler division, Hamasu said.

Kohanaiki Development

A joint venture of real estate investor Kennedy Wilson (KW) and Irvine, California-based IHP Capital Partners is spending about $300 million on Kohanaiki, a new golf-and-residential development on the Big Island of Hawaii’s Kona Coast, said William McMorrow, chairman and chief executive officer of Beverly Hills, California-based Kennedy Wilson. The companies expect the project to have a value of about $1 billion when it’s fully completed, in 10 to 15 years, he said.

“Everything in Hawaii is hitting on all cylinders,” McMorrow said in a telephone interview. “It’s an opportune time to deliver product to the Hawaiian market.”

Kohanaiki is the Big Island’s first new residential development in at least five years, said Saul Pinto, CEO of Kohanaiki Shores LLC, the property’s developer. The 500-unit, 500-acre (200-hectare) project received permits in 2004, then stalled during the slump, he said. Lots and units will be marketed at $1.7 million to $6 million “and up” toward the end of 2013’s first quarter, Pinto said.

California Buyers

“I would say 80 percent of buyers on the Big Island come from California, and to a lesser degree from Seattle and Portland,” Oregon, McMorrow said. “The majority of California buyers are from Northern California, and they have benefited from the success in the tech and venture-capitalist sectors. It’s a big driver.”

One of the biggest names in the technology industry, Oracle Corp. founder Larry Ellison, earlier this year bought 98 percent of the island of Lanai for an undisclosed price. The sale included two resort hotels, two championship golf courses and club houses, and more than 88,000 acres of land.

The sales volume for commercial-property transactions of at least $1 million is likely to reach about $2 billion this year in Hawaii, the highest level since 2007, when sales totaled $3.04 billion, according to Colliers. Real estate investments are likely to increase for the foreseeable future, said Toy of Hospitality Advisors.

“We see a lot of capital that is in search of acquisitions in Hawaii,” he said. “My phone rings a lot these days.”

.

By Nadja Brandt on 11 December 2012 for Bloomberg News -

(http://www.bloomberg.com/news/2012-12-11/hawaii-real-estate-paradise-returns-with-goldman-loan-mortgages.html)

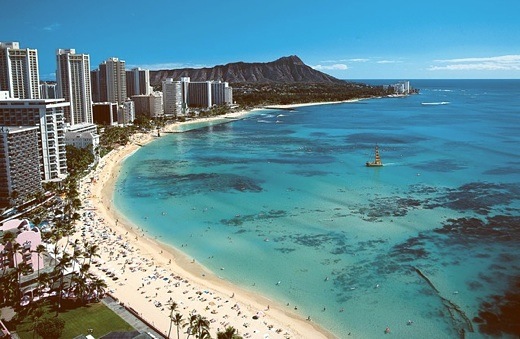

Image above: A view of Waikiki beach is seen from the Sheraton Waikiki on the island of Oahu, Hawaii. From original article.

Hawaii, buffeted in the aftermath of the U.S. recession and Japan’s tsunami, is benefiting from a travel rebound that’s sent tourism revenue to a record and spurred real estate investments across the islands.

Goldman Sachs Group Inc. (GS) last month announced a $1.85 billion loan for a once-distressed hotel portfolio that has five Hawaiian properties, including the Sheraton Waikiki and the Westin Moana Surfrider in Honolulu. Companies from Walt Disney Co. to Starwood Hotels & Resorts Worldwide Inc. (HOT) are expanding resorts. On the Big Island, the first new residential development in at least five years is starting construction.

Property investors and lenders are seeking to take advantage of increased demand from affluent Asian travelers and visitors from Northern California enriched by the technology- industry boom, according to Honolulu-based Hospitality Advisors LLC, an industry consulting firm. Oahu, which attracts the most visitors of Hawaii’s eight major islands, has the highest hotel occupancy among the top 25 U.S. markets, research firm STR said.

“What’s driving Hawaii now, particularly Oahu, is the resurgence of the Japanese market -- there was a lot of pent-up demand after the tsunami -- and substantial growth in Chinese and Korean numbers because of the increase in wealth in those regions,” said Joseph Toy, president of Hospitality Advisors.

