SUBHEAD: France risks becoming the next victim of the sovereign-debt crisis in the coming weeks.

By Ilargi on 12 November 2011 for the Automatic Earth -

(http://theautomaticearth.blogspot.com/2011/11/november-12-2011-bail-out-or-revitalize.html)

Image above: French Prime Minister Nicolas Sarkozy arrives for the the second day of G20 summit in Cannes, France, 04 November 2011. From (http://www.vosizneias.com/94153/2011/11/04/cannes-france-sarkozy-france-wont-sit-silent-over-iran-theart-on-israel/).

Image above: French Prime Minister Nicolas Sarkozy arrives for the the second day of G20 summit in Cannes, France, 04 November 2011. From (http://www.vosizneias.com/94153/2011/11/04/cannes-france-sarkozy-france-wont-sit-silent-over-iran-theart-on-israel/).

I'm convinced it’s not so much that it's hard to understand; instead, it's hard to accept. Still, for most people that's enough reason to not understand.

It might therefore be a good moment to reiterate what we've said often before at The Automatic Earth:

the financial system as we know it can not be saved. It doesn't matter whether "official institutions" nominate 30 banks as being too big to fail, or 300. It is inevitable that the enormous amounts of debt accumulated in a relatively and amazingly short period of time must be serviced. Pay offs, write downs, defaults, bankruptcies. They're cast in stone. It's too late, too big to fail or not.

Just as it is too late for the Eurozone. Tons of "experts" clamor for Europe to move closer together, and form for instance a full fiscal, if not political union. But it's way too late for that. The interests at this point in time have simply become too divergent.

There now seem to be talks underway to form a strong Euro core group. Ironically, these talks are led by France. Ironic, because France is the only country that really stands to benefit from such a core group. That is, if it's allowed to be a member. Which is highly questionable.

French President Nicolas Sarkozy is witnessing the fall of Italian PM Berlusconi with sweaty palms. He has ample reason, says also Henry Samuel in the Telegraph:

'France will be the next to crumble', warns Gordon Brown

France risks becoming the next victim of the sovereign-debt crisis "in the coming weeks", Gordon Brown, the former prime minister, has warned.

Mr Brown’s prediction came as the difference between French borrowing costs and those of Germany hit record levels. EU leaders urged France to draw up further austerity measures to meet its deficit reduction targets, amid fears the eurozone’s second biggest economy could crumble if Italy’s debt crisis spirals out of control.

Mr Brown, speaking in Moscow, said: "France is in danger of being picked off by the markets in the coming weeks and months." [..]

"Let’s not have any illusions," said Jacques Attali, a former adviser to president François Mitterrand and head of the European Bank of Reconstruction and Development. "On the markets French debt has already lost its triple-A status."

One Elysée Palace official told Le Monde newspaper: "If Nicolas Sarkozy loses our triple-A, he is dead."[..

While I have no desire to address Gordon Brown's level of credibility here, if we assume that the last statement is indeed true, then Sarkozy's career is over. Because there is no way France will keep its AAA rating. The only way that would be possible is if Germany (and/or the US, China) would guarantee anything French that's not bolted down. Not going to happen.

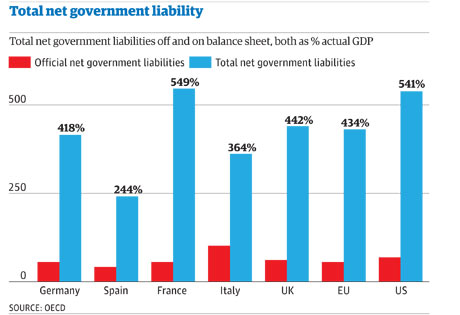

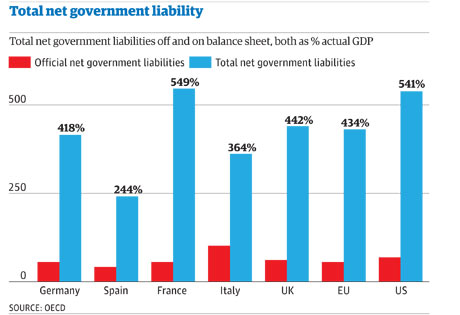

France's reality is clearly visible in this Société Générale graph, which I posted earlier this week:

Even if you would give Paris some benefit of the doubt, and assume that it can somehow handle the situation for an X amount of weeks/months/years longer, a country with liabilities running at 549% of GDP does not merit an AAA rating. No more than any CDO squared filled with toxic loans does. Which is why the US at 541% has already been downgraded.

This is a truth that every ratings agency will need to face up to at one point. Thursday's erroneous S&P report of a French downgrade could well be a gift from heaven for Sarkozy. After all, he gets the opportunity to angrily deny it all across the media, and plus he knows S&P will hesitate when it actually does want to downgrade the country. But it still must down the line.

France wants a core Euro group comprised of Germany, the Netherlands, Finland, Austria and itself. Not going to happen. If and/or when it came to a break-up, the other four would rather see France lead the "poor", mostly Latin group, for reasons the graph above spells out loud and clear. And that's a role France will not accept, ever.