Lodging and tourist-industry revenue, including room rentals and food and retail sales, rose 15 percent to a record $3.62 billion this year through Sept. 30, according to Hospitality Advisors. That compared with a low of $2.59 billion in the first nine months of 2009, when the U.S. was in a recession after the credit crisis.

Japan Tsunami

Travel was also reduced by the March 2011 Japanese earthquake and tsunami that killed thousands of people and led to the worst nuclear crisis since Chernobyl, according to Hawaii’s tourism board. Mary MacNeill, managing director at Fitch Ratings, predicted at the time that the disaster would set back a recovery by one to two years.

“Tourism bounced back sooner than expected,” she said in an e-mail last week. “The Japanese tourism decline was not as great as originally expected. In addition, other markets, particularly China and Korea, had a large increase in travel to Hawaii.”

The average property value for Oahu hotels probably will climb 24 percent to $547,764 a room by 2015, according to HVS and STR, developers of an index that tracks supply and demand, profit and loss forecasts, and investment yields. Oahu’s projected per-room value is the second-highest among 65 major U.S. markets, after New York City, the firms said.

Strong Comeback

“This market has come back so strongly after the downturn,” Suzanne Mellen, a San Francisco-based senior managing director at hospitality-consulting firm HVS, said in a telephone interview. The firm conducted appraisals of the hotels for the Goldman Sachs financing.

That deal involved hotels owned by private-equity firm Cerberus Capital Management LP and known as the Kyo-ya portfolio in the commercial-mortgage backed security market. The loan backed by the properties was sent to special servicing in April 2011 after the hotels’ value dropped. Special servicers negotiate with landlords on behalf of bondholders and decide whether to modify a loan or foreclose.

Cash flow at the properties has almost doubled since 2009, Deutsche Bank AG analysts said in a May research note. That month, Cerberus sought to replace debt after a deal struck with New York-based Goldman Sachs in 2011 failed to close, three people familiar with the transaction said at the time.

CMBS Demand

The new financing will include a mortgage and mezzanine loans. A portion of the debt may be sold as bonds as investor demand for CMBS surges. Wall Street banks issued about $16 billion of securities tied to everything from mobile home parks to skyscrapers in the fourth quarter, a post-credit-crisis record, according to JPMorgan Chase & Co. Sales are on pace to reach $46 billion in 2012, almost 50 percent more than last year, the analysts said.

“We’re going to let the financing speak for itself,” Michael DuVally, a Goldman Sachs spokesman, said in an e-mail. John Dillard, a spokesman for Cerberus with Weber Shandwick in New York, didn’t return a telephone call and e-mail seeking comment.

“These properties are completely irreplaceable because of the restrictive Waikiki zoning laws that make any new builds nearly impossible, and they are incredible cash cows,” Mellen said. “You can’t be better located than these hotels, sitting right on the beach in Hawaii.”

Redeveloping Hotels

Many lodging investors are limited to redeveloping existing hotels, rather than constructing new ones, because of strict environmental and zoning laws meant to prevent overbuilding in Hawaii, especially near beaches, Mellen said.

“It is the highest barrier of entry market I can think of,” she said. “People say New York is a high-barrier market or San Francisco, but I think Hawaii is much worse.”

In August, Walt Disney (DIS) announced plans to expand its Aulani Resort on Oahu, just one year after its opening, for an undisclosed amount. The Burbank, California-based company plans to add a third swimming pool and a splash zone for kids, and has already added more lawn space for weddings. The new pool and splash zone are scheduled for completion in mid-2013.

Starwood Hotels last month said it completed work at four properties: the $188 million redevelopment of the Sheraton Waikiki, the $6.5 million renovation of the Sheraton Maui Resort & Spa, the $16 million upgrade of the Sheraton Kauai Resort and the $20 million refurbishment of the Sheraton Kona Resort & Spa at Keauhou Bay.

Hawaii Flights

The work is intended to help meet “the increased demand for high-quality accommodations as business and leisure travel to the Hawaiian islands continues to grow,” the Stamford, Connecticut-based company said in a statement.