Moreover, Austria also runs the risk of a downgrade, over its exposure to Italy and Eastern Europe. In other words, a rich core group would consist of Germany, the Netherlands and Finland. But the Netherlands has seen a major housing bubble that has yet to pop. Once it does, and it must, we'll be left with just Germany and Finland. And why would the Finns choose that over independence?

Every single scenario that has Europe either come closer together or break up in an orderly fashion is full of holes. What's left, then, is chaos. The rise to power of Papademos in Greece and Monti in Italy will not change this. What it will do is put a much harder squeeze on the people of the countries.

There should be mass protest against the developments in the streets of Athens and Rome, but people have not yet processed what is happening. When they do, it will in all likelihood be too late. Monti and Papademos are there to execute a short lived "transition" job, and to then vanish.

To sign a whole bunch of things into law which facilitate yet another round of bailouts and other support measures for their financial industries, and which will cause enormous hardship for the people (you ain't seen nothing yet). Afterwards, someone else can take over and claim it's not his/her fault.

We've come to a point where there is really only one major choice left to make. It's either to support the financial industry, which is irrevocably linked to both the financial and the political system, or to support the people. The fairy tale we've consistently been fed that they're one and the same, that saving the banks will save the people, should have been laughed away and wiped off the table long ago. But it’s 11-11-'11, and the fairy tale's still there. It's big fat lie that serves only to take hold of what scarce money you have left.

We find ourselves in a full blown credit crunch.

Chris Whalen may call it a "slow motion" credit crunch, but that, however tempting the idea, is at best partly true. The reason why lies in the trillions in future taxpayer liabilities that governments have pushed into the banking sector. Without those trillions, hardly any lending would be taking place. And with the trillions, the whole house is still coming down anyway, no matter all the talk about a recovery.

It is slow motion only when you look at the stock markets, when you see the world through the eyes of an investor; in the streets of Athens or Detroit, for instance, there’s nothing slow motion about it. Not where the budget cuts and austerity measures are implemented that pay for bailing out banks silently drowning in as yet unrecognized but soon to be revealed losses.

Still, whether fast or slow, a giant credit crunch driven by debt deflation is irrevocably heading our way. Trying to stop it is entirely useless; using what scarce future wealth there will be to execute the futile attempt at doing so is extremely harmful. The world needs something better than finance industry henchmen like Papademos and Monti if we wish to minimize the upcoming suffering of the 99%.

See also:

Ea O Ka AIna: After Greece it's Italy 11/7/11

.

Image above: French Prime Minister Nicolas Sarkozy arrives for the the second day of G20 summit in Cannes, France, 04 November 2011. From (http://www.vosizneias.com/94153/2011/11/04/cannes-france-sarkozy-france-wont-sit-silent-over-iran-theart-on-israel/).

I'm convinced it’s not so much that it's hard to understand; instead, it's hard to accept. Still, for most people that's enough reason to not understand.

It might therefore be a good moment to reiterate what we've said often before at The Automatic Earth: the financial system as we know it can not be saved. It doesn't matter whether "official institutions" nominate 30 banks as being too big to fail, or 300. It is inevitable that the enormous amounts of debt accumulated in a relatively and amazingly short period of time must be serviced. Pay offs, write downs, defaults, bankruptcies. They're cast in stone. It's too late, too big to fail or not.

Just as it is too late for the Eurozone. Tons of "experts" clamor for Europe to move closer together, and form for instance a full fiscal, if not political union. But it's way too late for that. The interests at this point in time have simply become too divergent.

There now seem to be talks underway to form a strong Euro core group. Ironically, these talks are led by France. Ironic, because France is the only country that really stands to benefit from such a core group. That is, if it's allowed to be a member. Which is highly questionable.

French President Nicolas Sarkozy is witnessing the fall of Italian PM Berlusconi with sweaty palms. He has ample reason, says also Henry Samuel in the Telegraph:

Image above: French Prime Minister Nicolas Sarkozy arrives for the the second day of G20 summit in Cannes, France, 04 November 2011. From (http://www.vosizneias.com/94153/2011/11/04/cannes-france-sarkozy-france-wont-sit-silent-over-iran-theart-on-israel/).

I'm convinced it’s not so much that it's hard to understand; instead, it's hard to accept. Still, for most people that's enough reason to not understand.

It might therefore be a good moment to reiterate what we've said often before at The Automatic Earth: the financial system as we know it can not be saved. It doesn't matter whether "official institutions" nominate 30 banks as being too big to fail, or 300. It is inevitable that the enormous amounts of debt accumulated in a relatively and amazingly short period of time must be serviced. Pay offs, write downs, defaults, bankruptcies. They're cast in stone. It's too late, too big to fail or not.

Just as it is too late for the Eurozone. Tons of "experts" clamor for Europe to move closer together, and form for instance a full fiscal, if not political union. But it's way too late for that. The interests at this point in time have simply become too divergent.

There now seem to be talks underway to form a strong Euro core group. Ironically, these talks are led by France. Ironic, because France is the only country that really stands to benefit from such a core group. That is, if it's allowed to be a member. Which is highly questionable.

French President Nicolas Sarkozy is witnessing the fall of Italian PM Berlusconi with sweaty palms. He has ample reason, says also Henry Samuel in the Telegraph:

No comments :

Post a Comment