This year through September, total seats on flights to Hawaii rose 7.3 percent, including a 47 percent increase in scheduled seats from Asian countries, according to data from the Hawaii Tourism Authority. Seats from the Oceania region, which includes Australia and New Zealand, climbed 30 percent, and from Japan they rose 13 percent. Scheduled seats from the U.S. West Coast rose 4.1 percent.

Any airline cutbacks or economic slumps in countries such as China or Japan may quickly upset Hawaii’s recovery, according to Stephen Hennis, a director at Boulder, Colorado-based STR Analytics.

Very Susceptible

“The fact that you can only get to Hawaii by plane or boat makes it more susceptible to cutbacks by airlines,” he said. “And its dependence on discretionary spending makes it very susceptible to economic changes in the regions it gets most of its visitors from.”

The state’s visitor arrivals this year through September climbed 9.6 percent to 5.97 million, according to a Hawaii Tourism Authority study. The biggest increases came from Japan, with a jump of about 16 percent, and the category that includes China and Korea, which had a 27 percent gain.

Hawaii’s gross domestic product is expected to rise 2.4 percent next year, compared with a projected 1.6 percent increase in 2012 and a decline of 0.2 percent in 2011, according to data from the state Department of Business, Economic Development and Tourism. GDP probably will climb 2.5 percent in both 2014 and 2015, according to the agency.

While Hawaii’s recovery is driven largely by tourism, real estate categories other than lodging also are improving.

“The ripple effect on other aspects of the Hawaiian economy is phenomenal,” said Mellen of HVS.

Building Volume

Building-permit volume in the state, including residential and industrial applications, climbed 33 percent to $1.2 billion worth of projects this year through September, according to data from Colliers International, a Seattle-based real estate services company. That’s the highest level since 2007, when permits for a record $1.35 billion worth of development were filed in each of the comparable periods.

In Honolulu, construction of a dozen condominium projects with a total of about 3,000 units is expected to begin in the next three years -- about the same growth pace as in the peak years of 2006 and 2007, said Michael Hamasu, a Honolulu-based director of consulting and research at Colliers.

On Maui, two residential communities -- Kehalani and Maui Lani -- are under construction, and on Oahu, a couple of large residential projects are being developed, including Ho’opili, a planned community by Fort Worth, Texas-based D.R. Horton Inc. (DHI)’s Schuler division, Hamasu said.

Kohanaiki Development

A joint venture of real estate investor Kennedy Wilson (KW) and Irvine, California-based IHP Capital Partners is spending about $300 million on Kohanaiki, a new golf-and-residential development on the Big Island of Hawaii’s Kona Coast, said William McMorrow, chairman and chief executive officer of Beverly Hills, California-based Kennedy Wilson. The companies expect the project to have a value of about $1 billion when it’s fully completed, in 10 to 15 years, he said.

“Everything in Hawaii is hitting on all cylinders,” McMorrow said in a telephone interview. “It’s an opportune time to deliver product to the Hawaiian market.”

Kohanaiki is the Big Island’s first new residential development in at least five years, said Saul Pinto, CEO of Kohanaiki Shores LLC, the property’s developer. The 500-unit, 500-acre (200-hectare) project received permits in 2004, then stalled during the slump, he said. Lots and units will be marketed at $1.7 million to $6 million “and up” toward the end of 2013’s first quarter, Pinto said.

California Buyers

“I would say 80 percent of buyers on the Big Island come from California, and to a lesser degree from Seattle and Portland,” Oregon, McMorrow said. “The majority of California buyers are from Northern California, and they have benefited from the success in the tech and venture-capitalist sectors. It’s a big driver.”

One of the biggest names in the technology industry, Oracle Corp. founder Larry Ellison, earlier this year bought 98 percent of the island of Lanai for an undisclosed price. The sale included two resort hotels, two championship golf courses and club houses, and more than 88,000 acres of land.

The sales volume for commercial-property transactions of at least $1 million is likely to reach about $2 billion this year in Hawaii, the highest level since 2007, when sales totaled $3.04 billion, according to Colliers. Real estate investments are likely to increase for the foreseeable future, said Toy of Hospitality Advisors.

“We see a lot of capital that is in search of acquisitions in Hawaii,” he said. “My phone rings a lot these days.”

.

1 comment :

amazing...

I wonder which planet this is occurring on..

Post a Comment